- United States

- /

- Healthcare Services

- /

- NYSE:ELV

Is Elevance Health an Opportunity After Partnership News and Recent Share Price Rebound?

Reviewed by Bailey Pemberton

- Ever wondered if Elevance Health is truly a bargain at today’s prices? You’re not alone; valuing healthcare stocks can reveal opportunities that most investors overlook.

- The share price recently jumped 4.4% over the last week, but it's still down 6.3% for the past month and 17.9% over the year, hinting at shifting sentiment around its long-term prospects.

- News of strategic partnerships and ongoing healthcare industry reforms have brought Elevance Health into focus again. Analysts and investors alike are watching closely as these developments could reshape expectations for the company’s future growth.

- According to our detailed checks, Elevance Health scores a 5 out of 6 on undervaluation metrics, which is quite compelling for value-seekers. Let’s dig into how we arrive at that number using different valuation methods, and stay tuned for an even deeper perspective at the end.

Approach 1: Elevance Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to their value today. This approach gives investors insight into whether a stock is trading below or above its estimated worth based on the business's underlying fundamentals.

For Elevance Health, the latest available Free Cash Flow (FCF) stands at $3.58 Billion. Analysts project FCF to keep growing steadily, with expected annual cash flows surpassing $8.69 Billion by 2029. While analyst estimates typically cover up to five years, further projections are extrapolated, showing free cash flows potentially reaching over $12.38 Billion in 2035.

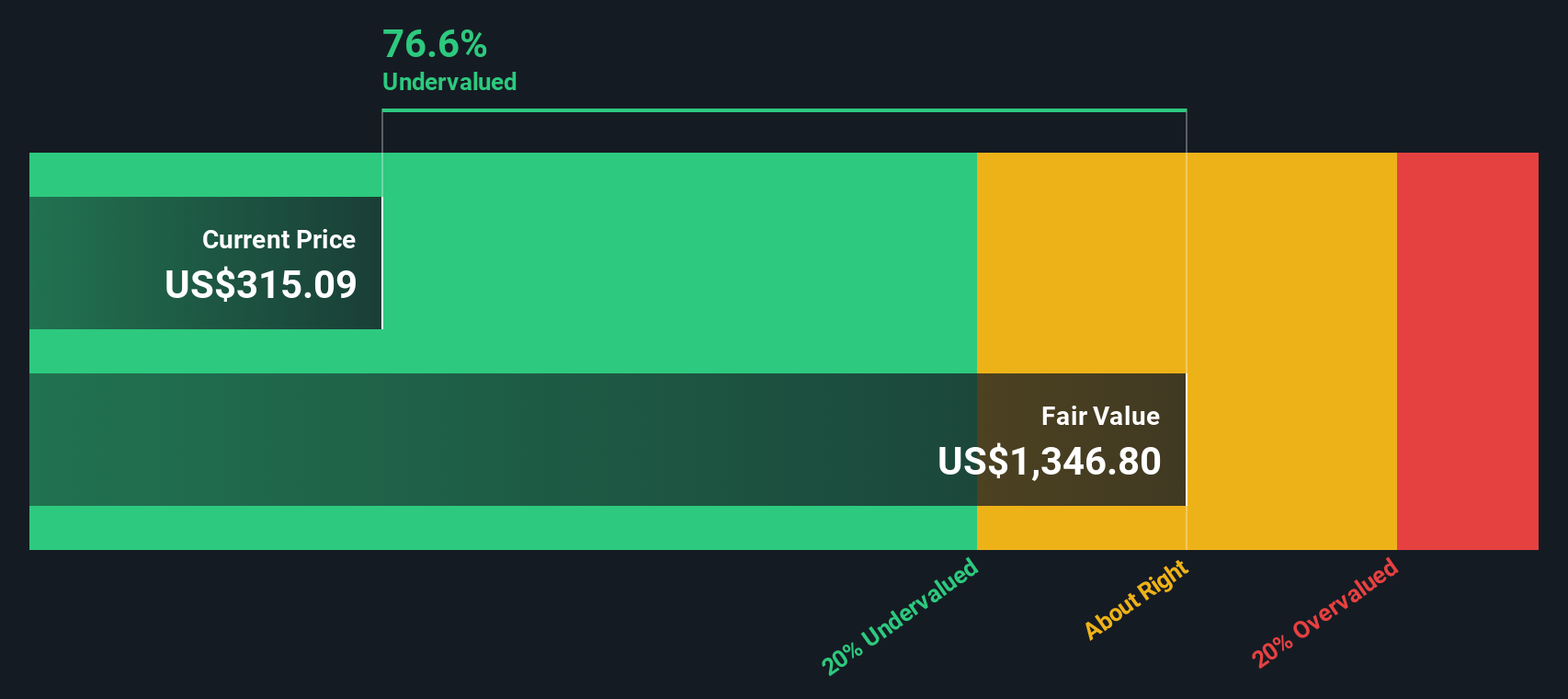

When these figures are discounted to the present, the model estimates an intrinsic value of $1,082 per share. This is roughly 69.7% higher than the current share price. This substantial intrinsic discount strongly suggests Elevance Health is undervalued using this rigorous DCF method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Elevance Health is undervalued by 69.7%. Track this in your watchlist or portfolio, or discover 880 more undervalued stocks based on cash flows.

Approach 2: Elevance Health Price vs Earnings

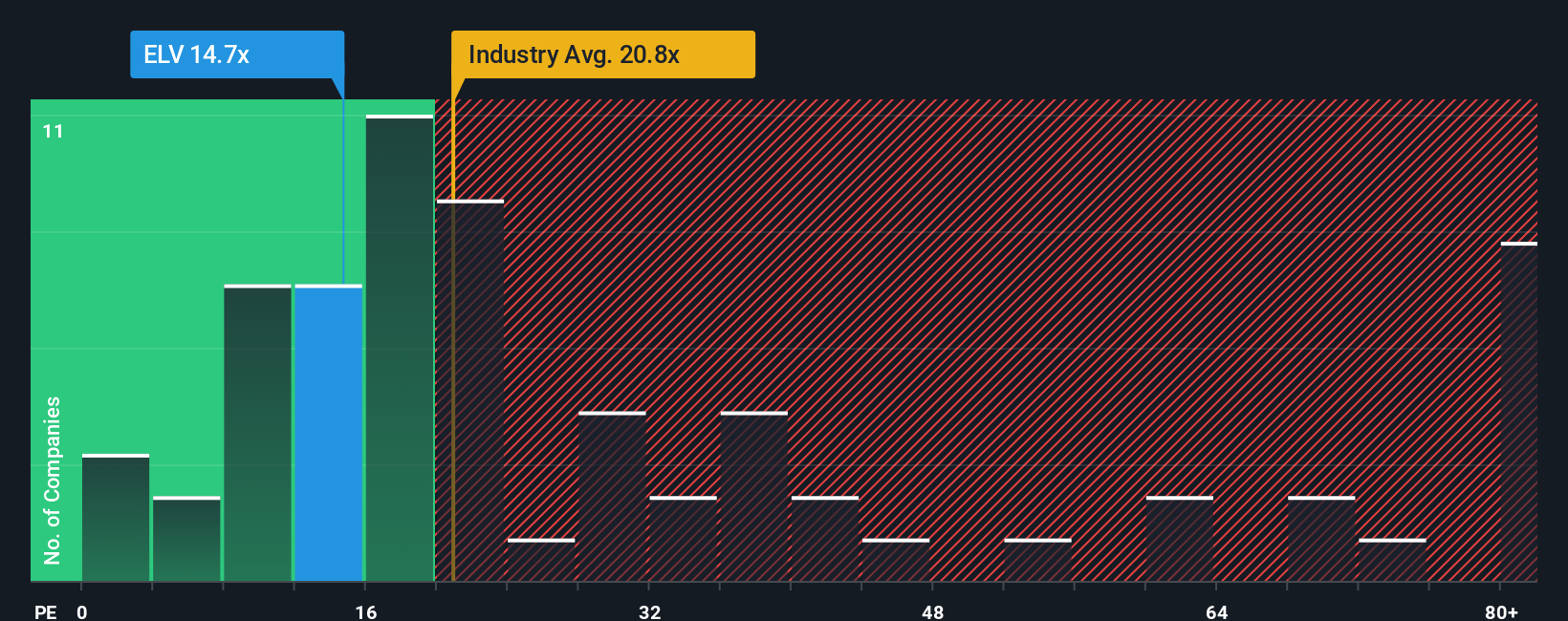

The Price-to-Earnings (PE) ratio is a widely used valuation metric for assessing profitable companies like Elevance Health. Because it relates a company's current share price to its per-share earnings, it offers a clear snapshot of how much investors are willing to pay for each dollar of profit. This makes PE especially suitable for evaluating established firms with consistent earnings, as it reflects current profitability, which is an important factor in the healthcare sector.

Growth expectations and risk play central roles in what counts as a "normal" or "fair" PE ratio. Fast-growing businesses or those with lower risk profiles typically command higher multiples because investors are willing to pay more for future earnings. Conversely, lower growth or higher risk tends to push the multiple down. That is why it is important to use relevant benchmarks for context.

Elevance Health is currently priced at 13.2x earnings. This is significantly below the Healthcare industry average of 22.0x and also well beneath its peers, which average 26.5x. However, rather than relying solely on broad industry or peer group comparisons, Simply Wall St introduces the “Fair Ratio.” This proprietary metric takes into account Elevance Health’s unique growth outlook, profit margins, market cap, and risk profile, providing a more tailored view of fair value. In Elevance Health’s case, the Fair Ratio stands at 32.4x, indicating the current valuation appears deeply discounted even after accounting for company-specific factors.

With Elevance Health trading at 13.2x versus a Fair Ratio of 32.4x, the stock looks meaningfully undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Elevance Health Narrative

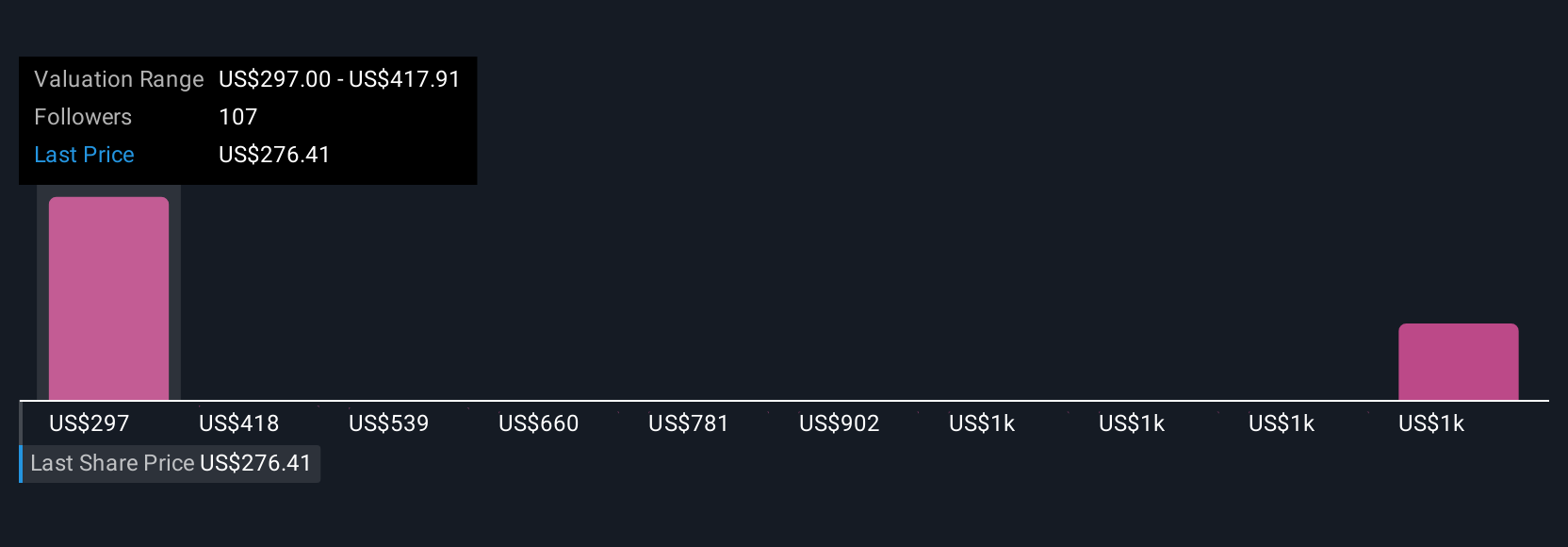

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce Narratives. A Narrative is a concise story investors create that ties together their perspective on a company’s future, including their own estimates for revenue, earnings, margins, and what they believe is a fair value. Narratives go beyond the numbers by connecting a company's real-world context and outlook to a personalized financial forecast. This process helps you clearly see the link between your investment thesis and what you think the stock is worth.

Available right on Simply Wall St’s Community page, Narratives are easy to build and adjust, making them a popular tool used by millions. By comparing your fair value to the current market price, Narratives provide a dynamic way to decide when to buy or sell and instantly update as new news, results, or market conditions emerge. For example, one investor may see Elevance Health’s ongoing cost pressures and cautious earnings forecasts, leading them to a reserved fair value near $297. Another investor with a more optimistic view on operational improvements and Medicare Advantage growth might assign a fair value as high as $507. Both perspectives transparently reveal the story behind their numbers with a Narrative.

Do you think there's more to the story for Elevance Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elevance Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELV

Elevance Health

Operates as a health benefits company in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives