- United States

- /

- Medical Equipment

- /

- NYSE:CNMD

The Bull Case For CONMED (CNMD) Could Change Following Buyback Launch and Dividend Suspension

Reviewed by Sasha Jovanovic

- Earlier this month, CONMED Corporation announced a new share repurchase program of up to US$150 million, suspended its quarterly cash dividend, and reported third quarter results with sales of US$337.93 million and net income of US$2.86 million.

- The company's evolving capital allocation strategy, together with improved operational performance and raised annual guidance, reflects ongoing efforts to bolster earnings and shareholder returns amid sector challenges.

- We will now consider how CONMED's decision to prioritize buybacks over dividends reshapes its investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CONMED Investment Narrative Recap

To be a CONMED shareholder, you need confidence in the long-term expansion of minimally invasive and robotic-assisted surgery, and believe that operational improvements will translate into margin recovery and profitable growth. The recent share buyback and dividend suspension do not materially affect the near-term catalyst for CONMED: restoring lost share in orthopedics through improved supply chain execution. However, the biggest risk remains persistent supply chain issues that could hamper top-line recovery if left unresolved.

Among the recent announcements, the raised full-year 2025 revenue guidance stands out. This update reflects management’s view that operational progress and strengthening key product adoption could drive better-than-expected results, directly tying back to the importance of volume growth as the main short-term catalyst.

In contrast, investors should be aware that ongoing supply chain bottlenecks could still impact recovery and profitability if...

Read the full narrative on CONMED (it's free!)

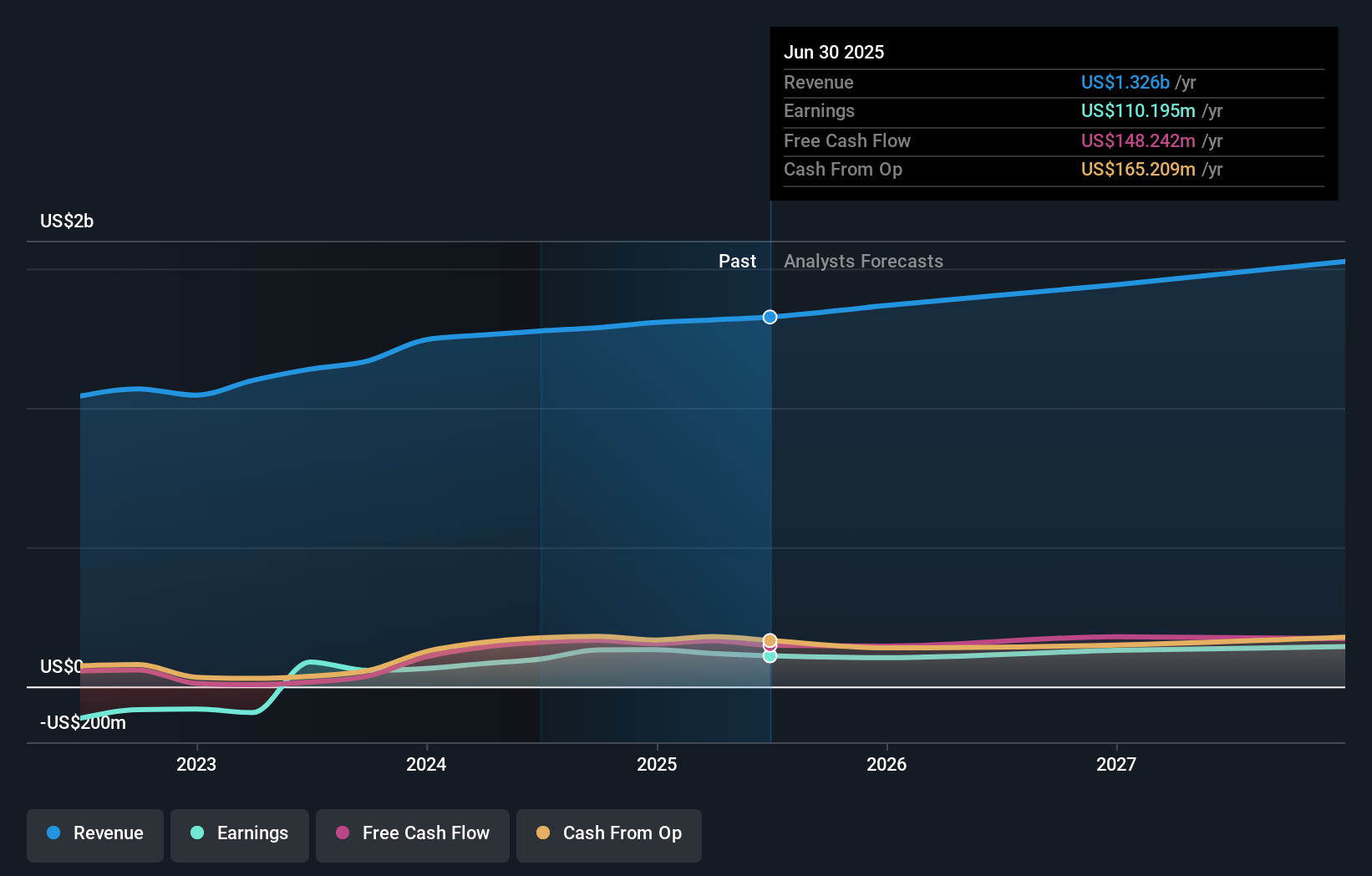

CONMED's outlook anticipates $1.6 billion in revenue and $154.0 million in earnings by 2028. This implies a 5.7% annual revenue growth rate and a $43.8 million increase in earnings from the current level of $110.2 million.

Uncover how CONMED's forecasts yield a $56.00 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors set fair value for CONMED between US$55 and US$56, based on two unique analyses. While opinions vary, ongoing debates center on supply chain risks and whether operational improvements will spark a quicker rebound.

Explore 2 other fair value estimates on CONMED - why the stock might be worth just $55.00!

Build Your Own CONMED Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CONMED research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CONMED research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CONMED's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNMD

CONMED

A medical technology company, develops, manufactures, and sells devices and equipment for surgical procedures in the United States and internationally.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives