- United States

- /

- Healthcare Services

- /

- NYSE:DVA

Is DaVita’s Advanced Dialysis Research Changing the Investment Case for DVA?

Reviewed by Sasha Jovanovic

- DaVita recently announced the launch of two large-scale clinical studies, MODEL and MEMOIRS, to examine the benefits of middle-molecule removal in dialysis for U.S. patients with kidney failure.

- This marks the first time such research will generate U.S.-based data on advanced dialyzer technologies, potentially informing future standards of care for end-stage kidney disease.

- We’ll now explore how DaVita’s expanded clinical research efforts could influence its long-term outlook and investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

DaVita Investment Narrative Recap

Being a DaVita shareholder hinges on the belief that consistent demand for dialysis, aided by an aging population and advances in care, will support long-term growth and patient outcomes. The recent launch of the MODEL and MEMOIRS studies expands DaVita’s clinical research ambitions, but these initiatives are unlikely to influence near-term catalysts such as patient volume recovery or address margin pressures from lagging reimbursement rates right away.

Of the recent announcements, the upcoming third-quarter earnings release on October 29 stands out as most relevant to short-term investor sentiment. While the new clinical studies highlight a long-term commitment to innovation, investors are likely to stay focused on financial results, given recent challenges in treatment volume and margin compression.

By contrast, investors should be aware that persistent declines in treatment volumes and ongoing operational challenges could present risks that...

Read the full narrative on DaVita (it's free!)

DaVita's outlook anticipates $15.0 billion in revenue and $970.4 million in earnings by 2028. This forecast rests on a 4.4% annual revenue growth rate and a $134.1 million increase in earnings from the current $836.3 million.

Uncover how DaVita's forecasts yield a $150.50 fair value, a 18% upside to its current price.

Exploring Other Perspectives

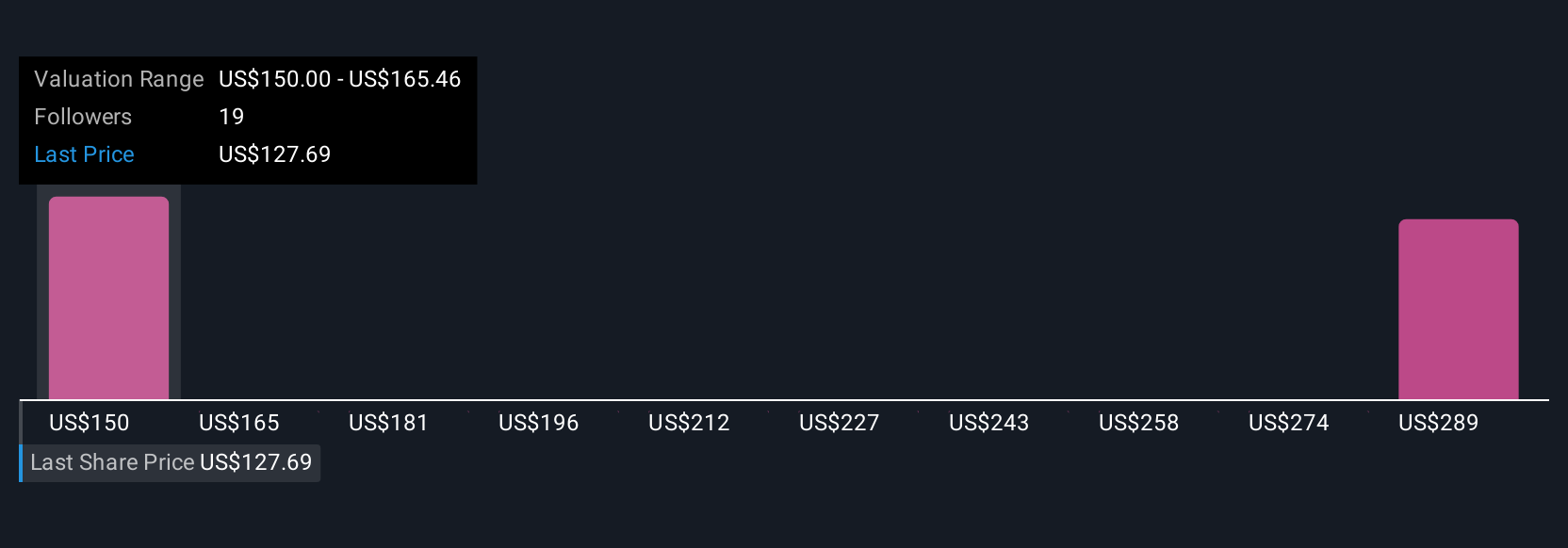

Simply Wall St Community members produced fair value estimates for DaVita ranging from US$150.50 to US$294.45, across two unique perspectives. With near-term treatment volume recovery still uncertain, you can explore these varied outlooks to inform your own view.

Explore 2 other fair value estimates on DaVita - why the stock might be worth over 2x more than the current price!

Build Your Own DaVita Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DaVita research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DaVita research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DaVita's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVA

DaVita

Provides kidney dialysis services for patients suffering from chronic kidney failure in the United States.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives