- United States

- /

- Medical Equipment

- /

- NYSE:BLCO

Bausch + Lomb (NYSE:BLCO): Weighing Valuation After Major Clinical Wins and New Product Launches

Reviewed by Kshitija Bhandaru

If you are watching Bausch + Lomb (NYSE:BLCO) right now, you have plenty to consider. In just the past couple of weeks, the company has announced a U.S. clinical trial showing their enVista Envy intraocular lens beat out the standard for intermediate and near vision, new evidence supporting XIIDRA’s benefits for contact lens wearers with dry eyes, and the launch of ASANA gas permeable lenses designed for more complex vision needs. These may sound like wins for patients and doctors alike, but savvy investors know that fresh data and new products are only part of the story.

It is true, the stock has shown strong movement over the past three months, jumping 27% amid this wave of trial results and product rollouts. However, taking a step back reveals a more mixed picture across the rest of the year, with shares still down 16% year-to-date and nearly 24% lower over the last twelve months. This pattern suggests momentum may be turning positive in the last quarter, but it also reflects persistent questions regarding BLCO’s ability to translate sales growth into consistent profitability.

As BLCO bounces back and product headlines accumulate, investors may be wondering whether this is a turnaround opportunity or if the market is already factoring in future growth risks.

Price-to-Sales of 1.1x: Is it justified?

Bausch + Lomb is currently trading at a price-to-sales (P/S) ratio of 1.1x, which is well below both the medical equipment industry average of 2.8x and the peer average of 2.4x. This suggests that, based on revenues, the market values BLCO at a significant discount compared to its sector and competitors.

The price-to-sales ratio is a widely used metric to value companies, especially those with inconsistent or negative earnings, by comparing a company’s stock price to its revenues. For a medical equipment company like BLCO, where profitability has been elusive in recent years, the P/S ratio is particularly useful because it focuses on top-line performance rather than bottom-line volatility.

Given BLCO's forecast of moderate revenue growth, but with current unprofitability and a discount to peers, the low P/S could indicate that the market remains skeptical about BLCO's ability to turn revenue into lasting profits. However, for investors seeking value in the sector, this significant discount may offer a potential opportunity if the company can execute on future profit growth as anticipated.

Result: Fair Value of $39.38 (UNDERVALUED)

See our latest analysis for Bausch + Lomb.However, persistent net losses and a year-long negative total return remain key risks that could hinder a sustained rebound for Bausch + Lomb's shares.

Find out about the key risks to this Bausch + Lomb narrative.Another View: Discounted Cash Flow Perspective

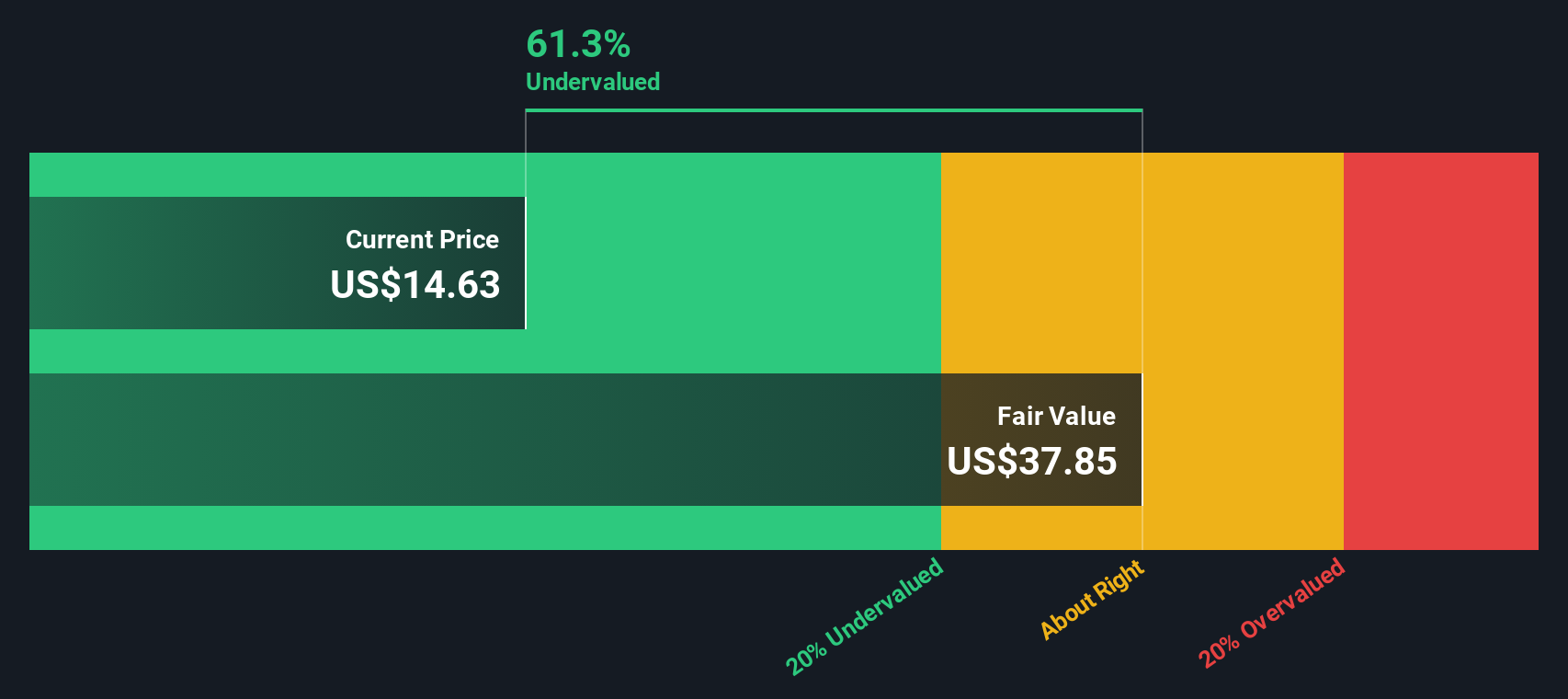

While the price-to-sales ratio paints BLCO as undervalued, our SWS DCF model also points to a significant discount in the current share price. Both approaches suggest good value. However, is the market noticing something these models might miss?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Bausch + Lomb to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Bausch + Lomb Narrative

Keep in mind that if you see things differently or want to dig deeper, you can easily assemble your own perspective based on the data in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bausch + Lomb.

Looking for more investment ideas?

Move ahead of the crowd and spot fresh opportunities with Simply Wall St’s dynamic screeners. The next game-changing stock could be on your radar today.

- Tap into the future by following groundbreaking artificial intelligence innovators using our AI penny stocks.

- Catch undervalued gems on the verge of a breakout with our handpicked selection of undervalued stocks based on cash flows.

- Boost your portfolio’s income with companies delivering reliable payouts with our expertly curated dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLCO

Bausch + Lomb

Operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives