- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Does Centene's (CNC) Withdrawal of Guidance Signal a Turning Point for Its Growth Outlook?

Reviewed by Simply Wall St

- In the past quarter, Centene Corporation reported a net loss of US$253 million and withdrew its 2025 financial guidance due to lower-than-expected market growth and higher morbidity across its markets, leading to several securities class action lawsuits over alleged misrepresentations regarding financial health and enrollment trends.

- Centene's decision to halt guidance and legal developments come after previously announcing extensive share buybacks exceeding US$8.7 billion and serve as a significant test of investor confidence amid heightened scrutiny.

- We'll review how Centene's withdrawal of financial guidance challenges its investment narrative and expectations for Medicaid and commercial segment growth.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

Centene Investment Narrative Recap

To be a Centene shareholder, you need conviction in the long-term resilience of Medicaid and Marketplace managed care businesses, especially their ability to absorb disruptions from policy changes and medical cost volatility. The recent net loss, withdrawal of 2025 guidance, and class action lawsuits have materially shifted the focus to rate adequacy in Medicaid and trends in commercial membership, making cost management and policy reform the most immediate catalyst and risk respectively.

Among recent developments, Centene's move to withdraw 2025 financial guidance stands out as the most relevant, as it signals uncertainty around enrollment trends and premium revenue outlook for both Medicaid and Marketplace segments. This action directly affects investor expectations and has heightened scrutiny on Centene's future margin recovery potential as regulatory and market dynamics continue to evolve.

In contrast, the spotlight is now firmly on policy risk and the uncertainty surrounding Medicaid rate negotiations, which investors should keep front of mind because...

Read the full narrative on Centene (it's free!)

Centene's outlook anticipates $193.4 billion in revenue and $2.6 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 6.6% and an increase in earnings of $0.5 billion from the current $2.1 billion.

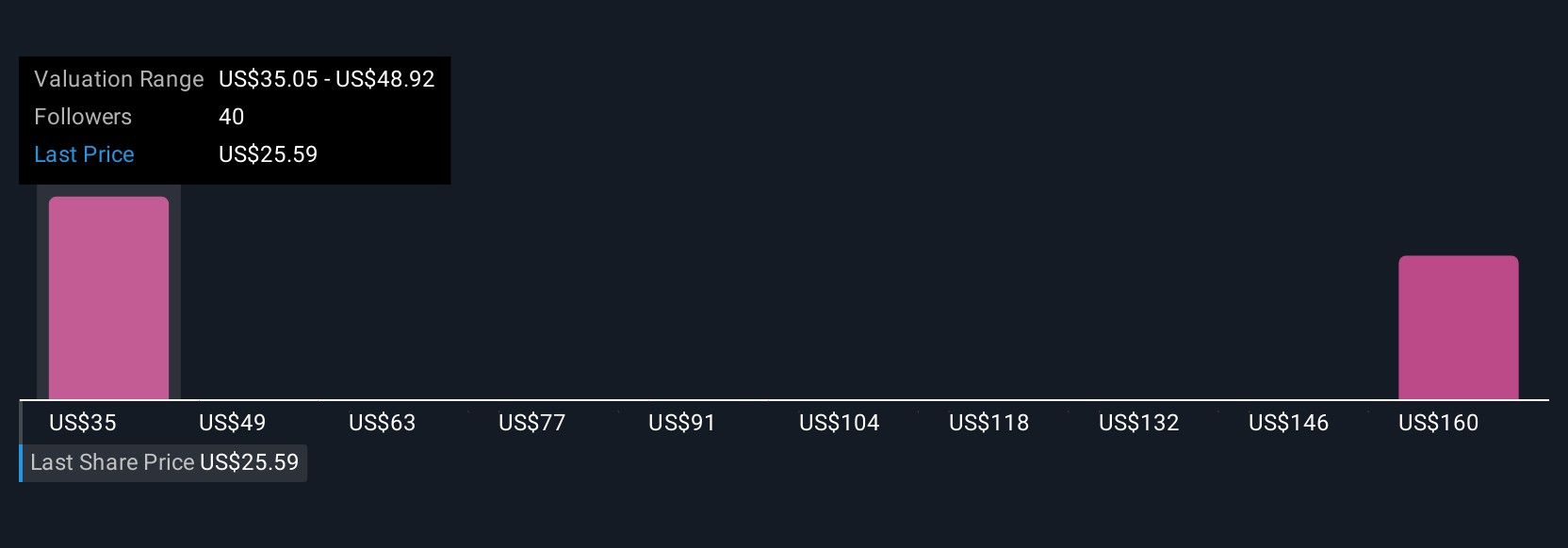

Uncover how Centene's forecasts yield a $35.62 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set Centene’s fair value estimates from US$35.05 to US$186.59, with 11 distinct views. Uncertainty about Medicaid rate adjustments and market growth could explain why opinions vary so widely, review these different angles before deciding where you stand.

Explore 11 other fair value estimates on Centene - why the stock might be worth over 7x more than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives