- United States

- /

- Healthcare Services

- /

- NYSE:EHC

Is Patient Safety Litigation Risk Reshaping the Investment Case for Encompass Health (EHC)?

Reviewed by Sasha Jovanovic

- Earlier this year, The New York Times published an article revealing serious safety issues and incidents of patient harm at Encompass Health rehabilitation hospitals, prompting Rosen Law Firm to investigate potential securities claims and prepare a class action lawsuit based on allegations of materially misleading business information.

- This development has focused attention on Encompass Health's internal controls, transparency, and the operational risks associated with maintaining safety standards in healthcare facilities.

- We'll assess how heightened legal and reputational risks stemming from the safety investigation could alter Encompass Health's investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Encompass Health Investment Narrative Recap

For Encompass Health, the core investment story hinges on belief in continued high demand for inpatient rehabilitation and the company’s ability to translate bed expansions and clinical expertise into sustainable growth. The recent safety concerns and subsequent class action lawsuit investigation have introduced elevated legal and reputational risks, which could become the most important short-term catalyst or risk, potentially impacting referral streams and relationships with payers and providers if not managed effectively.

Of the company’s recent announcements, the opening of new hospitals, such as the Connecticut and Central Florida facilities, is the most relevant in light of these news events. Ongoing facility expansions remain critical to the company’s growth outlook, but the scrutiny over safety standards intensifies the operational risks associated with rapid site openings and may require additional investment in compliance and oversight procedures.

Yet, against expectations for continued expansion and rising admissions, investors should also consider the risk that...

Read the full narrative on Encompass Health (it's free!)

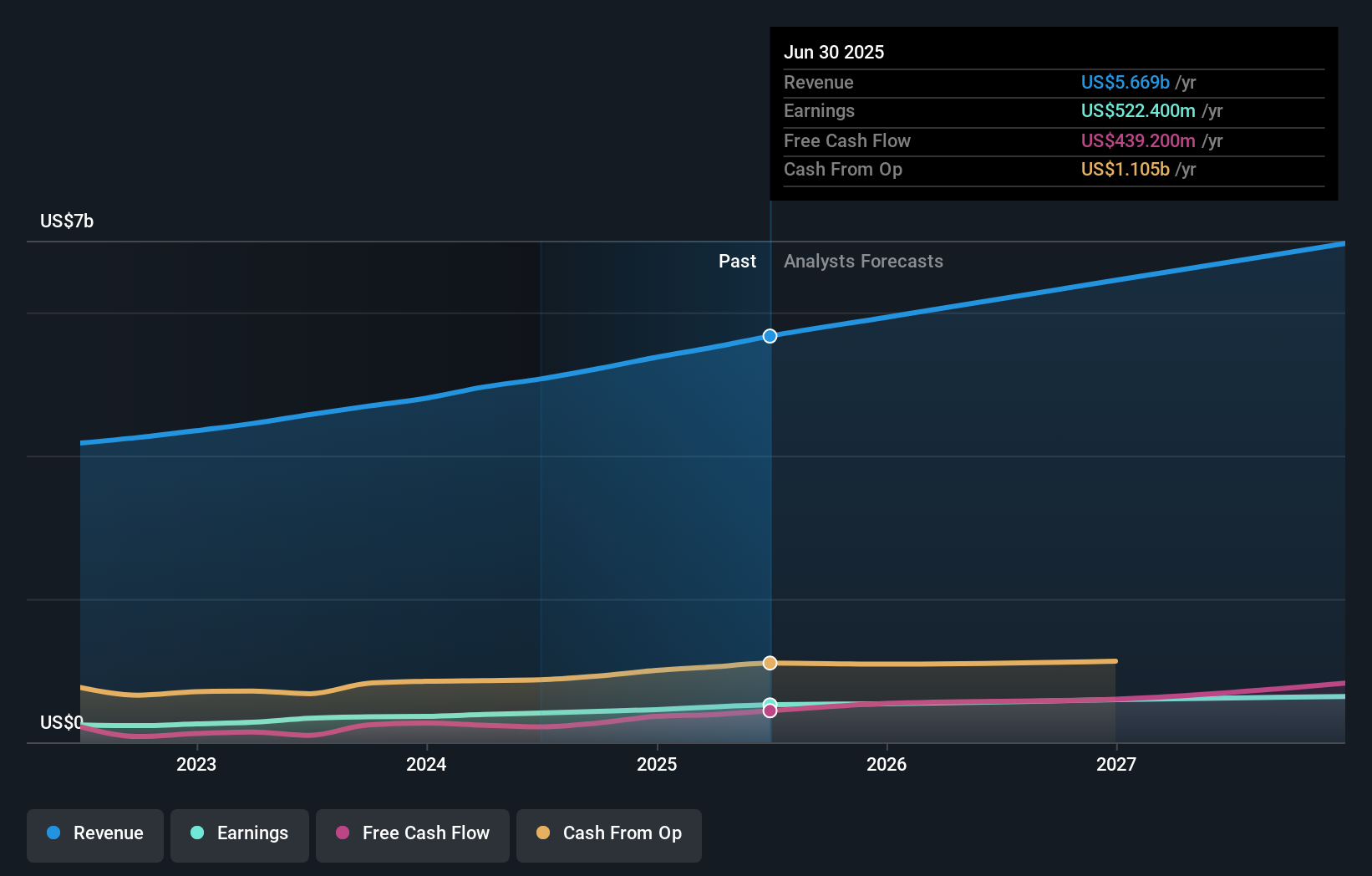

Encompass Health's outlook anticipates $7.2 billion in revenue and $711.6 million in earnings by 2028. This scenario assumes an 8.1% annual revenue growth rate and a $189.2 million increase in earnings from $522.4 million today.

Uncover how Encompass Health's forecasts yield a $139.08 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates, both at US$139.08, signaling high agreement even prior to recent news. With ongoing legal and reputational risks newly in focus, see how different viewpoints weigh these developments.

Explore 2 other fair value estimates on Encompass Health - why the stock might be worth just $139.08!

Build Your Own Encompass Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encompass Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encompass Health's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Encompass Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EHC

Encompass Health

Provides post-acute healthcare services in the United States and Puerto Rico.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives