- United States

- /

- Medical Equipment

- /

- NYSE:CNMD

CONMED (CNMD) Is Down 11.3% After US-China Trade Tensions and New Rare Earth Export Controls

Reviewed by Sasha Jovanovic

- In the past week, mounting US-China trade tensions and new Chinese export controls on rare earth minerals prompted a broad market sell-off that impacted medical technology firms, including CONMED.

- Amid these geopolitical headwinds, CONMED secured a revised US$550 million revolving credit facility, signaling a proactive approach to maintaining financial flexibility as external supply chain and cost risks mount.

- We’ll examine how the supply chain uncertainty from these global trade developments impacts CONMED’s investment outlook and future growth assumptions.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CONMED Investment Narrative Recap

CONMED’s long-term investment case rests on sustained demand for minimally invasive surgical technologies, clinical adoption of its key products, and operational gains tied to supply chain recovery. The recent US-China trade tensions and rare earth export controls raise short-term supply chain and cost concerns, but do not materially alter the most important near-term catalyst: accelerating procedure volumes and market share recovery, especially in orthopedics, which remains critical for earnings growth. The biggest risk continues to be persistent supply chain volatility that could delay this recovery.

The most relevant recent announcement for this news event is CONMED’s revised US$550 million revolving credit facility, which enhances the company's financial flexibility. In the context of supply chain uncertainty and potential cost pressures arising from geopolitical disruptions, this expanded credit access provides a much-needed buffer to weather external shocks, maintain procurement agility, and help secure the resources required to support growth initiatives.

Yet, despite this improved financing position, investors should be mindful that further supply shocks or sustained cost increases could...

Read the full narrative on CONMED (it's free!)

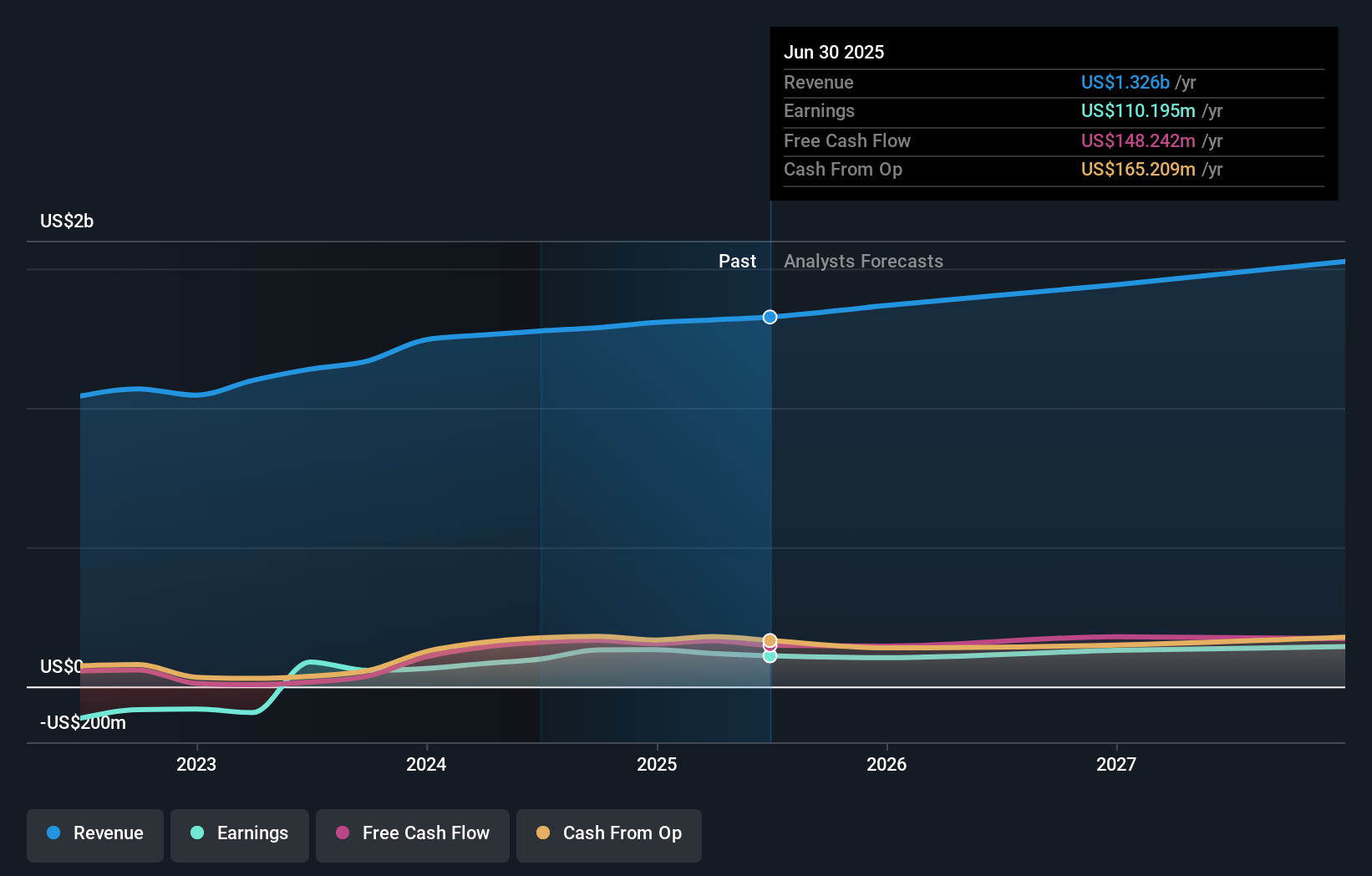

CONMED's narrative projects $1.6 billion revenue and $154.0 million earnings by 2028. This requires 5.7% yearly revenue growth and a $43.8 million increase in earnings from $110.2 million today.

Uncover how CONMED's forecasts yield a $61.00 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have offered fair value estimates for CONMED ranging from US$55 to US$61, reflecting differing views from two distinct analyses. While these opinions highlight a current consensus of undervaluation, ongoing external supply risks could influence future performance, be sure to consider several viewpoints before making any decisions.

Explore 2 other fair value estimates on CONMED - why the stock might be worth as much as 43% more than the current price!

Build Your Own CONMED Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CONMED research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CONMED research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CONMED's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNMD

CONMED

A medical technology company, develops, manufactures, and sells devices and equipment for surgical procedures in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives