- United States

- /

- Healthcare Services

- /

- NYSE:CYH

Community Health Systems (CYH): $340 Million One-Off Gain Reinforces Debate Over Profit Quality

Reviewed by Simply Wall St

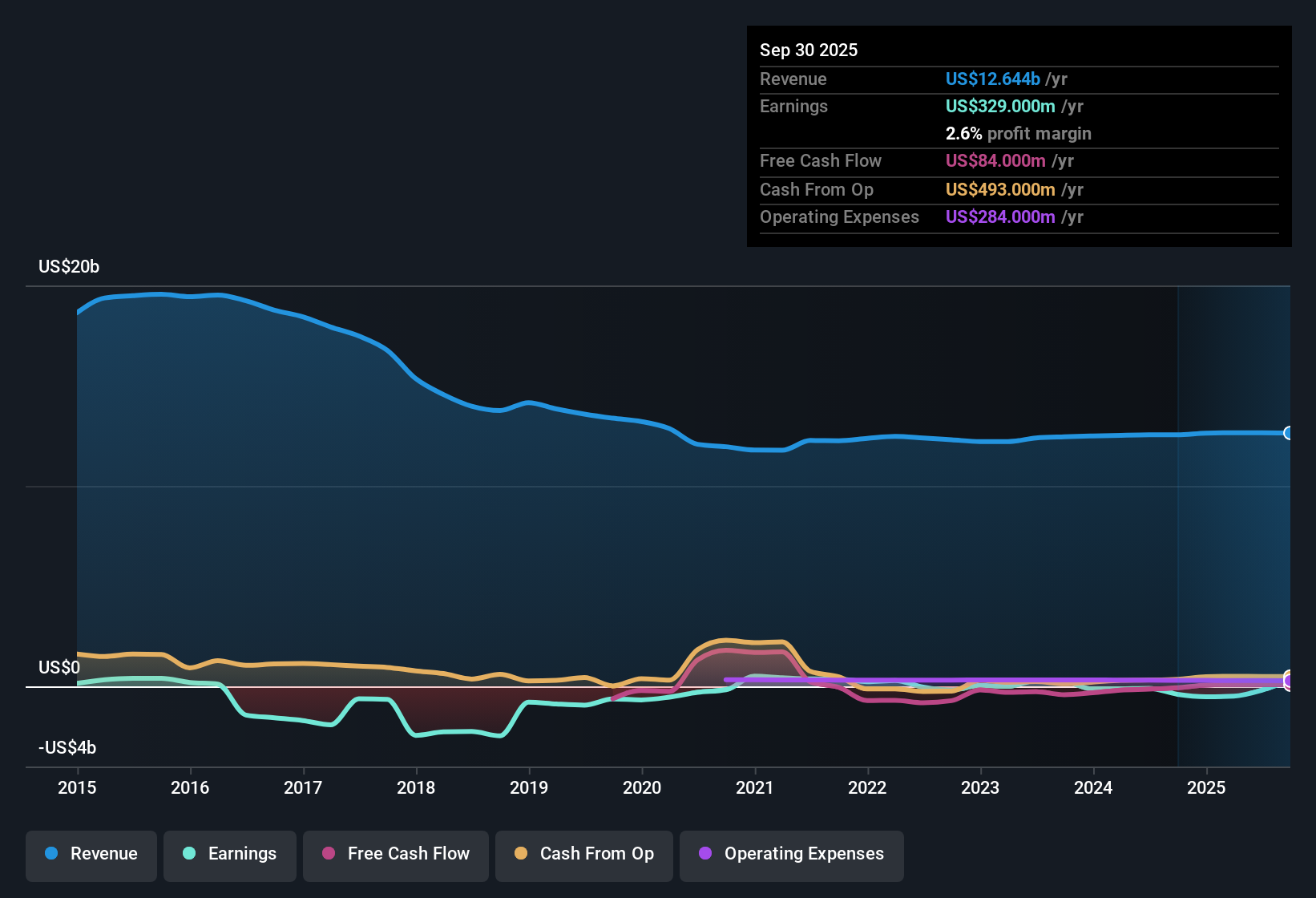

Community Health Systems (CYH) turned profitable over the past twelve months, benefiting from a significant one-off gain of $340 million. Despite this, the company’s earnings have declined at a rate of -43.9% per year over the last five years. Looking ahead, earnings are expected to fall even further at -107.8% per year for the next three years. With revenue forecast to grow just 1.9% annually, well below the broader US market’s 10% rate, investors are left weighing recent profitability against ongoing structural headwinds.

See our full analysis for Community Health Systems.Next up, we’ll set the latest financial performance against the key narratives shaping market expectations. We will highlight where the numbers back up the story and where they might tell a different tale.

See what the community is saying about Community Health Systems

Analyst Price Target Implies 10% Upside

- The current share price of $4.10 sits about 10% below the consensus analyst price target of $3.67, suggesting that the market may be more upbeat on future prospects than sell-side analysts.

- According to the analysts' consensus view, recent expansion in outpatient services and the addition of over 200 new providers in 2025 are set to drive future market share and operational efficiency.

- Divestitures of underperforming assets and strategic use of proceeds are also expected to improve cash flow and help contain debt, a critical need given balance sheet risk.

- However, the significantly lower revenue growth forecast of 1.9% annually versus the 10% US market average highlights softer performance, keeping investor expectations tempered.

- A key tension remains: even if revenues reach $13.2 billion and earnings swing to $713.5 million by 2028 as analysts assume, the required PE ratio of 1.0x to justify the price target is well below the healthcare industry’s average of 20.9x, indicating persistent skepticism about financial durability.

Want the full details of how analyst targets and growth trends play together? Dive into the whole narrative and weigh whether analysts are being too cautious or not cautious enough. 📊 Read the full Community Health Systems Consensus Narrative.

PE Ratio Far Below Industry Norms

- CYH trades at a price-to-earnings ratio of 1.7x, drastically undercutting the US healthcare industry average of 21.7x and signaling a valuation discount that is unusual among public peers.

- Analysts' consensus view points out that the low PE stems from a mix of risk and reward.

- Investors are attracted by apparent deep value; the low multiple suggests the market is already pricing in weak growth and ongoing debt risk.

- Yet this discount is balanced by caution, as negative equity and erratic profitability make some question whether the company can fully capitalize on operational turnaround efforts.

Debt, Medicaid, and Labor Costs Remain in Focus

- Heavy reliance on Medicaid funding and scheduled debt maturities at higher refinancing rates continue to keep financial flexibility under pressure, with risks to both margins and cash flow over the next several years.

- In the consensus narrative, multiple caution flags come up for investors.

- Bears highlight volume declines in elective surgeries and the risk that regulatory changes could reduce Medicaid payments by $300 to $350 million over 13 years.

- Persistent labor cost inflation, plus an unfavorable payer mix shift to lower reimbursement sources, are keeping margin recovery challenging despite digital modernization efforts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Community Health Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell a different story? Jump in and craft your own take in just a few minutes. Do it your way

A great starting point for your Community Health Systems research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Explore Alternatives

Community Health Systems faces ongoing headwinds from heavy debt, slow revenue growth, and persistent margin pressure. These factors cast doubt on long-term financial stability.

If you want to target companies with stronger financial footing, check out solid balance sheet and fundamentals stocks screener (1977 results) and find options with resilient balance sheets and less risk from debt or funding pressures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CYH

Community Health Systems

Owns, leases, and operates general acute care hospitals in the United States.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives