- United States

- /

- Medical Equipment

- /

- NYSE:BLCO

Could Bausch + Lomb’s (BLCO) ASANA Launch Reveal a Shifting Vision Care Strategy?

Reviewed by Simply Wall St

- On September 8, 2025, Bausch + Lomb announced the U.S. launch of its ASANA gas permeable contact lens portfolio, designed to meet complex vision correction needs with advanced features for durability and comfort.

- This new line offers eye care professionals and patients an extensive range of custom lens options, catering to underserved groups with challenging vision conditions like keratoconus and high corneal astigmatism.

- We'll explore how the all-in-one ASANA GP lens offering may impact Bausch + Lomb's investment narrative in the vision care market.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Bausch + Lomb's Investment Narrative?

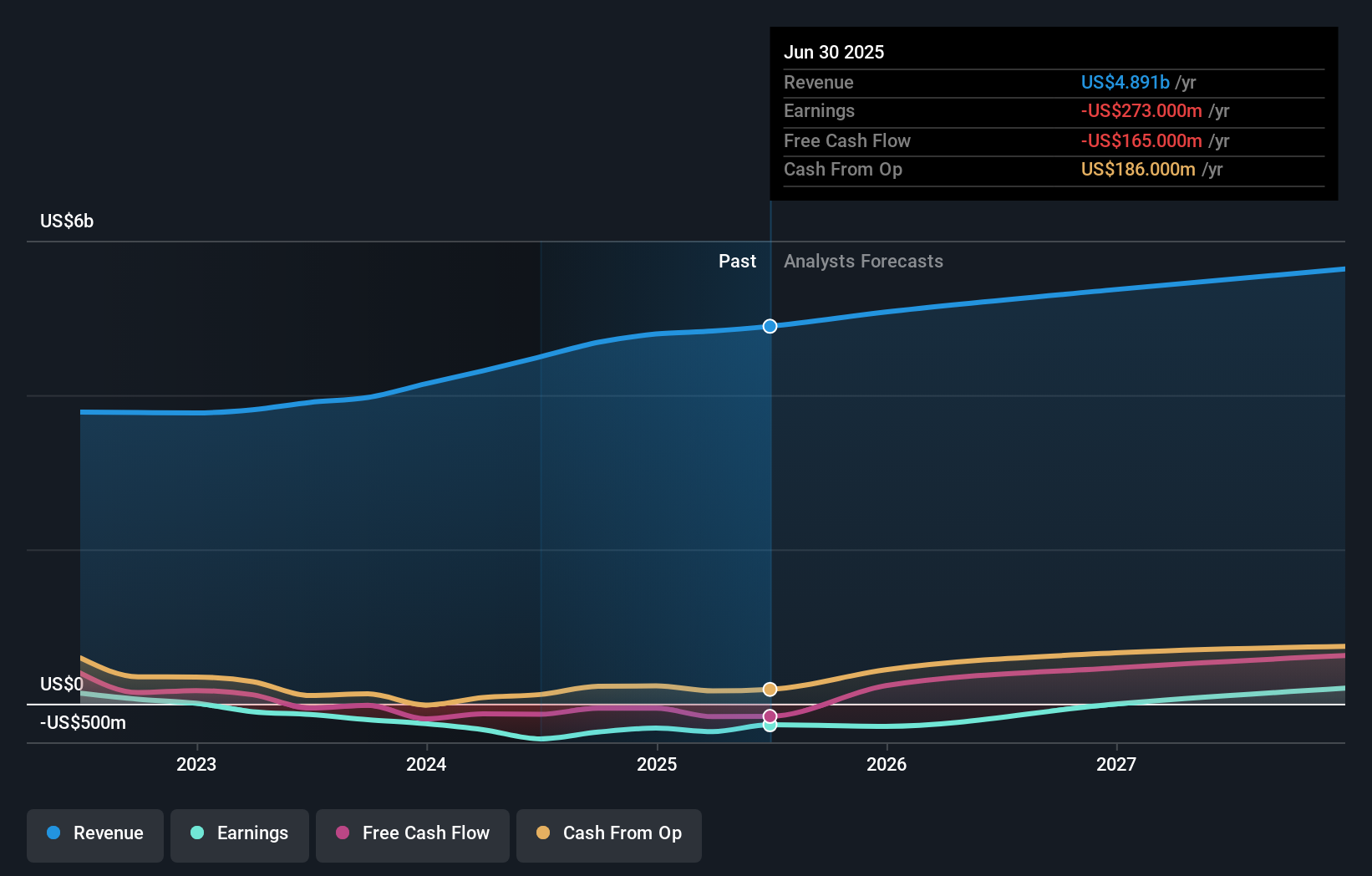

To believe in Bausch + Lomb as a shareholder right now, you must be comfortable with a story of cautious step-by-step growth, cost discipline, and a focus on expanding the product portfolio even as the company remains unprofitable. The recent ASANA gas permeable lens launch stands out as a thoughtful move into more specialized and customizable vision correction, aimed at underserved patient groups. While this could gradually improve Bausch + Lomb’s reputation with eye care professionals and help drive incremental sales, it’s unlikely to shift the balance of major short-term catalysts given the size of the complex lens market compared to the company’s overall revenue base. The largest risks, ongoing losses, the impact of refinancing and debt, and leadership adjustments, still matter most to the investment story. This new product shows progress, but investors should weigh whether growth in niche segments can noticeably impact broader financial results.

But against recent product innovation, the company’s profitability path is something investors should keep a close eye on. Bausch + Lomb's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Bausch + Lomb - why the stock might be worth just $15.14!

Build Your Own Bausch + Lomb Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch + Lomb research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bausch + Lomb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch + Lomb's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLCO

Bausch + Lomb

Operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives