- United States

- /

- Medical Equipment

- /

- NYSE:BLCO

Assessing Bausch + Lomb (NYSE:BLCO) Valuation as Goldman Sachs Brings New Spotlight to Ophthalmology Growth Prospects

Reviewed by Kshitija Bhandaru

Goldman Sachs recently updated its healthcare sector analysis, focusing on medical technology and ophthalmology. As the bank initiated coverage of Bausch + Lomb (NYSE:BLCO), investors have started to reassess the company’s exposure to long-term growth trends in vision-related care.

See our latest analysis for Bausch + Lomb.

Goldman’s new coverage comes as Bausch + Lomb continues to ride the wave of innovation in ophthalmology, with sector-wide attention putting its growth prospects back in focus. While share price returns over the past year have dipped slightly, recent momentum has been mixed as investors weigh ongoing industry advances against valuation risks. The long-term total shareholder return also remains just below flat, which suggests that the company’s next catalyst could shift sentiment meaningfully.

Curious which healthcare stocks might be poised for breakthroughs of their own? Discover potential leaders in the sector with our curated See the full list for free..

With Bausch + Lomb trading near analyst price targets and boasting solid revenue and net income growth, the question is whether the recent discount signals a real buying opportunity or if the market already reflects future prospects.

Price-to-Sales Ratio of 1.1x: Is it justified?

At a closing price of $14.76, Bausch + Lomb trades at a price-to-sales ratio of 1.1x, which is notably low relative to its US Medical Equipment industry peers and the market. This suggests the market might be undervaluing the company’s long-term growth potential compared to others in the sector.

The price-to-sales (P/S) ratio measures how much investors are willing to pay for each dollar of the company’s sales. For medical device companies like Bausch + Lomb, where earnings can be variable or negative due to reinvestment in innovation, the P/S ratio is an especially useful gauge of market sentiment and growth expectations.

Currently, Bausch + Lomb’s P/S ratio is well below both the industry average of 2.8x and the peer average of 2.3x. Regression analysis suggests a fair price-to-sales ratio closer to 2.3x, indicating the market could eventually re-rate the stock upward if performance improves or sentiment shifts.

Explore the SWS fair ratio for Bausch + Lomb

Result: Price-to-Sales Ratio of 1.1x (UNDERVALUED)

However, weak one-year and multi-year returns, along with ongoing net losses, could challenge optimism if revenue growth or sentiment fails to accelerate meaningfully.

Find out about the key risks to this Bausch + Lomb narrative.

Another View: What Does the DCF Model Say?

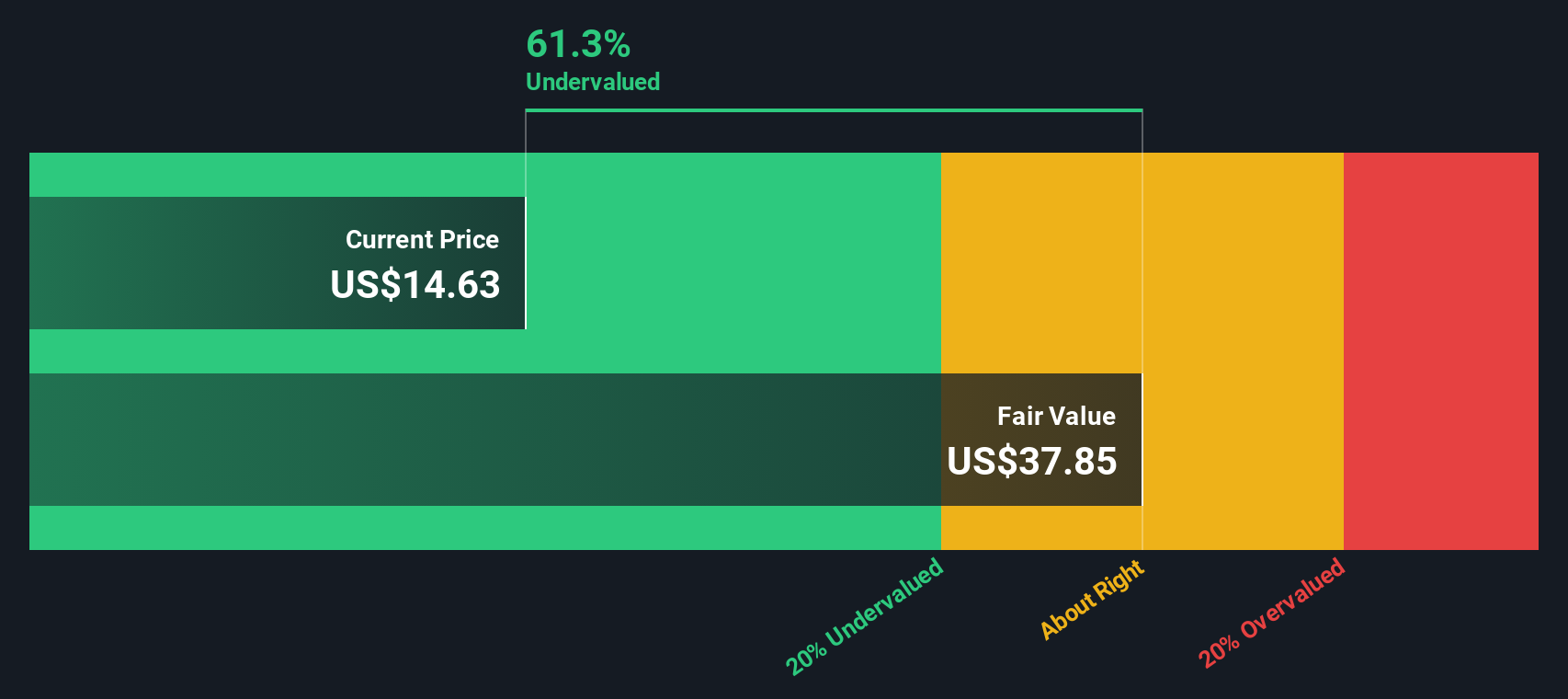

While the price-to-sales ratio suggests Bausch + Lomb is undervalued versus peers, the SWS DCF model offers a more optimistic perspective. According to this approach, the current share price is trading well below estimated fair value, pointing to a significant discount. Could the market be missing something significant, or are there risks that justify such a gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bausch + Lomb for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bausch + Lomb Narrative

If you prefer to draw your own conclusions or want a hands-on look at the numbers, you can dive in and craft a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bausch + Lomb.

Looking for More Smart Investment Ideas?

Stay ahead of the market and spot your next big winner with our powerful screeners, tailored to reveal opportunities that might fly under the radar.

- Capture rapid growth potential by uncovering these 24 AI penny stocks positioned at the forefront of the artificial intelligence revolution.

- Tap into reliable income streams with these 19 dividend stocks with yields > 3% offering attractive yields that can power your portfolio forward.

- Capitalize on value by zeroing in on these 904 undervalued stocks based on cash flows trading below their intrinsic worth based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLCO

Bausch + Lomb

Operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives