- United States

- /

- Healthcare Services

- /

- NYSE:CON

Will Raised Guidance and a Share Buyback Redefine Concentra Group Holdings Parent's (CON) Growth Story?

Reviewed by Sasha Jovanovic

- In the past week, Concentra Group Holdings Parent announced raised financial guidance for 2025, launched a new US$100 million share repurchase program through 2027, and named Jason Cooper as Chief Data, Analytics, and AI Officer.

- These actions indicate management's confidence in future performance, with a focus on technology leadership and capital allocation that supports long-term growth.

- We'll explore how the raised financial guidance reflects management's conviction and impacts Concentra's existing investment narrative in the occupational health sector.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Concentra Group Holdings Parent Investment Narrative Recap

To be a Concentra Group Holdings Parent shareholder, you need to believe in the company's ability to drive steady growth in occupational health services through operational scale, digital investment, and sustained demand from employers. The recent guidance raise and buyback launch point to management's optimism, but the most important short-term catalyst, volume and revenue acceleration, remains challenged by modest organic visit growth. The biggest risk continues to be margin compression from elevated costs tied to acquisitions and integration efforts; the new updates do not materially alter this risk profile.

Among the latest announcements, Concentra's initiation of a US$100 million share repurchase program through 2027 stands out as especially relevant for investor interests, offering a concrete form of capital return that may help stabilize sentiment amid questions around long-term earnings leverage. While this move targets shareholder value in the short run, it occurs alongside ongoing margin pressures and the necessity to achieve cost synergies from recent expansion.

In contrast, the most pressing risk for investors to monitor is whether persistent G&A expenses and integration challenges could continue to weigh on near-term profitability and...

Read the full narrative on Concentra Group Holdings Parent (it's free!)

Concentra Group Holdings Parent's outlook anticipates $2.6 billion in revenue and $249.0 million in earnings by 2028. This projection implies an annual revenue growth rate of 8.4% and a $100.9 million earnings increase from the current $148.1 million.

Uncover how Concentra Group Holdings Parent's forecasts yield a $28.12 fair value, a 45% upside to its current price.

Exploring Other Perspectives

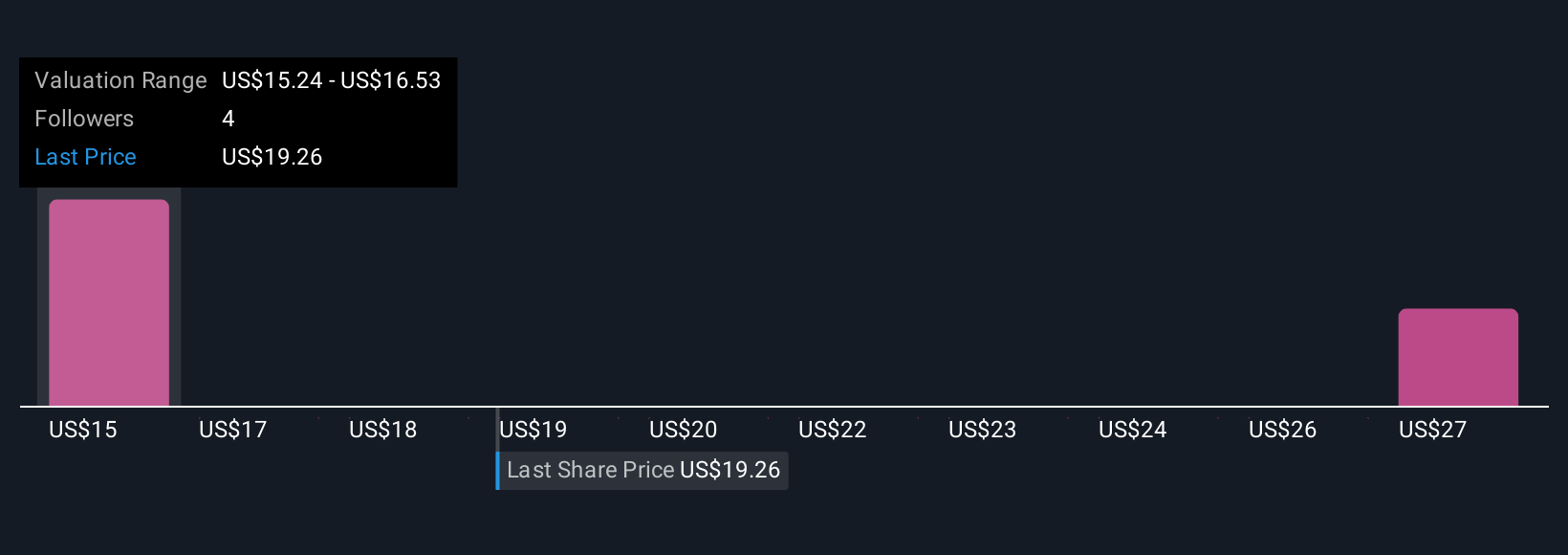

Simply Wall St Community fair value estimates for Concentra Group Holdings Parent, from US$15.72 to US$28.13, highlight the wide spectrum of investor expectations, based on only two user perspectives. With margin pressures posing a near-term risk, consider how such differences in outlook can influence each shareholder’s view on future performance.

Explore 2 other fair value estimates on Concentra Group Holdings Parent - why the stock might be worth as much as 45% more than the current price!

Build Your Own Concentra Group Holdings Parent Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Concentra Group Holdings Parent research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Concentra Group Holdings Parent research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Concentra Group Holdings Parent's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CON

Concentra Group Holdings Parent

Provides occupational health services in the United States.

Fair value with limited growth.

Market Insights

Community Narratives