- United States

- /

- Healthcare Services

- /

- NYSE:BKD

Brookdale Senior Living (BKD) Is Up 6.6% After Occupancy Surge and CEO Appointment—What's Changed?

Reviewed by Sasha Jovanovic

- Earlier this month, Brookdale Senior Living reported substantial occupancy gains for September and the third quarter of 2025, alongside the appointment of Nikolas W. Stengle as the new Chief Executive Officer, effective October 6, 2025.

- These developments reflect both operational momentum, driven by improved move-in and move-out trends, and a leadership shift that may influence Brookdale’s direction within the senior living sector.

- To assess the impact of these operational improvements and executive changes, we’ll examine how Brookdale’s accelerated occupancy growth could reshape its investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Brookdale Senior Living Investment Narrative Recap

To own shares in Brookdale Senior Living today, an investor needs to believe that strengthening occupancy gains will continue to improve operational efficiency and free cash flow, even as the company faces ongoing margin pressures from high labor costs and leverage. The recent jump in occupancy rates offers a clear short-term catalyst by fueling revenue momentum, but persistent debt and the risk of wage inflation remain the most important risks, a strong quarter alone does not resolve these longer-term headwinds.

The appointment of Nikolas W. Stengle as Chief Executive Officer is especially relevant, arriving at a time when Brookdale is focusing on operational improvement and cost control. As Mr. Stengle steps in, investors are watching closely to see if new leadership maintains the progress in occupancy while navigating industry challenges tied to costs and capital needs.

Yet, contrasted with this positive news in occupancy, investors should be aware that Brookdale’s elevated debt load could limit financial flexibility if conditions change...

Read the full narrative on Brookdale Senior Living (it's free!)

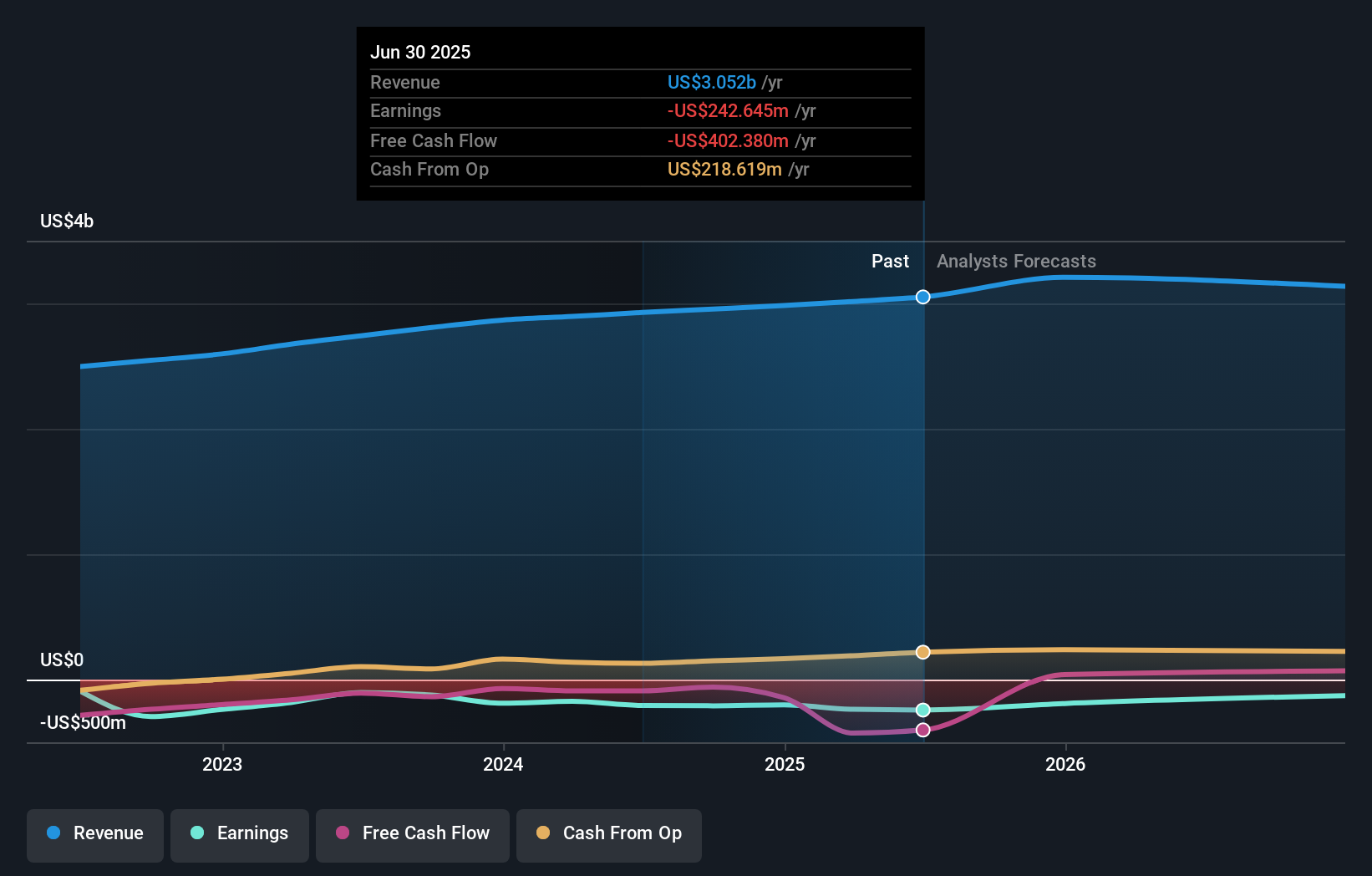

Brookdale Senior Living's projections estimate $3.3 billion in revenue and $176.3 million in earnings by 2028. This outlook assumes annual revenue growth of 2.3% and an earnings increase of $418.9 million from current earnings of -$242.6 million.

Uncover how Brookdale Senior Living's forecasts yield a $8.30 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members all estimated a fair value of US$24.79 per share before the latest occupancy data. With operating gains in focus, high leverage is still seen as a key issue for Brookdale’s longer-term prospects. Check out how opinions differ and see what matters most to others in the market.

Explore another fair value estimate on Brookdale Senior Living - why the stock might be worth just $24.79!

Build Your Own Brookdale Senior Living Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookdale Senior Living research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Brookdale Senior Living research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookdale Senior Living's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookdale Senior Living might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKD

Brookdale Senior Living

Owns, manages, and operates senior living communities in the United States.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives