- United States

- /

- Healthcare Services

- /

- NYSE:DVA

DaVita's (DVA) Index Departure Raises Questions About Investor Base and Strategic Direction

Reviewed by Simply Wall St

- DaVita Inc. was recently removed from the FTSE All-World Index, prompting changes to how funds tracking this benchmark allocate DaVita shares.

- This index exclusion may lead to adjustments by institutional investors and could influence the company’s investor base composition going forward.

- We'll explore how DaVita’s drop from the FTSE All-World Index may affect its future growth outlook and market position.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

DaVita Investment Narrative Recap

To be a DaVita shareholder, investors need to believe that steady demand from an aging population and ongoing operational improvements can offset recent headwinds in patient volume and net earnings growth. DaVita’s recent removal from the FTSE All-World Index is unlikely to change the company’s underlying short-term catalysts, but it could modestly impact trading volumes by shifting the composition of its investor base. The main immediate risk remains persistently subdued treatment volumes, which continues to weigh on revenue and earnings expectations.

Among DaVita’s recent announcements, the Q2 2025 earnings report stands out. Revenue rose to US$3,379.53 million compared to the prior year, though net income was lower, echoing ongoing challenges in both operating margins and patient growth. These results provide direct context for the pressing questions about DaVita’s earnings resilience following benchmark index exclusion.

In contrast, investors should carefully consider how ongoing reimbursement pressures from CMS could further limit DaVita’s ability to...

Read the full narrative on DaVita (it's free!)

DaVita's outlook anticipates $15.0 billion in revenue and $970.4 million in earnings by 2028. This is based on expected annual revenue growth of 4.4% and an earnings increase of $134.1 million from the current $836.3 million.

Uncover how DaVita's forecasts yield a $153.50 fair value, a 18% upside to its current price.

Exploring Other Perspectives

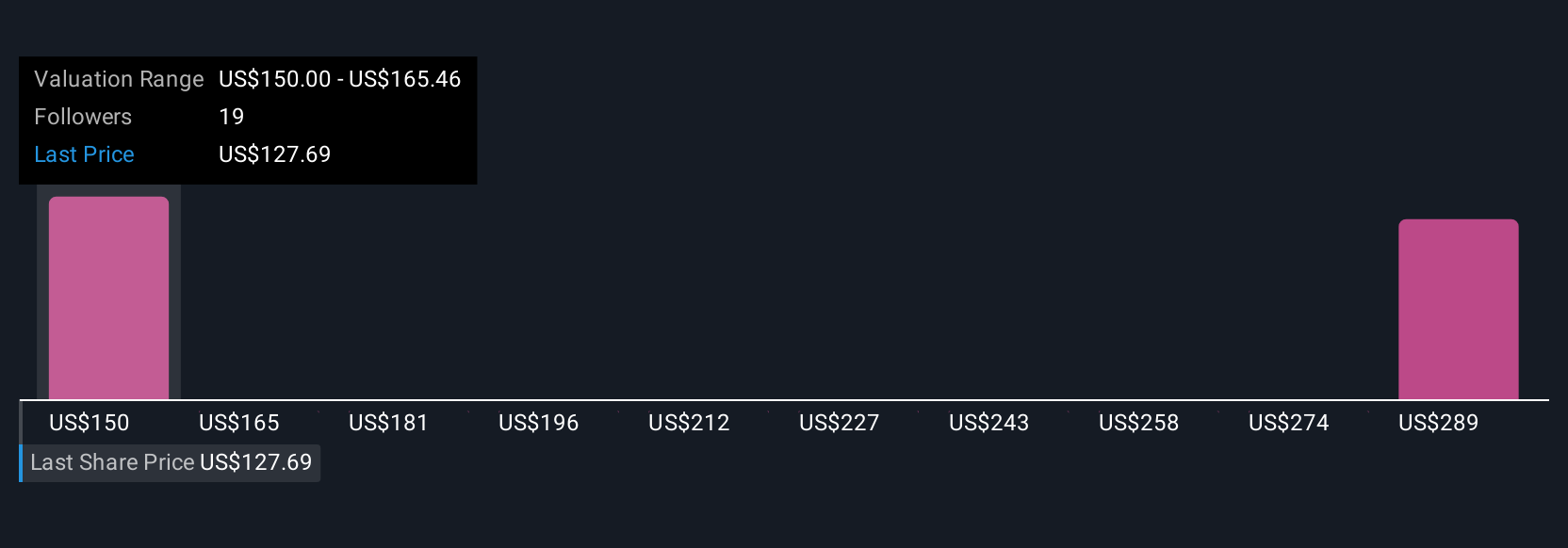

Simply Wall St Community members offered three fair value estimates for DaVita ranging from US$150 to US$299.74 per share. While opinions differ widely, persistent challenges with treatment volume growth mean many are closely watching the company’s revenue trajectory and future cash flow potential.

Explore 3 other fair value estimates on DaVita - why the stock might be worth over 2x more than the current price!

Build Your Own DaVita Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DaVita research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DaVita research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DaVita's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVA

DaVita

Provides kidney dialysis services for patients suffering from chronic kidney failure in the United States.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives