- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Does Centene’s Recent 4% Rebound Signal a New Value Opportunity for 2025?

Reviewed by Bailey Pemberton

- Wondering if Centene's current share price finally offers real value, or if there's more beneath the surface? You are not alone, and we are about to dig into what might really matter for investors like you.

- Centene's stock has taken investors on a ride lately, jumping 4.1% over the past week even after dropping a hefty 10.9% in the last month and sliding 43% since the start of the year.

- Much of this turbulence has been shaped by headlines about shifting healthcare policy and sector-wide volatility, as well as investor reactions to competitor moves and evolving regulatory discussions in Washington, D.C. These broader changes have kept Centene's share price particularly reactive and on traders' radars.

- The company's value score currently sits at 5 out of 6, suggesting it appears undervalued by several standard checks. Let us walk through what goes into this score with a range of valuation methods, but keep an eye out for an even more insightful way to judge Centene’s worth that we will reveal by the end.

Find out why Centene's -45.9% return over the last year is lagging behind its peers.

Approach 1: Centene Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and then discounting those cash flows back to today's dollars. This approach focuses on what a business will likely earn over time, providing a grounded, forward-looking sense of value based on tangible cash generation.

For Centene, the current Free Cash Flow stands at approximately $3.24 Billion. Analysts have projected annual cash flow growth, with forecasts suggesting Free Cash Flow could climb to about $3.24 Billion by 2029. After analysts’ five-year estimates, further numbers are extrapolated for the following years to form a full long-term view.

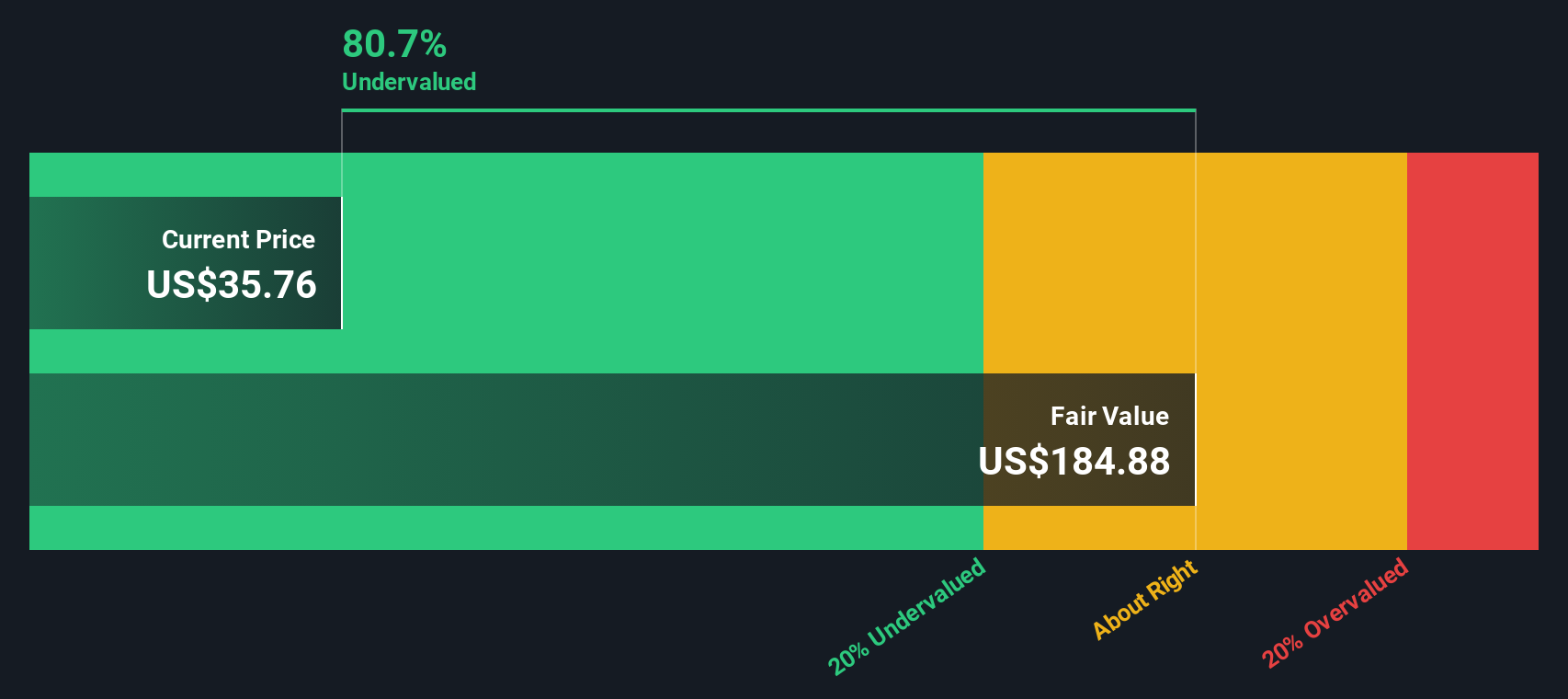

Applying these projections, the DCF model calculates Centene's fair value as $170.12 per share. This means that, based on the DCF analysis, Centene is currently trading at a 79.7% discount to its calculated intrinsic value. In practical terms, the stock appears to be significantly undervalued when judged on expected cash flows alone.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Centene is undervalued by 79.7%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Centene Price vs Sales

For companies like Centene, which operate at significant scale but may see variability in profitability, the Price-to-Sales (P/S) ratio is an especially useful valuation tool. This ratio compares a company’s market capitalization to its total sales and provides a sense of what investors are willing to pay for each dollar of revenue, regardless of short-term profit swings.

Growth prospects and potential risks play a major role in shaping what counts as a “normal” or “fair” P/S ratio for any business. Typically, fast-growing or lower-risk companies can justify higher multiples. In contrast, slower-growing or riskier firms will trade at lower ones. These benchmarks help put individual company valuations in a broader context.

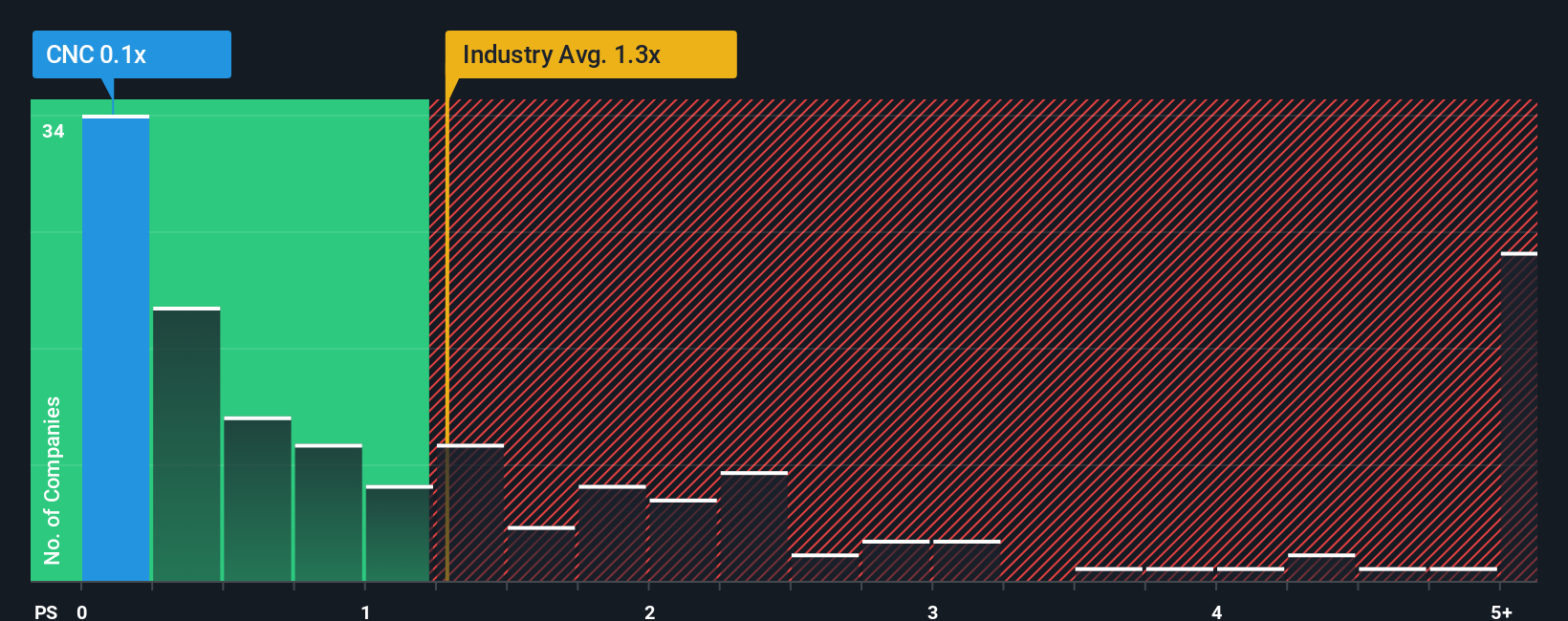

Centene’s current P/S ratio is 0.10x, which is far below both the healthcare industry average of 1.27x and the peer group average of 1.81x. At first glance, this suggests the market may be heavily discounting Centene’s sales relative to its sector and comparable companies.

Simply Wall St’s proprietary “Fair Ratio” goes a step further by estimating where a company’s P/S multiple should sit, after weighing critical elements like expected earnings growth, profit margins, industry outlook, company size, and risk factors. This approach is more comprehensive than relying on industry and peer averages, as it factors in Centene’s unique attributes, such as its business model, recent performance, and future prospects.

According to this Fair Ratio, Centene should trade at about 0.78x. With the stock currently at 0.10x, Centene not only looks undervalued when compared to peers, but also versus this deeper, context-aware standard.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Centene Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives.

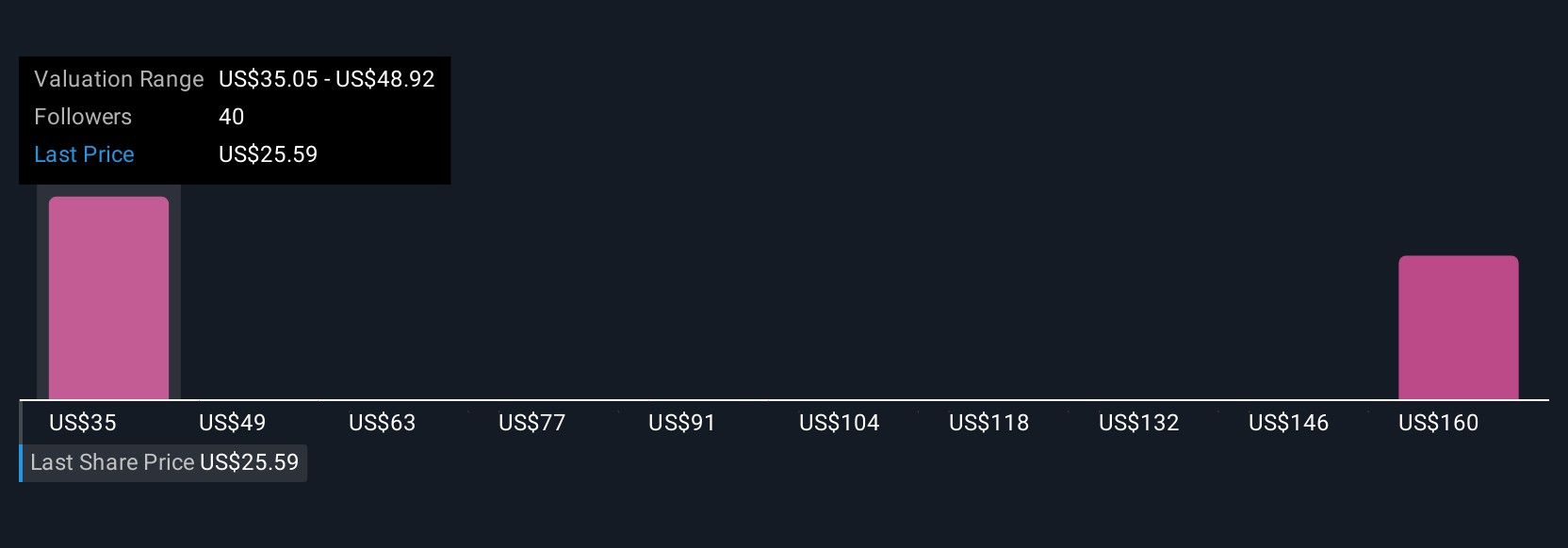

Narratives are an easy, approachable tool that let you tie your personal view of Centene's story to concrete financial forecasts like revenue, margins, and earnings. This effectively creates your own fair value based on what you believe about the company’s future.

Unlike traditional metrics or analyst targets, Narratives help you turn your research and intuition into a forecast, linking Centene’s unique business events (policy shifts, contract wins, membership trends) with what those might mean for its numbers, and ultimately its valuation.

Available on Simply Wall St’s Community page and used by millions of investors, Narratives update automatically as new news, results, and risks come in. This ensures your view always stays current.

This lets you quickly see how your estimated fair value for Centene compares to the latest share price and helps guide timely buy or sell decisions.

For example, you might take a more optimistic view, aligning closer to a $70 fair value if you believe in accelerating margin recovery and market wins, or a more cautious view, closer to $24 if you see sector headwinds weighing on results. Narratives let you track and revisit your rationale as conditions change.

Do you think there's more to the story for Centene? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives