- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Boston Scientific (BSX): Exploring Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Boston Scientific.

Boston Scientific's strong 1-day share price return of 3.95% caught some positive momentum after periods of more moderate movement, building on a year-to-date share price gain of 16.19%. Over the past five years, long-term shareholders have seen a total shareholder return of more than 200%. This pace speaks to the company’s ability to maintain investor confidence even as short-term swings play out.

If Boston Scientific's recent run has you thinking about what else is out there in healthcare, it's worth checking out See the full list for free.

With Boston Scientific’s recent surge and robust growth metrics, investors may be wondering whether the current price offers untapped value or if the market has already factored in all the company’s prospects for the future.

Most Popular Narrative: 16.6% Undervalued

With Boston Scientific’s latest close at $103.85 and the narrative’s fair value pinned at $124.53, consensus opinion points to meaningful further upside if expectations play out. A tightening gap between analyst projections and current price increases the stakes as investors weigh whether the market is discounting the company’s long-term story.

Accelerated adoption of advanced therapies like FARAPULSE (pulsed field ablation) and WATCHMAN, backed by expanded clinical indications, strong safety and efficacy data, and increased physician uptake, particularly in major global markets, positions Boston Scientific for continued above-market procedure growth, benefiting revenue and gross margins.

Want to uncover what’s driving this bold target? There is a lot riding on ambitious growth, disruptive innovation, and record-hunting profit margins. Curious exactly which financial forecasts fuel this narrative premium? See for yourself how the story stacks up.

Result: Fair Value of $124.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, headwinds such as regulatory changes and heightened competition could undermine Boston Scientific’s margin potential and challenge future revenue growth assumptions.

Find out about the key risks to this Boston Scientific narrative.

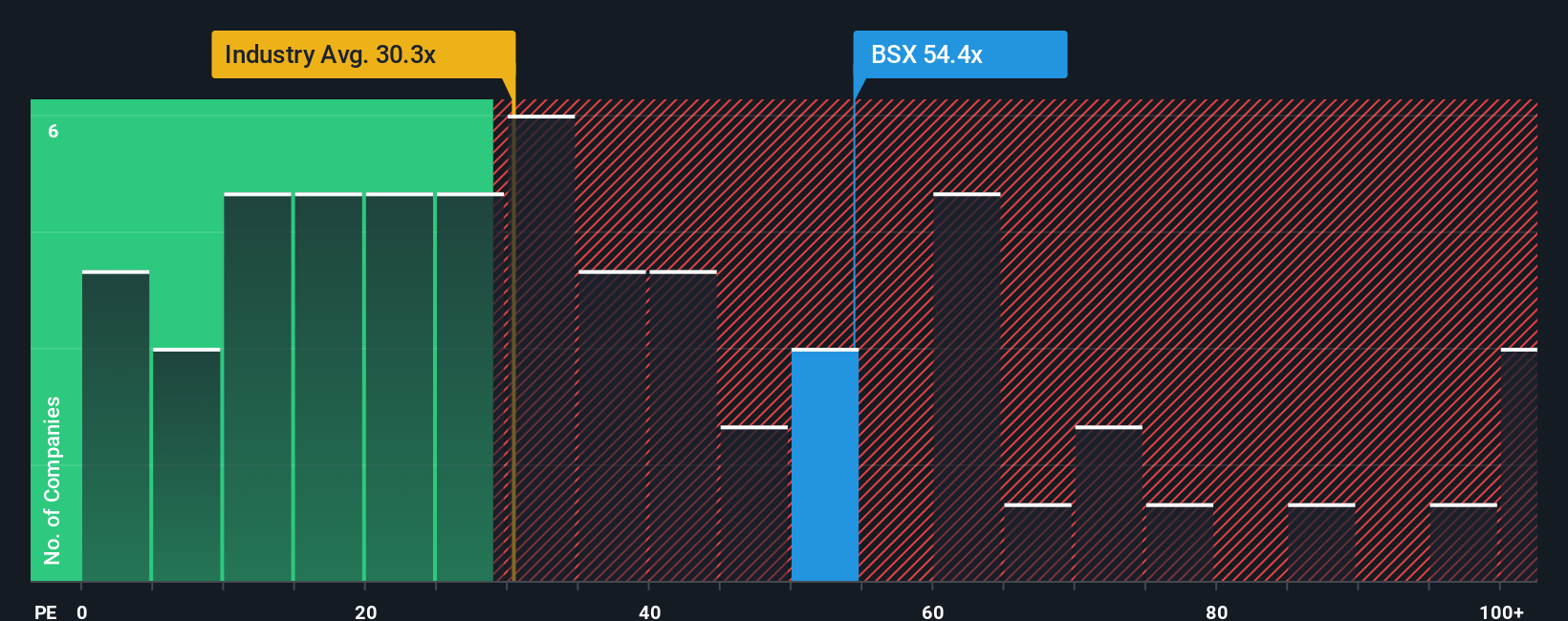

Another View: High Price Relative to Earnings Benchmarks

Looking from another angle, Boston Scientific's current price-to-earnings ratio sits at 59.1 times. This is higher than the US Medical Equipment industry average of 30.4 times and also well above its peer group average of 38.9 times. Compared to the fair ratio of 36, this signals the stock may be priced for a lot of future growth. Does this multiple suggest analysts are too optimistic, or could the strong narrative ahead justify such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Scientific Narrative

If you want to see the numbers up close or craft an alternative outlook, you can easily experiment with your own take on Boston Scientific’s story in just a few minutes, then Do it your way.

A great starting point for your Boston Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Plenty of unique opportunities are waiting for bold investors ready to think beyond the obvious. Don’t settle when you could position yourself for the next big move with a few clicks.

- Tap into game-changing breakthroughs in artificial intelligence by checking out these 25 AI penny stocks, which are powering tomorrow’s technology landscape.

- Capture steady growth with reliable yields and explore these 17 dividend stocks with yields > 3%, designed for income-focused strategies.

- Be the first to catch promising opportunities overlooked by most and browse these 876 undervalued stocks based on cash flows, trading at attractive valuations right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives