- United States

- /

- Healthcare Services

- /

- NYSE:DVA

How DaVita’s $3.5B Debt Refinancing Changes Its Capital Flexibility and Investment Story (DVA)

Reviewed by Sasha Jovanovic

- On November 24, 2025, DaVita Inc. amended its existing credit agreement, securing a new five-year US$2 billion term loan and a US$1.5 billion revolving credit facility to refinance earlier debt and support general corporate purposes.

- This refinancing provides DaVita with increased financial flexibility for working capital, possible acquisitions, and ongoing capital management initiatives.

- We'll explore how this significant refinancing move could impact DaVita's investment narrative, particularly regarding its capital structure and future operational flexibility.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

DaVita Investment Narrative Recap

To be a DaVita shareholder, you need to believe in the long-term stability of dialysis demand and the company’s ability to manage ongoing cost pressures while supporting innovation in patient care. The new US$2 billion term loan and US$1.5 billion revolving credit facility enhance DaVita’s financial flexibility, but do not meaningfully change the most important short-term catalyst, recovery in treatment volumes, or materially reduce the ongoing risk of reimbursement rates lagging inflation.

Of DaVita's recent announcements, the expanded share buyback program stands out as most relevant to the refinancing news. Enhanced liquidity from this debt refinancing could further support such capital management initiatives, which are closely watched by investors as DaVita continues to generate free cash that can be returned to shareholders despite recent earnings pressures.

In contrast, ongoing challenges from below-inflation reimbursement rate updates are a critical issue investors should be aware of, especially since...

Read the full narrative on DaVita (it's free!)

DaVita's outlook anticipates $15.0 billion in revenue and $970.4 million in earnings by 2028. This is based on a 4.4% annual revenue growth rate and a $134.1 million increase in earnings from the current level of $836.3 million.

Uncover how DaVita's forecasts yield a $144.50 fair value, a 20% upside to its current price.

Exploring Other Perspectives

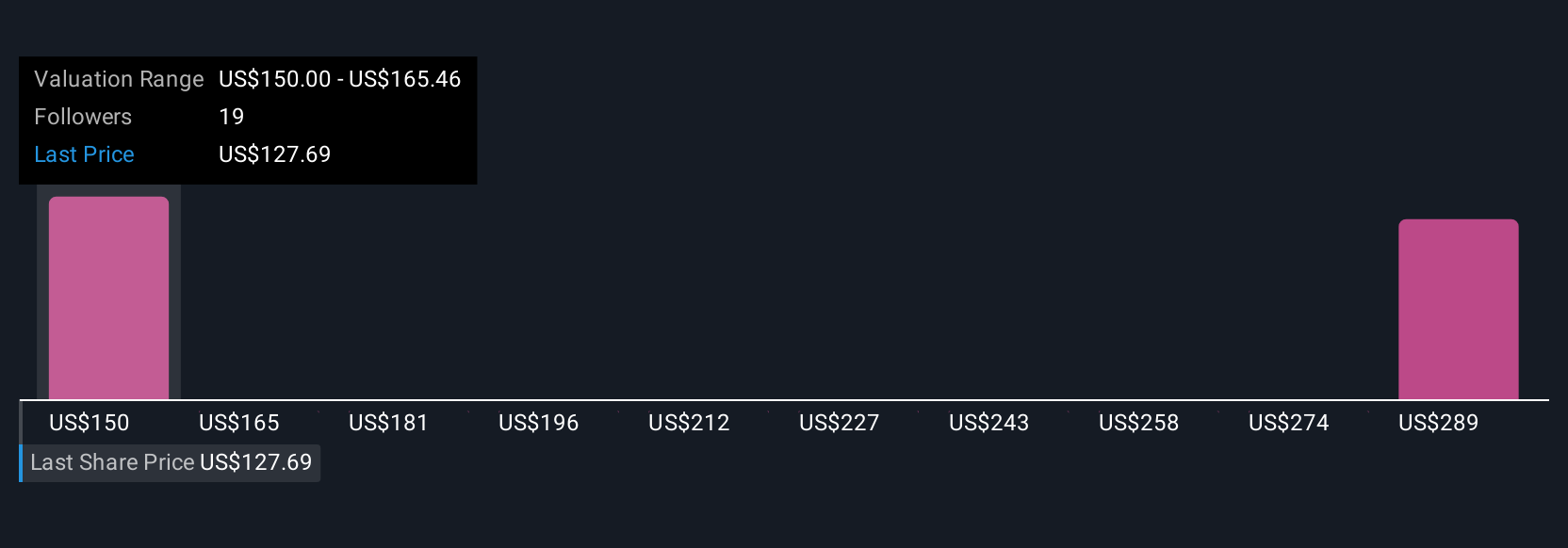

Three members of the Simply Wall St Community assessed DaVita’s fair value between US$144.50 and US$345.43 per share, showcasing a wide spread of individual forecasts. While expectations for treatment volume recovery remain a key focus, you can explore a broad range of independent perspectives on where DaVita could go next.

Explore 3 other fair value estimates on DaVita - why the stock might be worth just $144.50!

Build Your Own DaVita Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DaVita research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DaVita research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DaVita's overall financial health at a glance.

No Opportunity In DaVita?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVA

DaVita

Provides kidney dialysis services for patients suffering from chronic kidney failure in the United States.

Very undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.