- United States

- /

- Healthcare Services

- /

- NYSE:DVA

Could Declining Patient Volumes Reshape DaVita’s Long-Term Growth Narrative (DVA)?

Reviewed by Simply Wall St

- Recently, DaVita Inc. faced heightened scrutiny as investors weighed ongoing operational issues, including patient volume concerns and reduced full-year earnings guidance, against a modest revenue outperformance.

- While investor sentiment reflected near-term caution, analyst estimate revisions and expectations for future earnings growth offer some optimism amid lingering operational headwinds.

- We'll assess how concerns about declining patient volumes due to center closures could affect DaVita's broader investment outlook and growth catalysts.

This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

DaVita Investment Narrative Recap

For shareholders of DaVita, the key appeal lies in the company's ability to sustain stable demand for dialysis services as the population ages and chronic disease rates grow. However, the recent decline in DaVita's stock price after reporting lower full-year earnings guidance and ongoing concerns about patient volume underscores the importance of monitoring short-term disruptions; the near-term outlook depends on whether the company can restore patient growth, which remains its biggest operational risk right now.

Among recent company updates, DaVita’s August announcement of a $2 billion expansion to its share buyback program stands out. While buybacks can signal confidence and support per-share value, they do little to address immediate operational challenges like lower treatment volumes, a core issue weighing on potential growth catalysts.

Yet, while DaVita’s buyback ambitions grab headlines, investors should be just as aware that persistent declines in patient numbers...

Read the full narrative on DaVita (it's free!)

DaVita's outlook anticipates $15.0 billion in revenue and $970.4 million in earnings by 2028. This scenario assumes 4.4% annual revenue growth and a $134.1 million increase in earnings from the current $836.3 million.

Uncover how DaVita's forecasts yield a $153.50 fair value, a 15% upside to its current price.

Exploring Other Perspectives

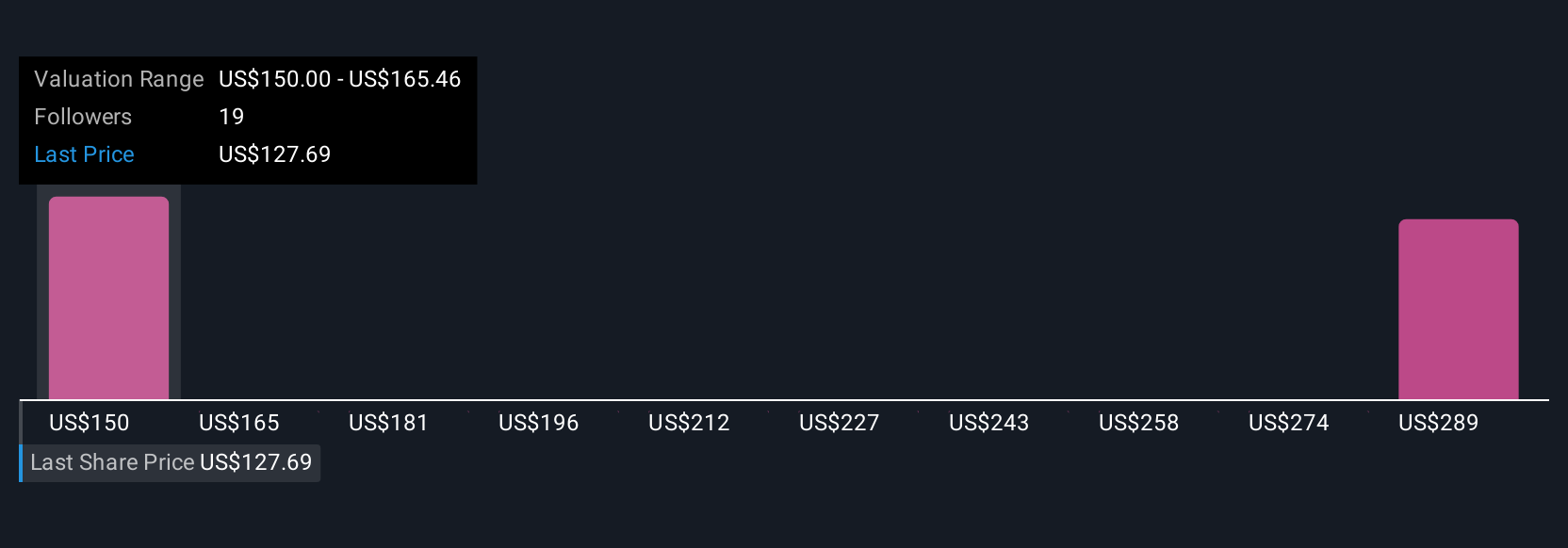

Fair value estimates from three members of the Simply Wall St Community range widely from US$150 to US$303,350, reflecting contrasting outlooks. Patient volume pressures remain front of mind, reminding you to consider how diverse opinions could shape your own view on what comes next for DaVita.

Explore 3 other fair value estimates on DaVita - why the stock might be worth over 2x more than the current price!

Build Your Own DaVita Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DaVita research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DaVita research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DaVita's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVA

DaVita

Provides kidney dialysis services for patients suffering from chronic kidney failure in the United States.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives