- United States

- /

- Healthcare Services

- /

- NYSE:COR

Cencora (COR): Assessing Fair Value After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Cencora.

Momentum for Cencora has really picked up, with its share price climbing 9.46% over the past month and posting an impressive 49.5% year-to-date price return. This steady investor enthusiasm, along with a strong 45% total shareholder return in the last year, highlights that both short- and long-term performance have remained robust, even as the market weighs the stock's valuation and growth outlook.

If Cencora’s strong run has you curious about what else the market is rewarding right now, it might be the perfect time to discover fast growing stocks with high insider ownership.

But with Cencora’s shares hovering near recent highs and barely any discount to target prices, it raises a key question: does the current valuation leave room for further upside, or is future growth already baked in?

Most Popular Narrative: Fairly Valued

Cencora’s last close price lands within a fraction of what the consensus narrative pegs as fair value, making this a story of perfect market alignment. The current market stance reflects high conviction in Cencora's earnings and revenue path.

Cencora's ongoing investment in digital infrastructure and advanced analytics positions the company to capitalize on the accelerating digitization of healthcare and regulatory requirements like the Drug Supply Chain Security Act. This improves supply chain efficiency and transparency, which should drive higher net margins and operating income over time.

What is really fueling this confident price? The narrative’s foundation rests on a bold blend of higher future margins, robust top-line growth, and a surprisingly ambitious profit valuation. Want to unravel exactly what kind of financial leap the consensus is counting on? The underlying numbers may challenge your expectations. Find out what is giving analysts such conviction by reading on.

Result: Fair Value of $333.29 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts such as increased competition in specialty distribution or persistent weakness in international segments could present challenges to Cencora’s growth and margin outlook.

Find out about the key risks to this Cencora narrative.

Another View: Discounted Cash Flow Signals Upside

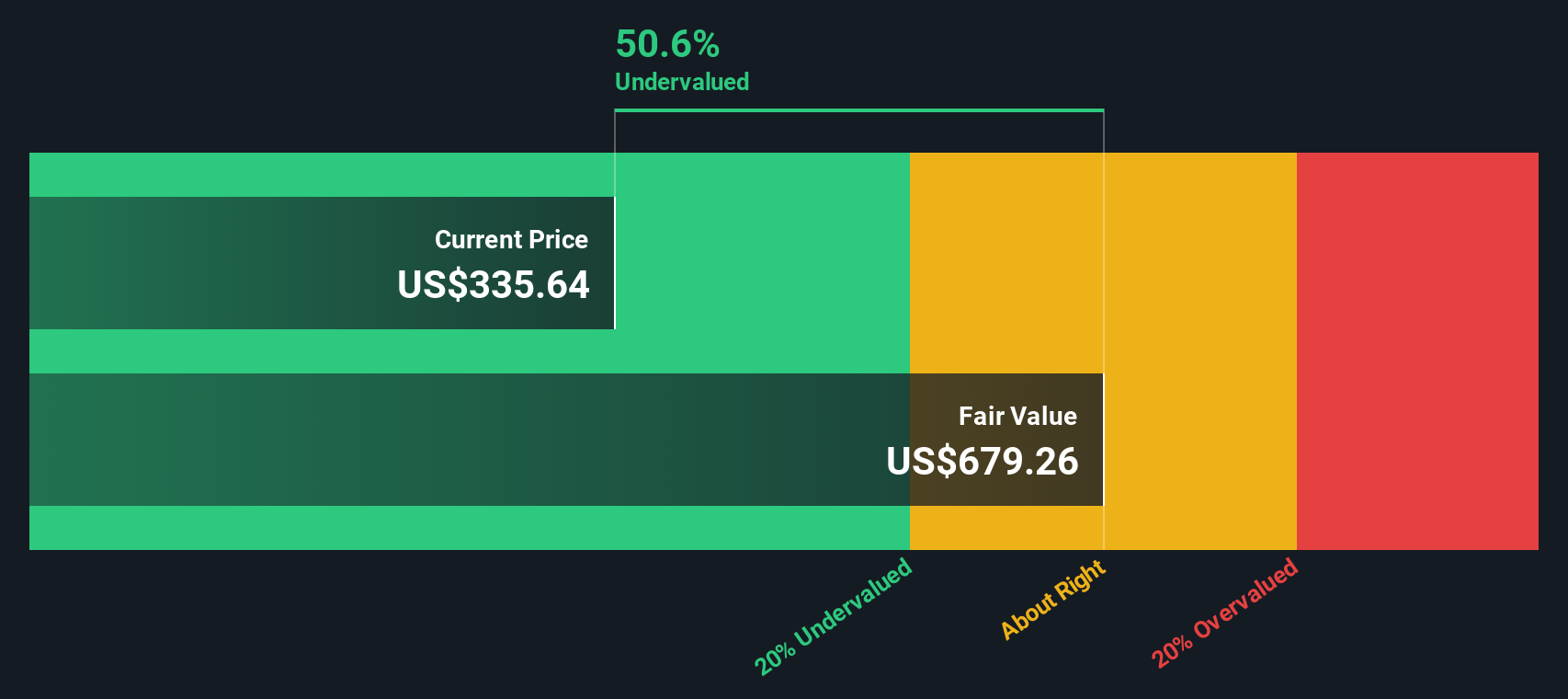

While much of the market analysis suggests Cencora is trading close to fair value by consensus, our SWS DCF model offers a striking contrast. This approach estimates Cencora's fair value at $679.26 per share, which is over 50% above the current trading price. Could this divergence point to a hidden opportunity, or is the market right to be cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cencora for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cencora Narrative

If you’re not convinced by the market’s story or want a fresh perspective, you can easily build your own narrative from the data in just a few minutes. Do it your way.

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your investing potential to just one stock. Expand your strategy to powerful trends and let other promising companies help you achieve your financial goals.

- Unlock steady income streams by tapping into these 19 dividend stocks with yields > 3%, which are known for delivering yields above 3% and consistent returns.

- Spot tomorrow’s tech leaders by evaluating these 27 AI penny stocks, which are reshaping industries with artificial intelligence breakthroughs and strong growth prospects.

- Seize value opportunities among these 869 undervalued stocks based on cash flows, currently priced below their future cash flow potential for a sharper edge on your investments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives