- United States

- /

- Healthtech

- /

- NYSE:CTEV

Can Analyst Optimism Over CTEV’s AI Healthcare Push Outweigh Its Financial Hurdles?

Reviewed by Sasha Jovanovic

- In recent days, Claritev Corporation has attracted significant investor attention as multiple analysts upgraded their ratings, reflecting increased confidence in the company's innovative data analytics and technology-driven healthcare solutions.

- This analyst support comes even as Claritev faces financial challenges, with its efforts to reduce healthcare costs and positive sentiment around AI-driven solutions helping to strengthen its position in the industry.

- We’ll explore how this wave of analyst optimism, particularly around Claritev’s healthcare technology innovations, may impact its overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Claritev Investment Narrative Recap

For investors considering Claritev, the core belief centers on the company’s ability to drive widespread adoption of its AI-powered data analytics to reshape healthcare decision-making and cost efficiency. Citi’s recent analyst upgrade signals strong endorsement of Claritev’s technology and sector potential, but it doesn’t materially change the most important short-term catalyst, sustained momentum in client wins, or alter the biggest risk, which remains Claritev’s dependence on a concentrated set of payor and TPA clients.

Of recent developments, Claritev's new partnership with iO Health-FZE to deliver its Optima AI solution across the MENA region stands out as directly relevant. This move expands Claritev’s international reach, aligning with the current excitement around new markets and AI-driven opportunities, and strengthens the argument for future revenue growth catalysts tied to geographic diversification outside of the company’s core U.S. base.

However, despite all the new partnerships and analyst optimism, investors should also be aware that a high share of Claritev’s revenues remains tied to a small group of major clients, so if there’s significant churn or renegotiation...

Read the full narrative on Claritev (it's free!)

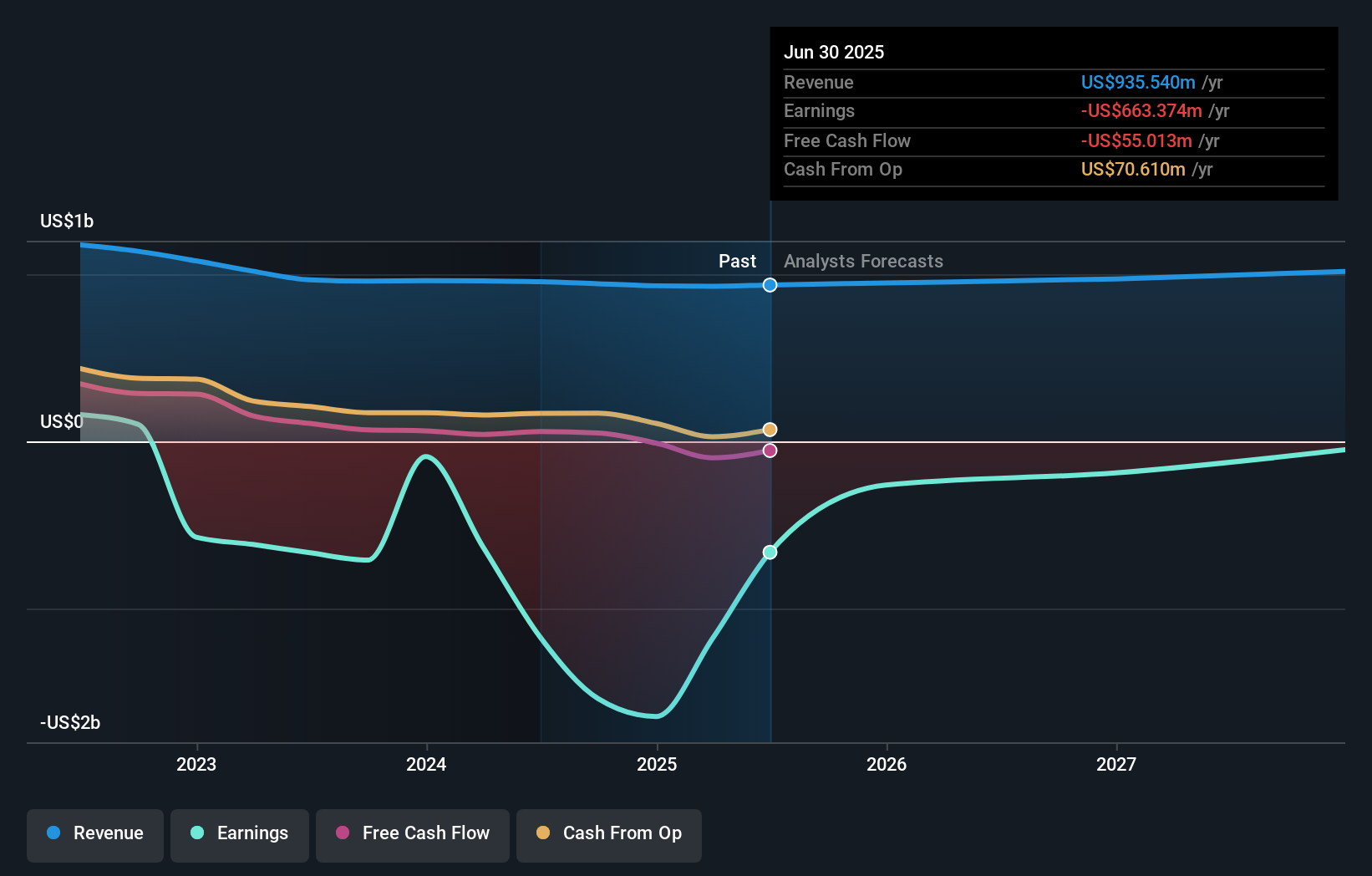

Claritev's narrative projects $1.0 billion revenue and $90.0 million earnings by 2028. This requires 3.1% yearly revenue growth and a $753.4 million earnings increase from current earnings of $-663.4 million.

Uncover how Claritev's forecasts yield a $80.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for Claritev ranging from US$10.98 to US$162.41, based on three independent perspectives. In light of Claritev’s client concentration risk, these diverse views highlight how assumptions on revenue sustainability can dramatically affect outlooks for the company’s future performance.

Explore 3 other fair value estimates on Claritev - why the stock might be worth over 2x more than the current price!

Build Your Own Claritev Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Claritev research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Claritev research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Claritev's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTEV

Claritev

Provides data analytics and technology-enabled cost management, payment, and revenue integrity solutions to the healthcare industry in the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives