- United States

- /

- Medical Equipment

- /

- NYSE:ENOV

Enovis Corporation's (NYSE:ENOV) Shares Not Telling The Full Story

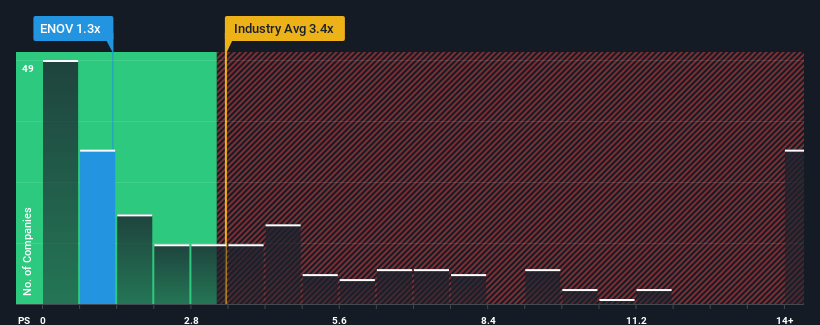

You may think that with a price-to-sales (or "P/S") ratio of 1.3x Enovis Corporation (NYSE:ENOV) is definitely a stock worth checking out, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios greater than 3.4x and even P/S above 8x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Enovis

How Has Enovis Performed Recently?

Enovis certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Enovis will help you uncover what's on the horizon.How Is Enovis' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Enovis' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. As a result, it also grew revenue by 7.9% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 9.6% over the next year. With the industry predicted to deliver 9.0% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Enovis' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Enovis' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Enovis currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It is also worth noting that we have found 1 warning sign for Enovis that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Enovis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ENOV

Enovis

Operates as a medical technology company focus on developing clinically differentiated solutions in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.