- United States

- /

- Healthcare Services

- /

- NYSE:EHC

What to Make of Encompass Health Shares After Strong 34% Rise in 2024

Reviewed by Bailey Pemberton

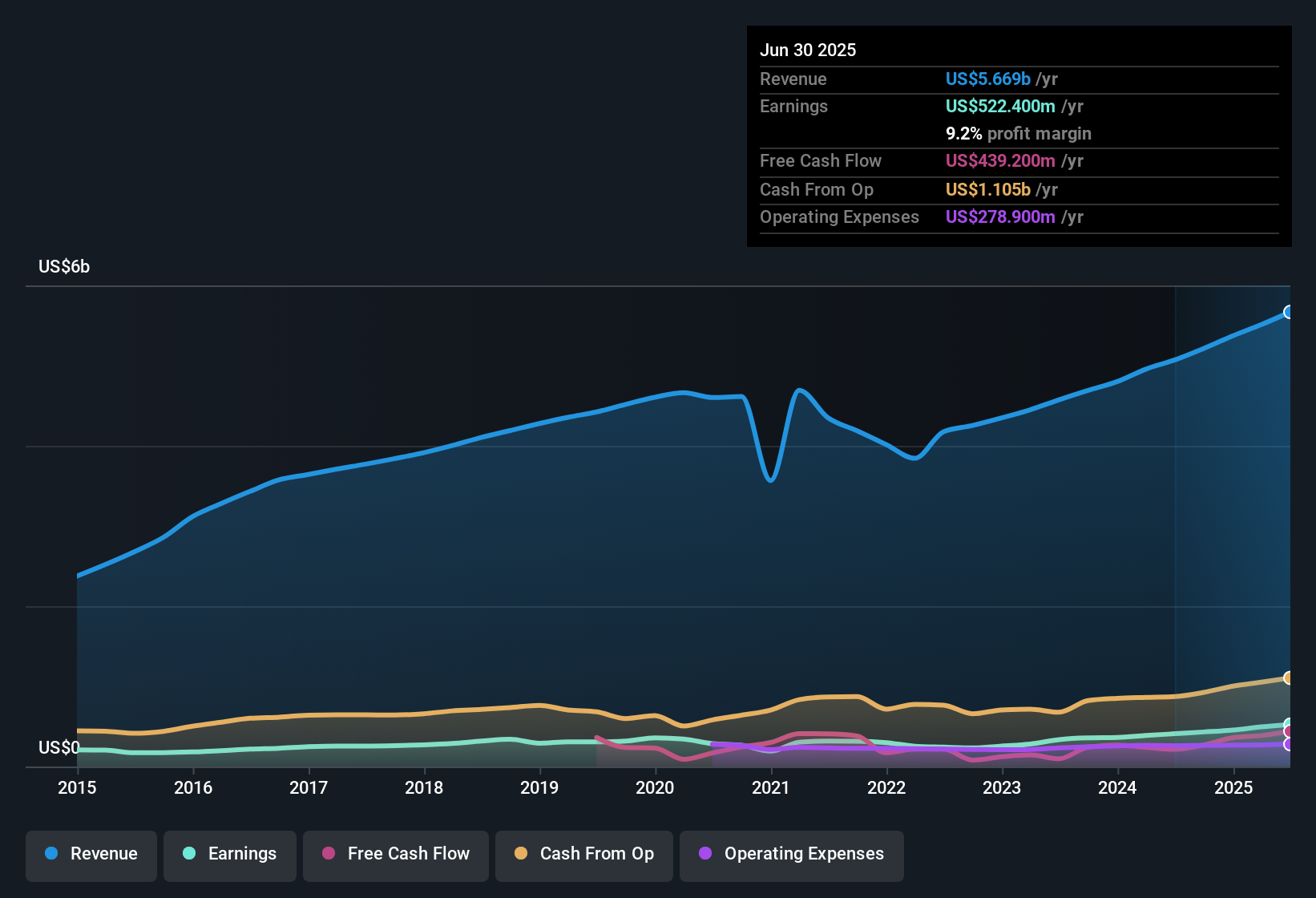

If you’re staring at Encompass Health’s ticker and wondering whether now is the time to buy, sell, or simply hold, you’re definitely not alone. The stock world seems to have taken a close look at this healthcare heavyweight lately. The past week and month haven’t exactly shown fireworks, with the stock dipping 2.1% and 1.9% respectively. If you zoom out, it’s not hard to spot the strong uptrend. Year-to-date, Encompass Health is up a remarkable 34.2%, and the one-year return comes in at 31.8%. For those who had conviction three or five years ago, the gains are even more impressive, with returns of 162.1% and 143.4% respectively. That is the kind of long-term growth story that tends to make headlines or at least earn serious attention from patient investors.

So what is fueling the momentum? Part of it is grounded in growing demand for quality healthcare services across the country, especially as demographic trends continue to shift. Savvy investors are noticing the company’s ability to navigate a changing landscape while staying relevant to both patients and payers. As headlines come and go, one question inevitably re-emerges: is the stock actually undervalued, fairly valued, or maybe even a little too hot right now?

Our valuation checks assign Encompass Health a score of 2 out of 6 for being undervalued, suggesting there is a bit of a mixed bag when it comes to pricing versus potential. In the next section, I’ll break down exactly how those valuation approaches stack up and hint at a broader way to get to the heart of whether Encompass Health deserves a spot in your long-term portfolio.

Encompass Health scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Encompass Health Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by taking future expected cash flows and discounting them back to today’s value. This approach is widely used because it focuses on a company's actual ability to generate cash in the years ahead, offering a data-driven perspective on what the business is fundamentally worth.

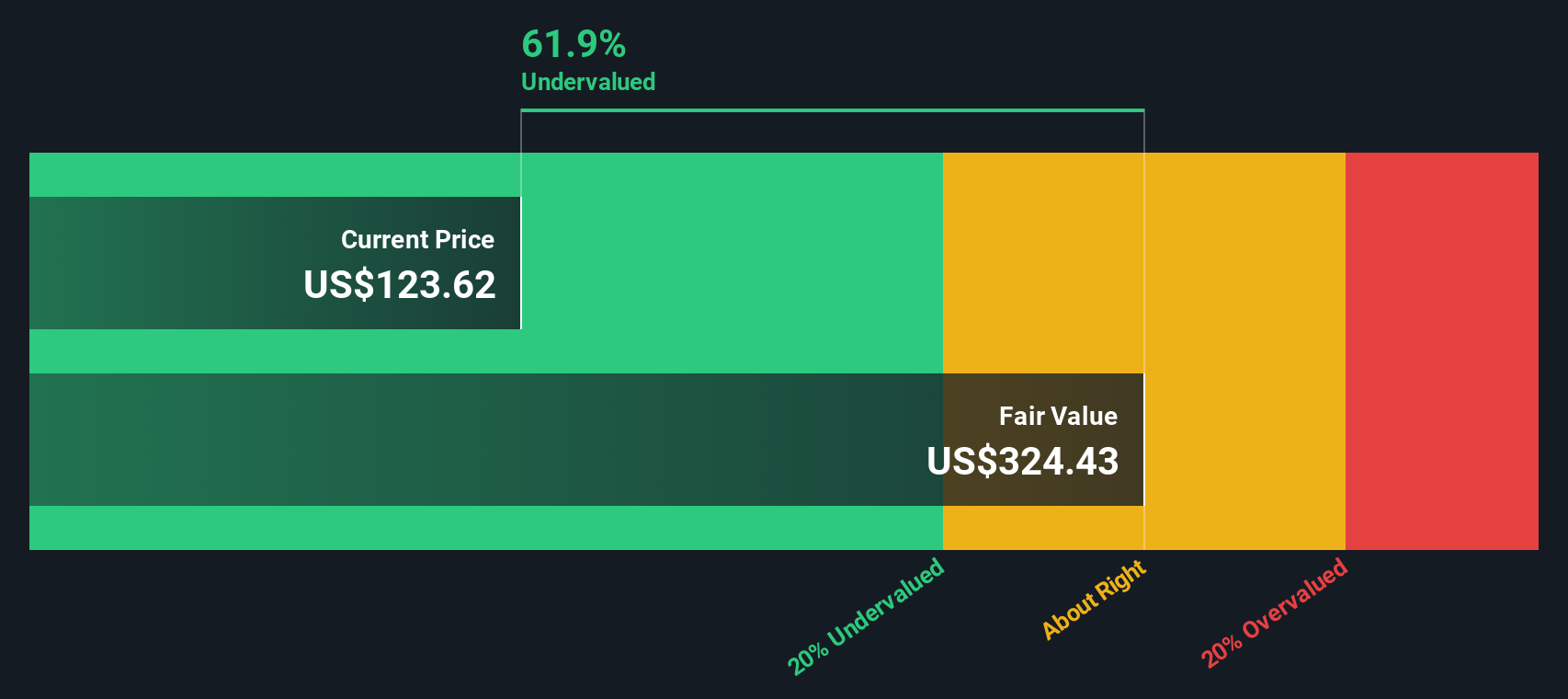

For Encompass Health, current Free Cash Flow stands at $400.5 Million. Analyst estimates project steady growth, reaching $825 Million by the year ending 2027. Looking further ahead, projections for 2035, extrapolated by Simply Wall St, suggest Free Cash Flow could expand to $1.68 Billion. These forecasts illustrate how cash generation might evolve as the business grows and adapts to industry changes.

After running these numbers through a two-stage DCF model, the resulting intrinsic value per share comes out to $324.43. With a 62.0% discount implied by this analysis, Encompass Health stock appears deeply undervalued compared to its current trading price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Encompass Health is undervalued by 62.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Encompass Health Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like Encompass Health. It shows how much investors are willing to pay for each dollar of earnings, making it particularly useful for benchmarking valuation, especially when a company has solid historical and expected profits.

What counts as a “reasonable” PE ratio can vary, depending on growth prospects, potential risks, and broader market sentiment. In general, companies expected to grow quickly or with less risk can justify higher PE ratios. Those facing headwinds or with uncertain outlooks tend to trade at lower multiples.

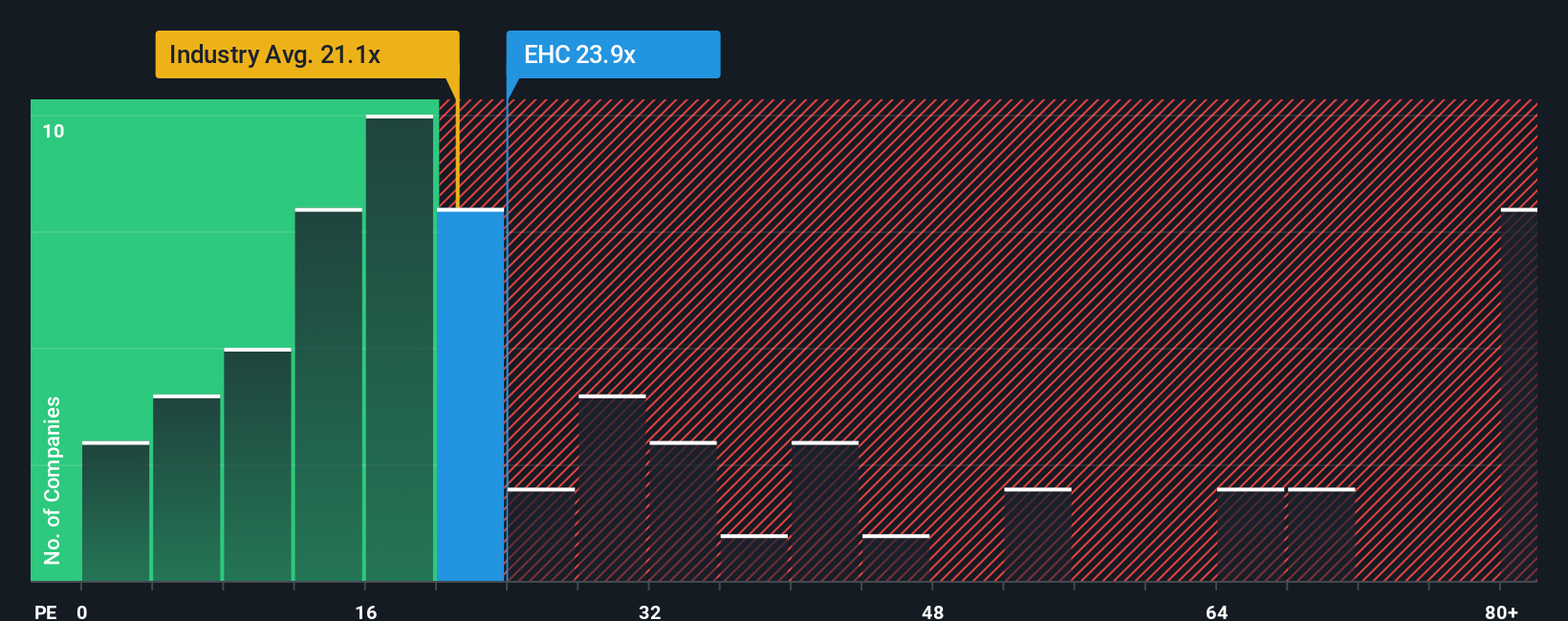

Encompass Health’s current PE ratio sits at 23.8x. This is higher than both the average among its peers (17.9x) and the broader healthcare industry (21.4x). On the surface, that could suggest a premium valuation, but numbers only tell part of the story.

Simply Wall St’s proprietary “Fair Ratio” framework digs deeper than generic industry or peer comparisons. It calculates a tailored fair PE multiple for Encompass Health at 21.6x in this case, by weighing factors like its unique growth outlook, profitability, risk profile, and size. This context makes the Fair Ratio a more meaningful standard because it reflects Encompass Health’s actual business factors rather than relying on broad averages.

Comparing the current PE ratio of 23.8x to the Fair Ratio of 21.6x, the stock looks slightly elevated, trading just above what would be considered fair given its financials and prospects.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Encompass Health Narrative

Earlier, we mentioned that there is an even better way to interpret valuation. Let us introduce you to Narratives. A Narrative is your personal story or perspective about a company, built from the numbers you believe matter, such as your estimates of future revenue, earnings, and margins, along with what you think the fair value should be. This process connects the company’s unique situation to a clear financial forecast and then straight through to a fair value, making investing feel more logical and less mysterious.

Narratives make this process easy and accessible. With Simply Wall St’s Community page, you can join millions of other investors in using this tool to state your beliefs, see others’ perspectives, and update your views whenever new information, like news or earnings, emerges. The great thing about Narratives is that they help you decide when to buy or sell by clearly comparing your own Fair Value to the current market Price, all backed by your assumptions about the company’s story and future.

For instance, one investor might see Encompass Health’s expansive hospital openings, growth in complex care, and strong earnings outlook and build a Narrative targeting a fair value of $137.42. Another might focus on labor shortages or regulatory risks, resulting in a lower fair value. Each Narrative is constantly updated as facts change, empowering you to make smarter, more responsive investment decisions.

Do you think there's more to the story for Encompass Health? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Encompass Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EHC

Encompass Health

Provides post-acute healthcare services in the United States and Puerto Rico.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives