- United States

- /

- Healthcare Services

- /

- NYSE:EHC

How Investors May Respond To Encompass Health (EHC) Expanding Texas Rehab Network With New Amarillo Hospital

Reviewed by Simply Wall St

- Encompass Health Corp. and BSA Health System recently announced a joint venture to own and operate a new, freestanding 50-bed inpatient rehabilitation hospital in Amarillo, Texas, with BSA relocating its current 24-bed unit to the facility, which will open in late 2025.

- This arrangement signals substantial expansion of regional rehabilitation capacity while introducing advanced therapy techniques and technologies to serve patients with complex needs.

- We'll examine how the new Amarillo hospital venture supports Encompass Health's growth in Texas and its core rehabilitation strategy.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Encompass Health Investment Narrative Recap

Owning Encompass Health hinges on belief in continued demand for inpatient rehabilitation and the company’s ability to leverage expansion to drive admissions and revenue. The recent joint venture in Amarillo strengthens Encompass Health’s Texas footprint but does not alter the core, short-term catalysts of admission growth and capacity expansion, nor displace the biggest risks of cost overruns and labor pressures that accompany aggressive development.

The August announcement of a new 50-bed rehabilitation hospital in Haslet, Texas, reinforces the theme of steady network growth highlighted by the Amarillo project. Both announcements reflect ongoing commitment to expansion, a major catalyst for capturing unmet demand and supporting incremental revenue, but also underscore rising investment and execution risks as the company builds in multiple markets simultaneously.

By contrast, investors should be aware that heightened capital expenditure and preopening costs in new facilities could...

Read the full narrative on Encompass Health (it's free!)

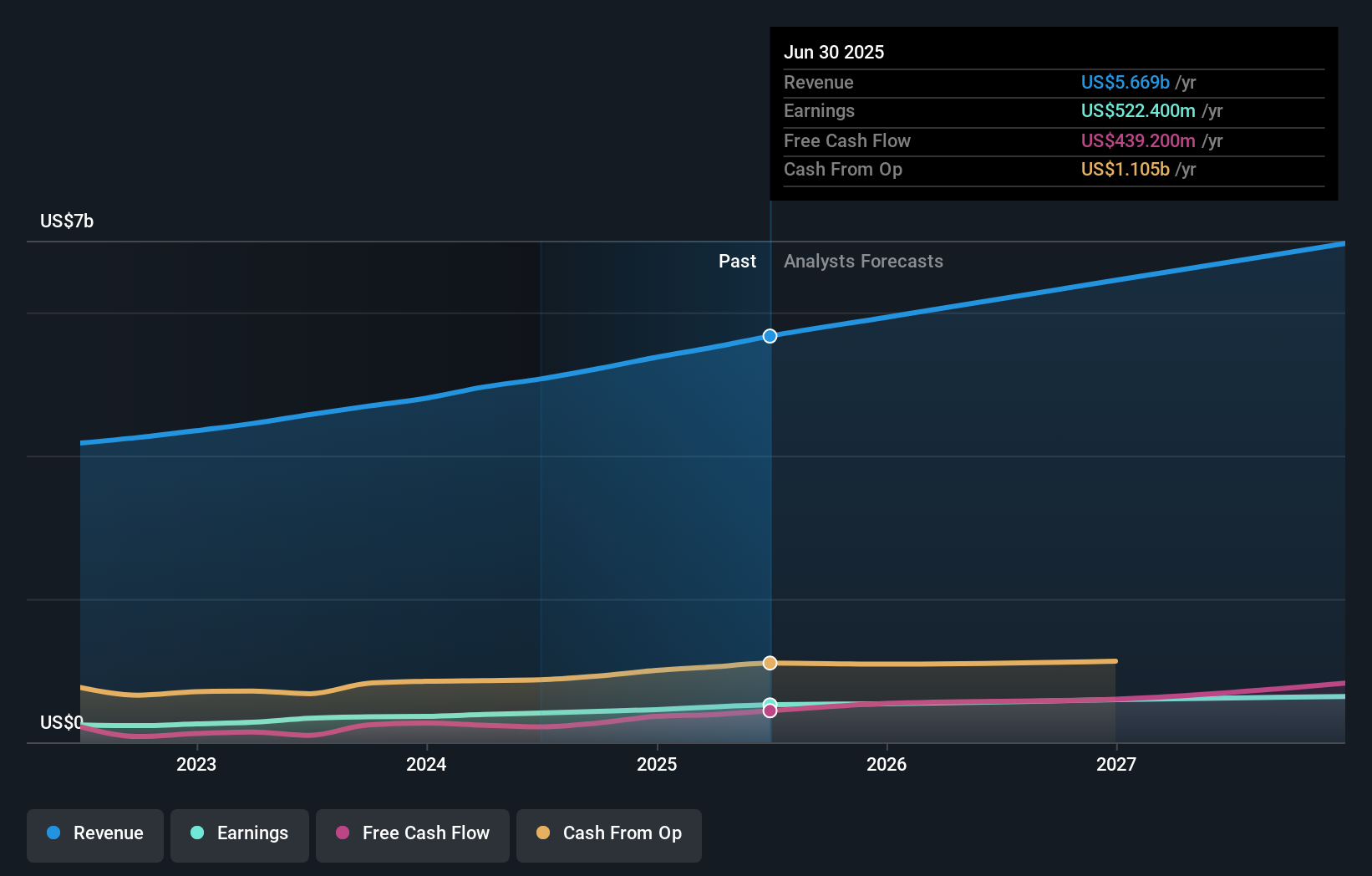

Encompass Health's narrative projects $7.2 billion revenue and $711.6 million earnings by 2028. This requires 8.1% yearly revenue growth and a $189.2 million earnings increase from $522.4 million currently.

Uncover how Encompass Health's forecasts yield a $135.75 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community puts Encompass Health at US$135.75. As you consider expansion catalysts, remember that investor opinions can differ widely on the potential rewards and risks.

Explore another fair value estimate on Encompass Health - why the stock might be worth just $135.75!

Build Your Own Encompass Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encompass Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encompass Health's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 22 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Encompass Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EHC

Encompass Health

Provides post-acute healthcare services in the United States and Puerto Rico.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives