- United States

- /

- Healthcare Services

- /

- NYSE:CNC

Does Centene’s 44% Price Plunge Signal Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

If you’re standing at the crossroads debating what to do with Centene stock, you’re not alone. Investors from every camp have been watching this insurer’s price chart with a mix of skepticism and curiosity lately, especially after another volatile stretch. Centene shares have slid 3.6% in the last week and taken a staggering dive of over 43% since the start of the year, following a longer trend of underperformance that has seen the stock tumble by 44% over the past 12 months. That’s a tough pill to swallow, especially for anyone who’s held on through the ups and downs of the last three or even five years, both of which have left investors in the red.

Why the tumult? Part of the picture relates to shifting industry sentiment, growing competition among managed care organizations, and ongoing policy debates around Medicaid. In recent news, there has also been increasing attention on Centene’s strategy to balance growth with profitability and efforts to optimize their government-focused business. These factors have injected uncertainty, which the market has mostly interpreted as risk, though the underlying fundamentals tell a more nuanced story.

Against this backdrop, Centene’s valuation stands out. Looking at six key checks commonly used by analysts to gauge whether a company is undervalued, Centene passes five of them, earning a strong value score of 5 out of 6. If you’re wondering exactly how those numbers shake out and what they mean for your investment decision, you’re in the right place. Up ahead, I’ll walk you through each valuation method and wrap up with an even better way to look at Centene’s long-term worth.

Why Centene is lagging behind its peers

Approach 1: Centene Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular method for estimating a company’s underlying value. It works by projecting future cash flows generated by the business and then discounting those values back to the present using a required rate of return. The goal is to determine what all of Centene’s expected future free cash flows are worth in today’s dollars.

For Centene, the company is currently generating $911 million in Free Cash Flow. Analyst estimates suggest significant growth ahead, projecting Free Cash Flow to reach $3.6 billion by 2029. After those first five years, additional projections by Simply Wall St continue to show growth, using reasonable growth rates based on industry averages and recent performance. All cash flow figures are reported in US dollars.

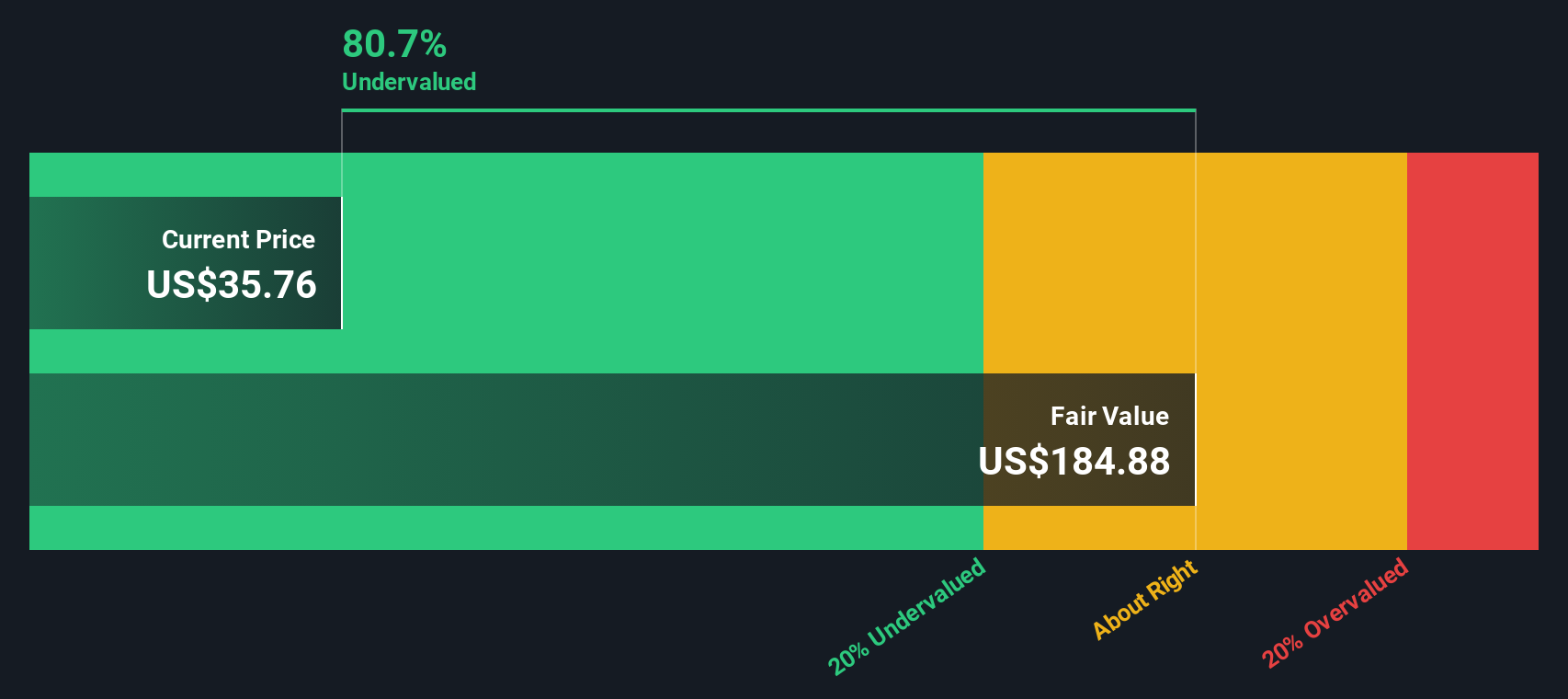

According to this two-stage Free Cash Flow to Equity model, Centene’s estimated intrinsic value is $184.94 per share. This figure is calculated after discounting all future cash flows to their present value. Compared to Centene’s current share price, this valuation suggests the stock is trading at an 81.4% discount to its fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Centene is undervalued by 81.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Centene Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested yardstick for valuing profitable companies like Centene because it connects a company's share price directly to its actual earnings. When a business is consistently generating profits, the PE ratio helps investors quickly gauge what the market is willing to pay for each dollar of earnings. However, what qualifies as a “fair” or “normal” PE can shift significantly depending on factors such as expected earnings growth, stability of profits, and the riskiness of the underlying business.

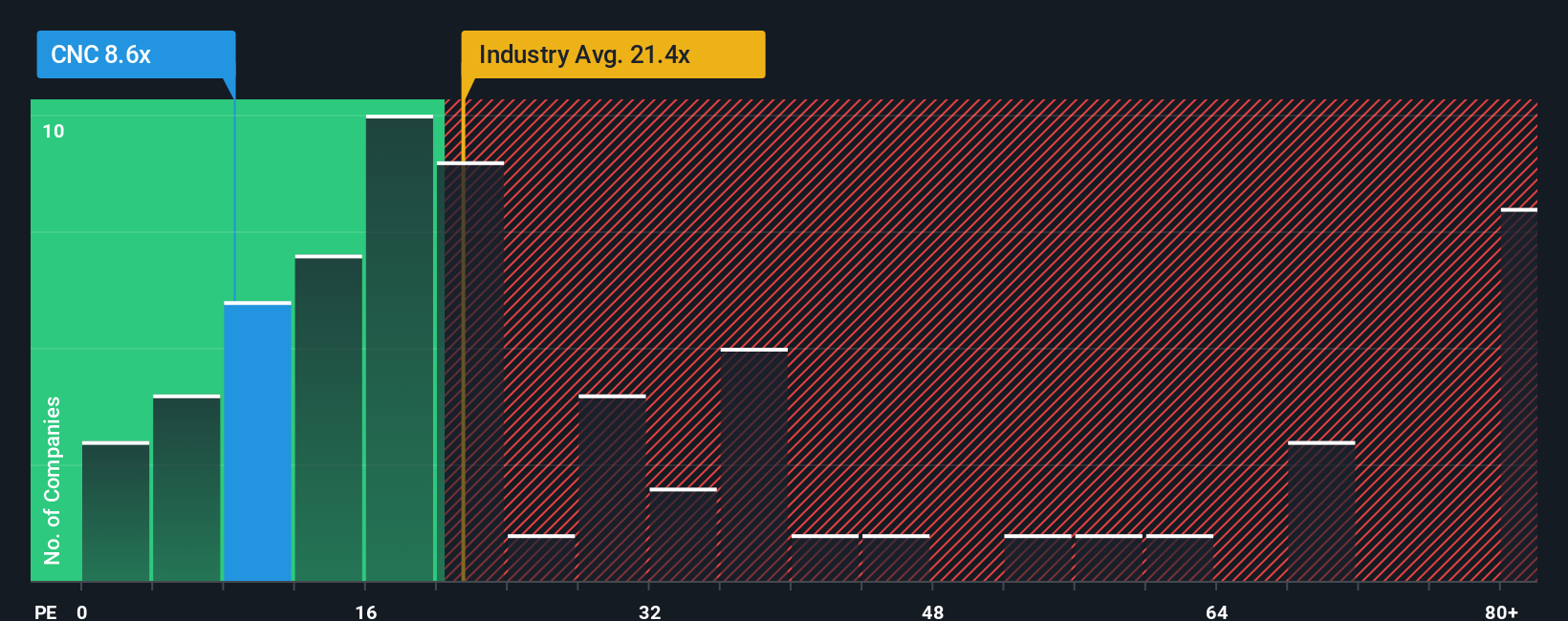

Right now, Centene trades at a PE ratio of 8.2x. That is a substantial discount compared to the healthcare industry average of 21.8x and even more so when stacked up against the average PE of its closest peers, sitting at 25.6x. In other words, Centene is currently valued by the market at far less per dollar of earnings than its industry rivals. On the surface, that can look appealing, but it is important to dig deeper than broad averages.

Enter the “Fair Ratio” calculated by Simply Wall St. In this analysis, the fair PE ratio for Centene is 38.1x. This proprietary metric does not just compare Centene against sector benchmarks; it also takes into account nuances like the company’s earnings growth, risk profile, profitability, industry position, and market cap. By considering a broader set of fundamentals, the Fair Ratio delivers a more tailored valuation benchmark than a simple industry or peer comparison could provide.

Comparing Centene’s current PE ratio of 8.2x to its Fair Ratio of 38.1x, the stock appears meaningfully undervalued by this method.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Centene Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply a story you create about a company like Centene that connects your perspective, such as your own estimates of future revenue, earnings, and margins, with a concrete financial forecast and a fair value calculation. Rather than just relying on historical numbers or analyst averages, Narratives empower you to lay out your assumptions in plain language, see how they shape the numbers, and instantly compare your fair value with Centene’s current share price.

What makes Narratives especially powerful is that they bridge the gap between the company’s evolving story and real-time data. Narratives automatically update your forecasts as new information, news, or earnings releases come in. This dynamic, story-driven approach is easy to use within Simply Wall St’s Community page, where millions of investors access and share their own Narratives, making them a more accessible decision-making tool than ever before.

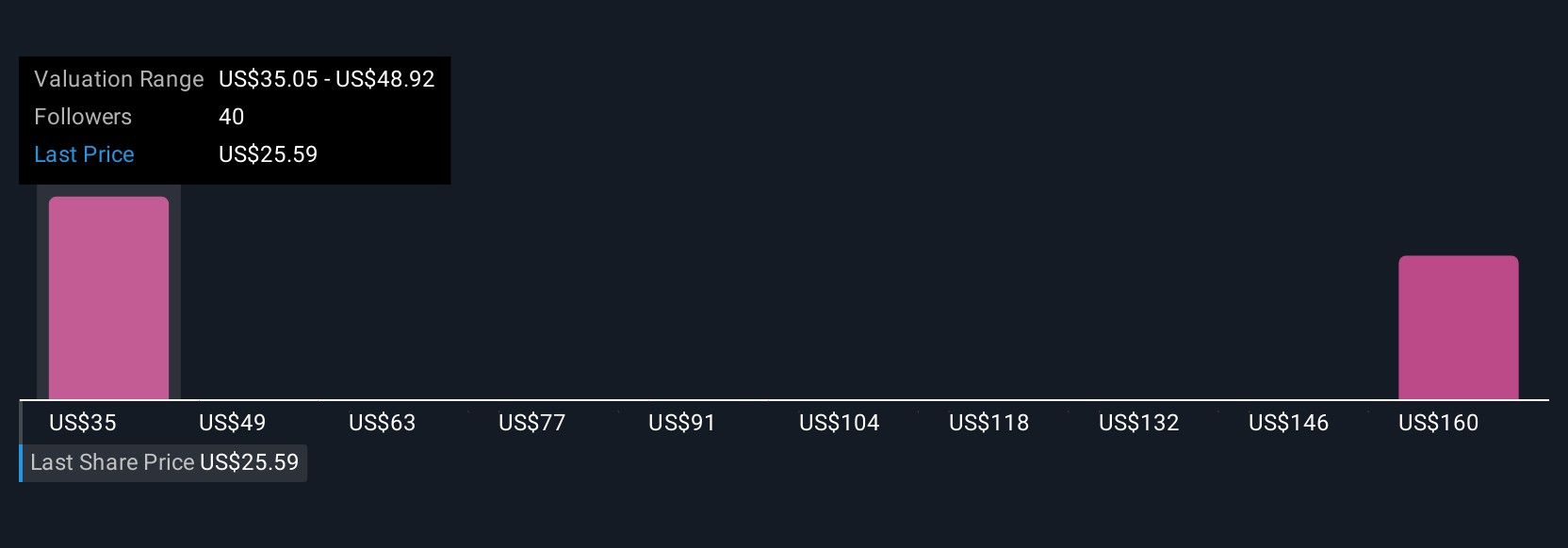

Narratives also account for differing perspectives. One investor might focus on Centene’s margin recovery and set a bullish fair value target near $70.00, while another, concerned about sector headwinds, may see a more conservative value as low as $24.00. By comparing these contrasting Narratives, you can better weigh your own convictions and decide if Centene’s current price justifies a buy, hold, or sell, based on your personal outlook.

Do you think there's more to the story for Centene? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives