- United States

- /

- Healthcare Services

- /

- NYSE:EHC

Encompass Health (EHC): Assessing Valuation as New Florida Rehab Hospital Opens

Reviewed by Simply Wall St

Encompass Health (EHC) just opened the doors to a brand-new 50-bed inpatient rehabilitation hospital in The Villages, Central Florida, and it is already welcoming its first patients. This move stands out as a meaningful expansion for the company and is designed to address surging demand for intensive rehabilitation services in one of the country’s fastest-growing retirement communities. Advanced therapy technology and personalized care at this facility serve as important additions not only for patients but for investors tracking the company’s execution of its 2025 growth strategy.

As Encompass Health continues to invest in growing its national footprint, its stock has outperformed many peers, up 36% over the past year and gaining strong momentum year-to-date. The steady stream of hospital openings, like this new facility, has become a core part of the company’s long-term playbook. Recent business moves hint at increasing confidence in the firm’s trajectory, both internally and in the wider market.

With solid stock gains and a commitment to expansion, is the market fully recognizing Encompass Health’s growth potential or could there still be room for upside?

Most Popular Narrative: 7% Undervalued

According to the most widely followed narrative, Encompass Health is currently undervalued by 7% compared to its fair value estimate. Analysts point to a robust growth outlook supported by key demographic and business trends.

The surge in the 65-plus population and persistent undersupply of inpatient rehabilitation beds are driving high and still-unmet demand for Encompass Health's core services. Ongoing hospital openings and bed expansions position the company to capture significant incremental patient volume, supporting higher revenue growth for years to come.

Want to uncover what’s fueling this bullish view? The market’s price target comes from bold growth assumptions and a future profit multiple that rivals industry leaders. Curious which projections and metrics triggered this premium value? Dive deeper to reveal the eye-opening numbers driving Encompass Health’s fair value estimate.

Result: Fair Value of $135.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent labor shortages and the industry's shift toward value-based, outpatient care could threaten Encompass Health’s growth trajectory if these trends accelerate.

Find out about the key risks to this Encompass Health narrative.Another View: Market Ratio Signals

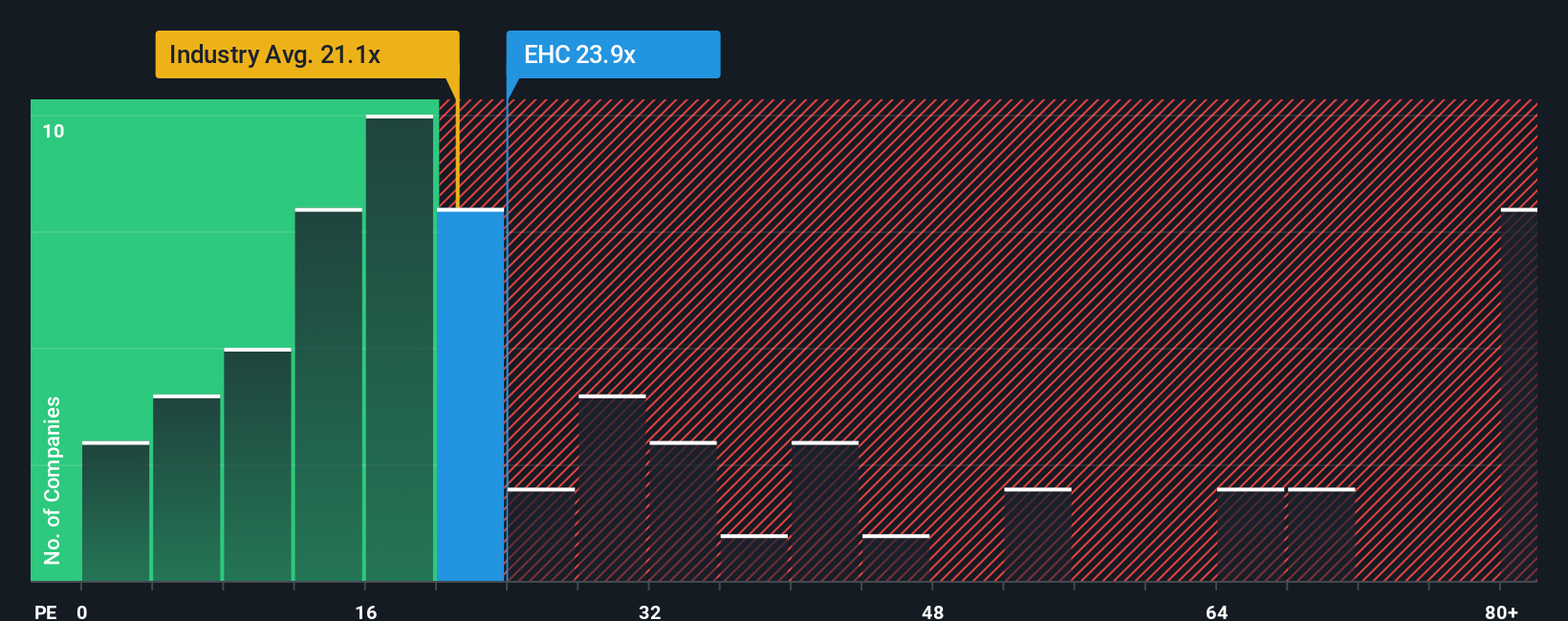

Looking at valuation from a different angle, Encompass Health appears expensive when compared with the industry’s standard measure for healthcare stocks. Does this suggest the market is pricing in more optimism than the fundamentals support?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Encompass Health Narrative

Feel inspired to dig deeper or chart your own course? It takes just minutes to analyze the numbers and shape your own unique perspective. Do it your way.

A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game by searching beyond the obvious. If you want to sharpen your portfolio or stay ahead of market trends, these powerful stock collections will open new doors and help you spot opportunities others miss.

- Jump on fast-growing companies with robust business models and uncover potential winners through our selection of undervalued stocks based on cash flows.

- Level up your portfolio by targeting income-generating firms. Check out companies boasting impressive yields with dividend stocks with yields > 3%.

- Ride the innovation wave in health tech by browsing breakthroughs in artificial intelligence and healthcare with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Encompass Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EHC

Encompass Health

Provides post-acute healthcare services in the United States and Puerto Rico.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives