- United States

- /

- Medical Equipment

- /

- NYSE:BSX

How Are Analysts Weighing Boston Scientific’s (BSX) Innovation Pipeline Against Market Execution Strategies?

Reviewed by Sasha Jovanovic

- At the MEDevice Boston conference on September 30, 2025, Boston Scientific highlighted ongoing product advances and market access strategies, with insights from senior leaders in endoscopy and health economics.

- Widespread analyst optimism has focused on Boston Scientific’s innovation momentum, including the development of next-generation devices and strong execution in high-growth markets.

- We’ll explore how analyst confidence in Boston Scientific’s innovation pipeline and clinical study progress shapes the current investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Boston Scientific Investment Narrative Recap

Boston Scientific attracts shareholders who believe in the power of medical innovation to deliver consistent, above-market growth, especially through next-generation devices and increased global access. The MEDevice Boston event underscored the company’s commitment to endoscopy advances and market expansion, but did not materially impact the primary near-term catalyst, the ramp-up of key clinical studies like CHAMPION-AF for Watchman, and leaves regulatory and pricing risks, particularly reimbursement cuts, as the most immediate concerns.

Against this backdrop, the recent FDA approval for expanded labeling of the FARAPULSE Pulsed Field Ablation System stands out. This milestone directly supports the growth narrative centered on advanced therapies and highlights Boston Scientific’s ability to drive procedure volume growth, reinforcing analyst optimism tied to clinical and regulatory progress.

On the other hand, investors should not overlook the risk posed by proposed reimbursement rate cuts, especially for procedures such as left atrial appendage closure, which may...

Read the full narrative on Boston Scientific (it's free!)

Boston Scientific's outlook anticipates $25.4 billion in revenue and $4.8 billion in earnings by 2028. This is based on 11.1% annual revenue growth and a $2.3 billion increase in earnings from the current $2.5 billion.

Uncover how Boston Scientific's forecasts yield a $124.53 fair value, a 29% upside to its current price.

Exploring Other Perspectives

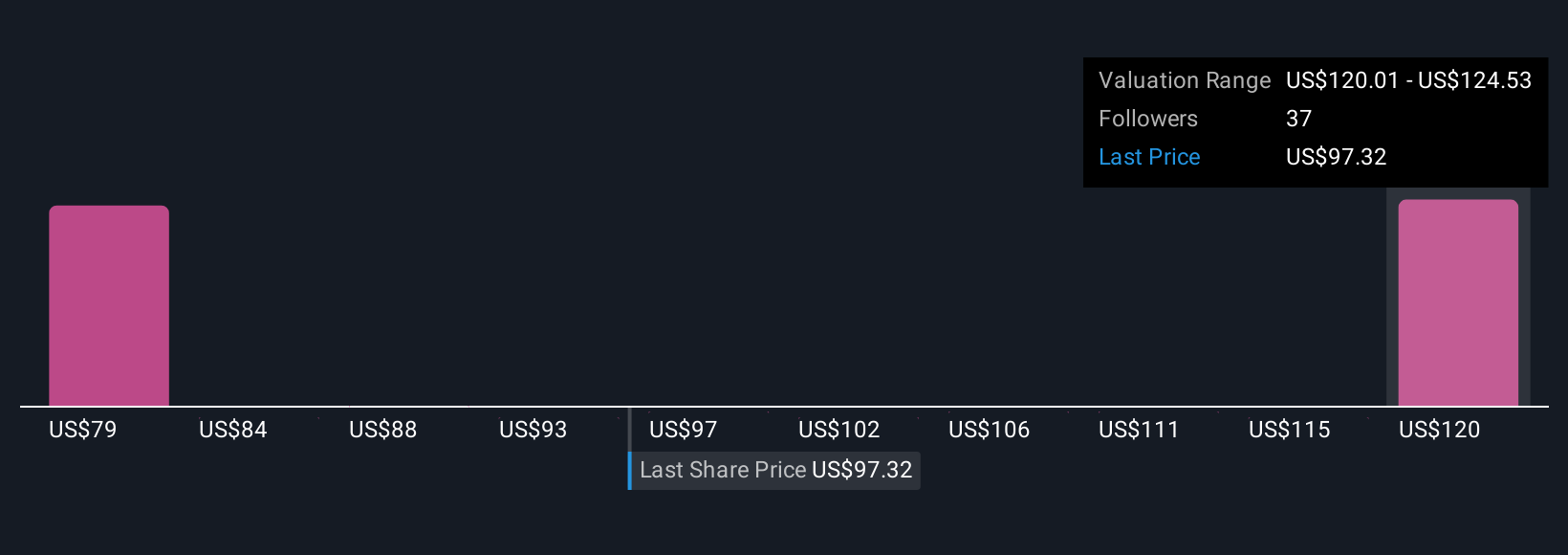

Simply Wall St Community members provided seven valuation estimates ranging from US$79.44 to US$124.53 per share prior to the recent news event. While many focus on Boston Scientific’s innovation pipeline and clinical milestones, concerns around US reimbursement rate cuts could still weigh on near-term returns, showing just how broad the spectrum of investor beliefs can be.

Explore 7 other fair value estimates on Boston Scientific - why the stock might be worth as much as 29% more than the current price!

Build Your Own Boston Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boston Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boston Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boston Scientific's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives