- United States

- /

- Healthtech

- /

- NYSE:DOCS

Doximity Stock Surges 67% as Digital Health Momentum Sparks Valuation Debate in 2025

Reviewed by Bailey Pemberton

If you have been watching Doximity lately and wondering if it is finally time to buy, hold, or sell, you are hardly alone. The stock has been on quite a ride. Just in the past year, shares are up a remarkable 67.1%, and year-to-date they have climbed 36.8%. Even after a minor slip this week of -1.5%, broad momentum seems firmly with the bulls. Over the long haul, Doximity’s returns are even more striking, posting a 146.9% gain over three years. Much of this optimism mirrors wider developments in digital healthcare solutions as investors are betting on doctors’ lives and patient engagement moving ever more online while the medical world updates its playbook.

With all the excitement, though, the big question now is value. Is Doximity trading at a bargain or is it riding a hype wave? If you look at conventional valuation measures, the company currently scores 0 out of 6 on our undervaluation checklist, suggesting Doximity does not look undervalued by traditional standards. But are those methods missing something? Next, we will break down the key approaches to valuing Doximity and share a fresh, nuanced perspective at the end that might reshape how you think about what the stock is worth.

Doximity scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Doximity Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and discounting them back to their value today. This approach is widely used for fast-growing technology or healthcare businesses, such as Doximity, because it seeks to look beyond short-term metrics and focus on longer-term earning power.

Doximity’s current Free Cash Flow (FCF) stands at $286.3 million. Analysts provide detailed forecasts for the next five years, with growth expected to drive FCF up to $478.1 million by 2030. After that, further increases are extrapolated using reasonable growth rates to round out a ten-year outlook, culminating in $622.1 million FCF by 2035. All amounts are based in US dollars.

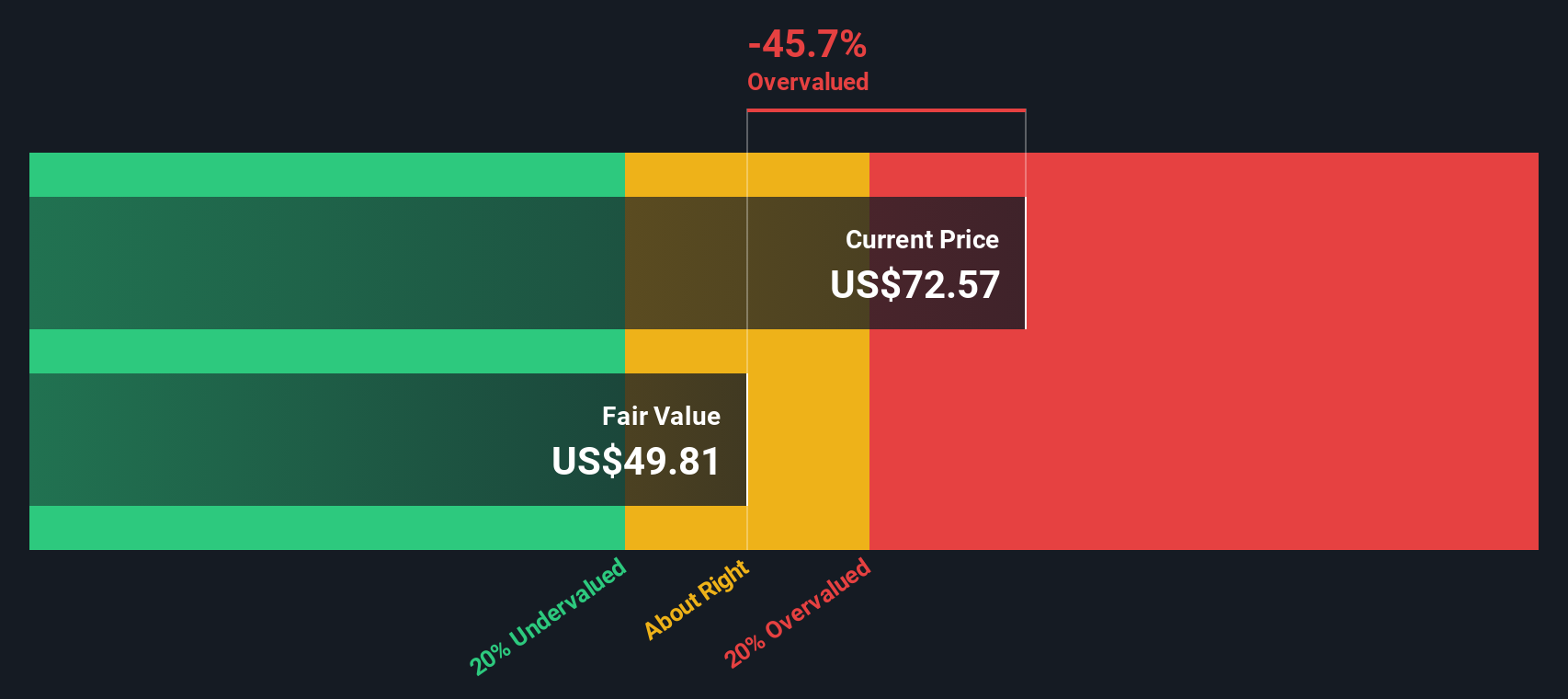

When these future cash flows are discounted back to their present value and tallied, the DCF model produces an estimated intrinsic value of $49.83 per share. Compared to the recent market price, this implies the stock is roughly 47.0% overvalued according to this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Doximity may be overvalued by 47.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Doximity Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for assessing whether a profitable company like Doximity is attractively valued. For companies generating consistent earnings, the PE ratio helps investors quickly gauge how much they are paying for each dollar of profit. This makes it especially relevant for mature, steadily growing businesses.

Growth expectations and perceived risk play a big role in what investors consider a “normal” or “fair” PE ratio. Higher predicted earnings growth and lower risk typically justify a higher multiple. Companies with uncertain futures or lower profit growth usually command less.

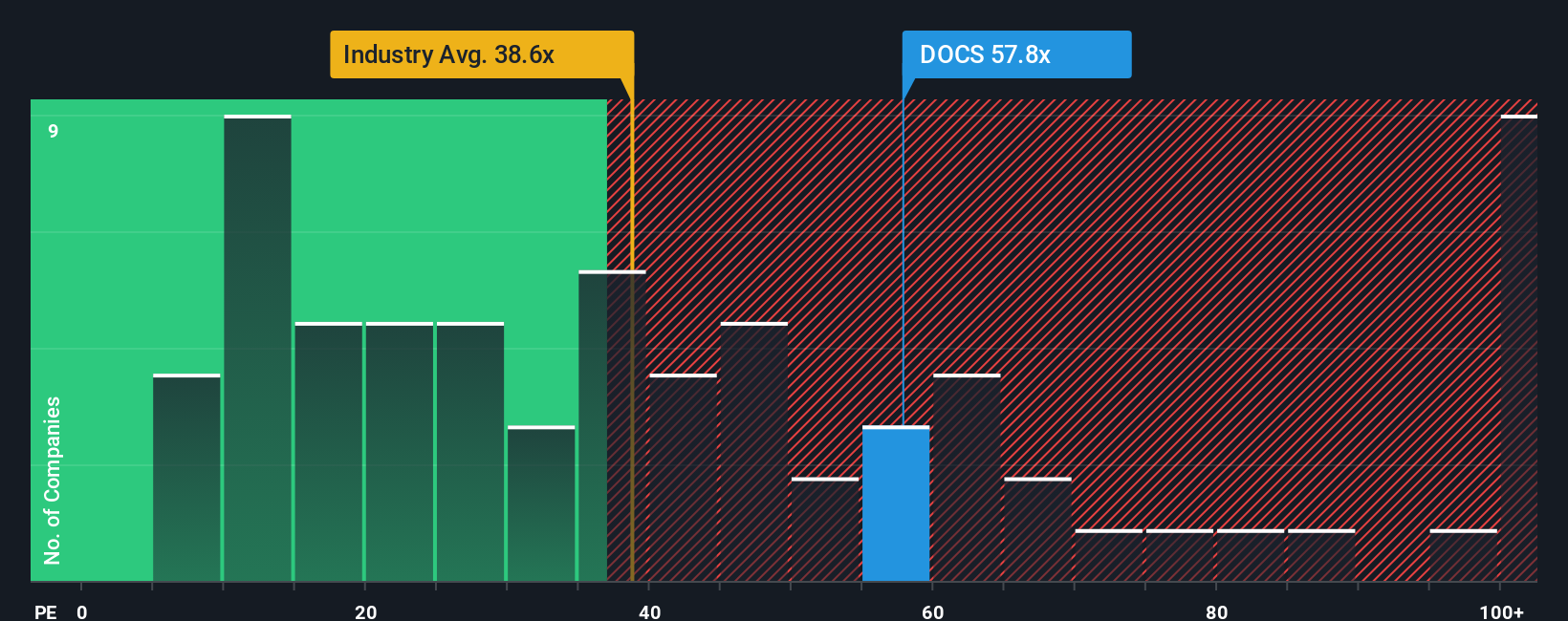

Doximity is currently trading at a PE ratio of 58.4x. For context, this is marginally above both the peer group average of 57.8x and well above the healthcare services industry average of 38.5x. Rather than relying solely on these rough benchmarks, Simply Wall St’s proprietary "Fair Ratio" offers a more nuanced take. This Fair Ratio, set at 33.0x for Doximity, accounts for the company’s unique mix of earnings growth, profit margins, market capitalization, industry dynamics, and risk profile.

By considering these factors, the Fair Ratio provides a more tailored perspective than industry or peer averages alone. When comparing Doximity’s actual PE of 58.4x to its Fair Ratio of 33.0x, the stock appears to be trading at a considerable premium to what its fundamentals suggest is reasonable.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Doximity Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Simply put, a Narrative is your own story about where Doximity is heading, backed up by your view of future revenues, earnings, margins, and what you believe the company should be worth.

Unlike static valuation checklists or models, a Narrative helps you link the qualitative story you believe about Doximity, such as its growth in telehealth, AI tools, or client base, to concrete financial forecasts and, ultimately, a fair value estimate. Narratives make investing more personal and dynamic because they put your perspective front and center, translating your beliefs into numbers and actionable investment decisions.

Using Simply Wall St’s Community page, you can easily create and update your own Narrative with just a few clicks, comparing your assumptions with other investors and analysts who use the platform. Narratives help you decide whether Doximity is a buy or sell by directly comparing your updated Fair Value (grounded in your story) with the current market Price. Best of all, when new information comes in, whether from news or earnings, your Narrative stays up-to-date, making it a living tool that grows and adapts alongside the company.

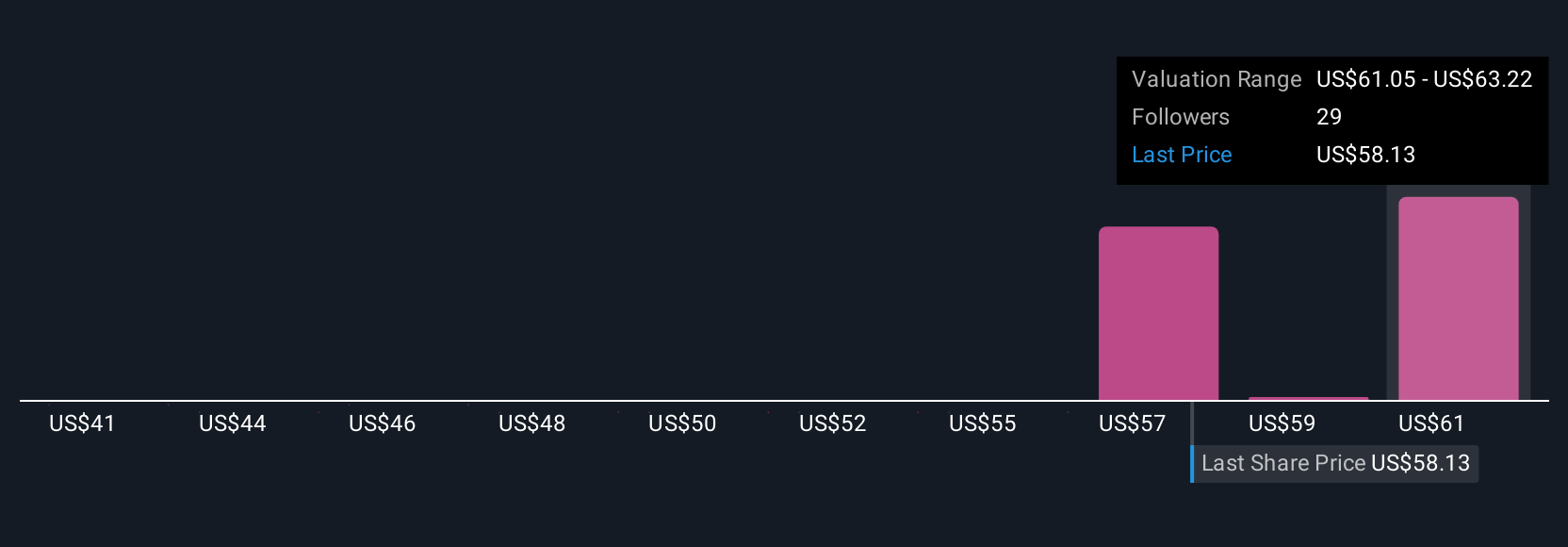

For example, some investors, focused on accelerating adoption of AI and digital healthcare, see a fair value for Doximity as high as $80.00 per share. Others, cautious about regulatory risks or slowing user growth, see it closer to $55.00. This demonstrates just how powerful and flexible Narratives can be for every perspective.

Do you think there's more to the story for Doximity? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCS

Doximity

Operates as a digital platform for medical professionals in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives