- United States

- /

- Healthcare Services

- /

- NYSE:BKD

What Brookdale Senior Living (BKD)'s Sustained Occupancy Gains and Raised Guidance Mean For Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, Brookdale Senior Living reported that consolidated weighted average occupancy for September 2025 increased to 82.5%, up 330 basis points year-over-year and 70 basis points sequentially, with third quarter occupancy also showing significant improvement compared to the prior year.

- Management raised annual guidance for the second consecutive quarter, highlighting sustained operational progress driven by higher move-ins and reduced move-outs within their communities.

- We'll explore how these sustained occupancy gains and upward guidance revisions could reshape Brookdale Senior Living’s long-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Brookdale Senior Living Investment Narrative Recap

Long-term shareholders in Brookdale Senior Living are betting on the company’s ability to drive sustainable margin improvement through rising occupancy, operational efficiency, and an expanding senior care market. While the latest occupancy gains and upward guidance revision reinforce management’s progress, they may have limited short-term impact if rising labor costs or staffing challenges continue to pressure profitability. The main catalyst remains further fixed-cost leverage from sustained occupancy growth, but this must be balanced against the risk that wage inflation outpaces rate hikes, a scenario that could erode margins and challenge earnings momentum.

Against this backdrop, the recent appointment of Nikolas W. Stengle as CEO stands out, as leadership continuity and proven industry experience could provide added confidence around the execution of operational initiatives supporting occupancy and retention. As Brookdale continues to optimize its portfolio and enhance community-level performance, the focus on execution will be crucial for translating occupancy gains into stronger financials over time.

Yet, in contrast to positive occupancy trends, the persistent risk of wage inflation and labor shortages is something investors should not lose sight of...

Read the full narrative on Brookdale Senior Living (it's free!)

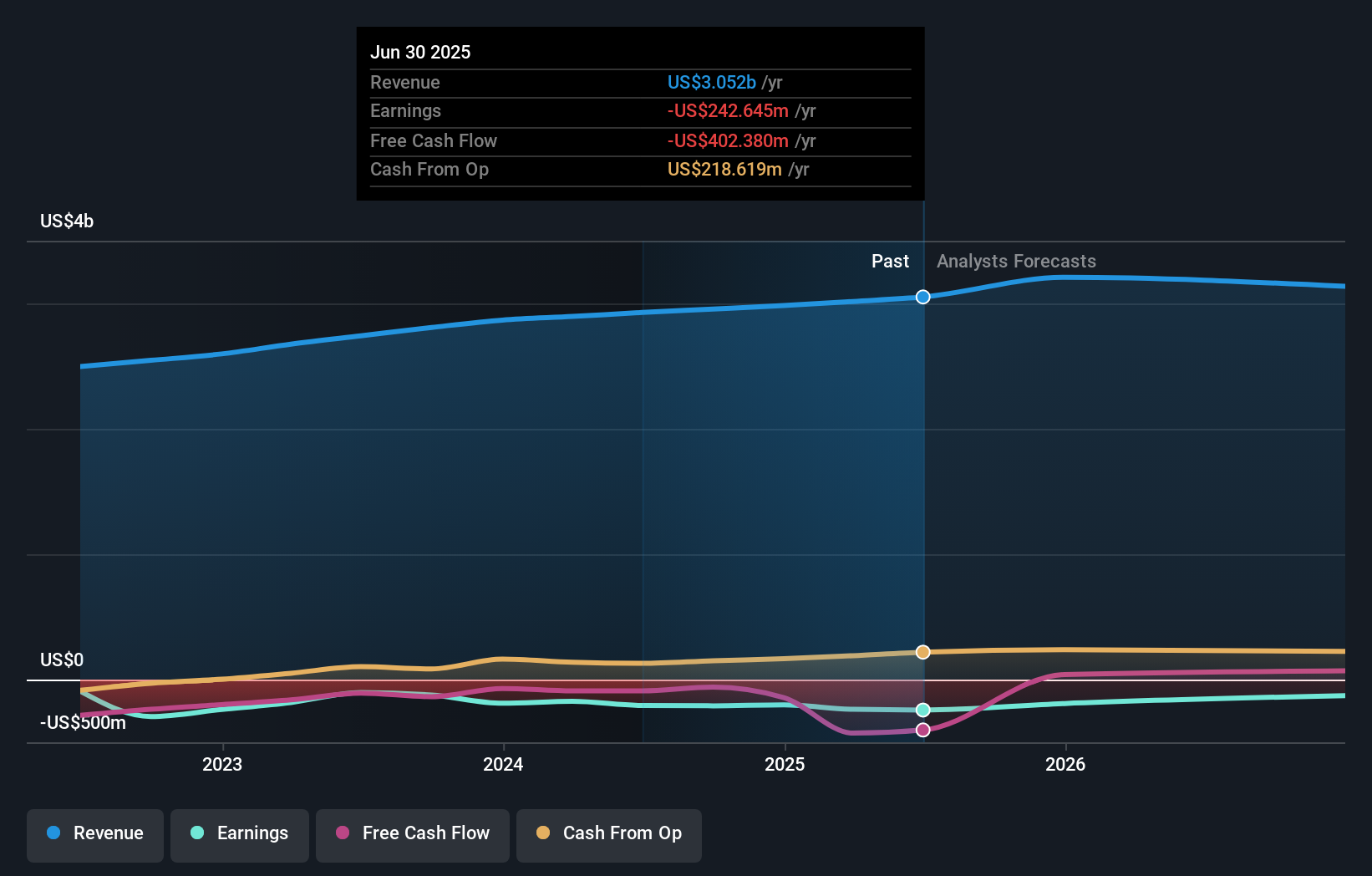

Brookdale Senior Living is projected to reach $3.3 billion in revenue and $176.3 million in earnings by 2028. This outcome assumes annual revenue growth of 2.3% and a $418.9 million increase in earnings from the current -$242.6 million.

Uncover how Brookdale Senior Living's forecasts yield a $8.30 fair value, a 5% downside to its current price.

Exploring Other Perspectives

One private investor from the Simply Wall St Community set Brookdale’s fair value at US$24.95 per share, far above current levels. With rising occupancy as a major catalyst, you’ll find opinions can vary widely, see how your outlook compares and explore more perspectives.

Explore another fair value estimate on Brookdale Senior Living - why the stock might be worth just $24.95!

Build Your Own Brookdale Senior Living Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookdale Senior Living research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Brookdale Senior Living research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookdale Senior Living's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookdale Senior Living might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKD

Brookdale Senior Living

Owns, manages, and operates senior living communities in the United States.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives