- United States

- /

- Healthcare Services

- /

- NYSE:BKD

Brookdale Senior Living (BKD) Is Up 5.3% After Occupancy Tops 81.8% in August - Has The Bull Case Changed?

Reviewed by Simply Wall St

- Brookdale Senior Living Inc. announced in early September 2025 that its consolidated weighted average occupancy increased to 81.8% in August, marking a year-over-year gain of 2.9 percentage points and continued sequential improvement throughout the third quarter to date.

- This progress means the company now has a growing number of communities above the critical 80% occupancy threshold, enhancing operational efficiency and financial stability.

- We will explore how this sustained occupancy growth strengthens Brookdale’s investment outlook and supports the value-creation narrative for investors.

Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

Brookdale Senior Living Investment Narrative Recap

To see value in Brookdale Senior Living, an investor should believe in the company’s capacity to use growing occupancy to translate fixed-cost leverage into improved margins and financial stability, while managing risks like labor cost pressures and ongoing portfolio optimization. The latest occupancy gains reinforce a key short-term catalyst, margin improvement from communities above the 80 percent threshold, yet escalating labor costs remain a significant risk, and these recent occupancy figures do not materially eliminate this concern.

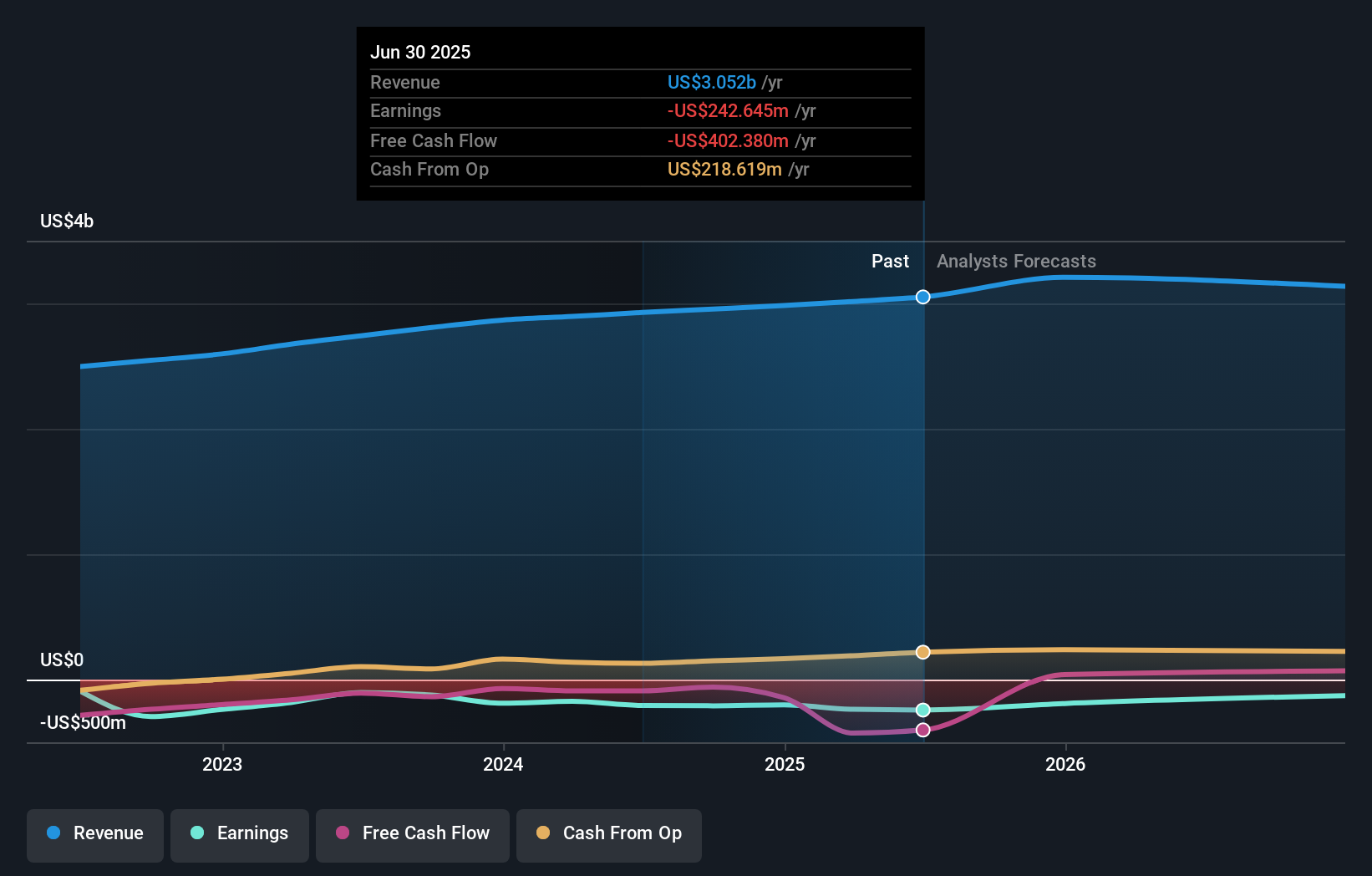

One recent announcement relevant to these trends is Brookdale’s Q2 2025 earnings report from August, which showed higher sales and revenue alongside a widening net loss. This underscores how growing occupancy alone is not yet enough to fully offset operational challenges or ease margin pressures associated with wages and other fixed costs.

But despite occupancy momentum, investors should not overlook how ongoing wage inflation and staffing shortages could...

Read the full narrative on Brookdale Senior Living (it's free!)

Brookdale Senior Living's outlook anticipates $3.3 billion in revenue and $176.3 million in earnings by 2028. This scenario assumes a 2.3% annual revenue growth rate and an earnings improvement of $418.9 million from current earnings of -$242.6 million.

Uncover how Brookdale Senior Living's forecasts yield a $8.30 fair value, a 5% upside to its current price.

Exploring Other Perspectives

The sole fair value estimate from the Simply Wall St Community stands at US$22.99 per share, pointing to considerable perceived upside. However, with risks around labor costs potentially eroding margins, it is clear your view could diverge, consider how others interpret Brookdale’s outlook before deciding.

Explore another fair value estimate on Brookdale Senior Living - why the stock might be worth just $22.99!

Build Your Own Brookdale Senior Living Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookdale Senior Living research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Brookdale Senior Living research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookdale Senior Living's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookdale Senior Living might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKD

Brookdale Senior Living

Owns, manages, and operates senior living communities in the United States.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives