- United States

- /

- Healthcare Services

- /

- NYSE:BKD

Brookdale Senior Living (BKD): Exploring Valuation After Reported Gains in Occupancy and Operating Momentum

Reviewed by Simply Wall St

Brookdale Senior Living announced its latest operating results, showing steady improvements in occupancy rates for September and the third quarter of 2025. Both consolidated and same community figures are up compared to last year and last quarter.

See our latest analysis for Brookdale Senior Living.

Brookdale’s recent strength in occupancy has caught investors’ attention, reflected in a 70% year-to-date share price return. The positive operating momentum, paired with a one-year total shareholder return of 39%, suggests confidence is building around both near-term recovery and long-term prospects.

If you’re interested in discovering other companies pushing forward in healthcare and resident-focused services, our healthcare stocks screener is your go-to for standout opportunities. See the full list for free.

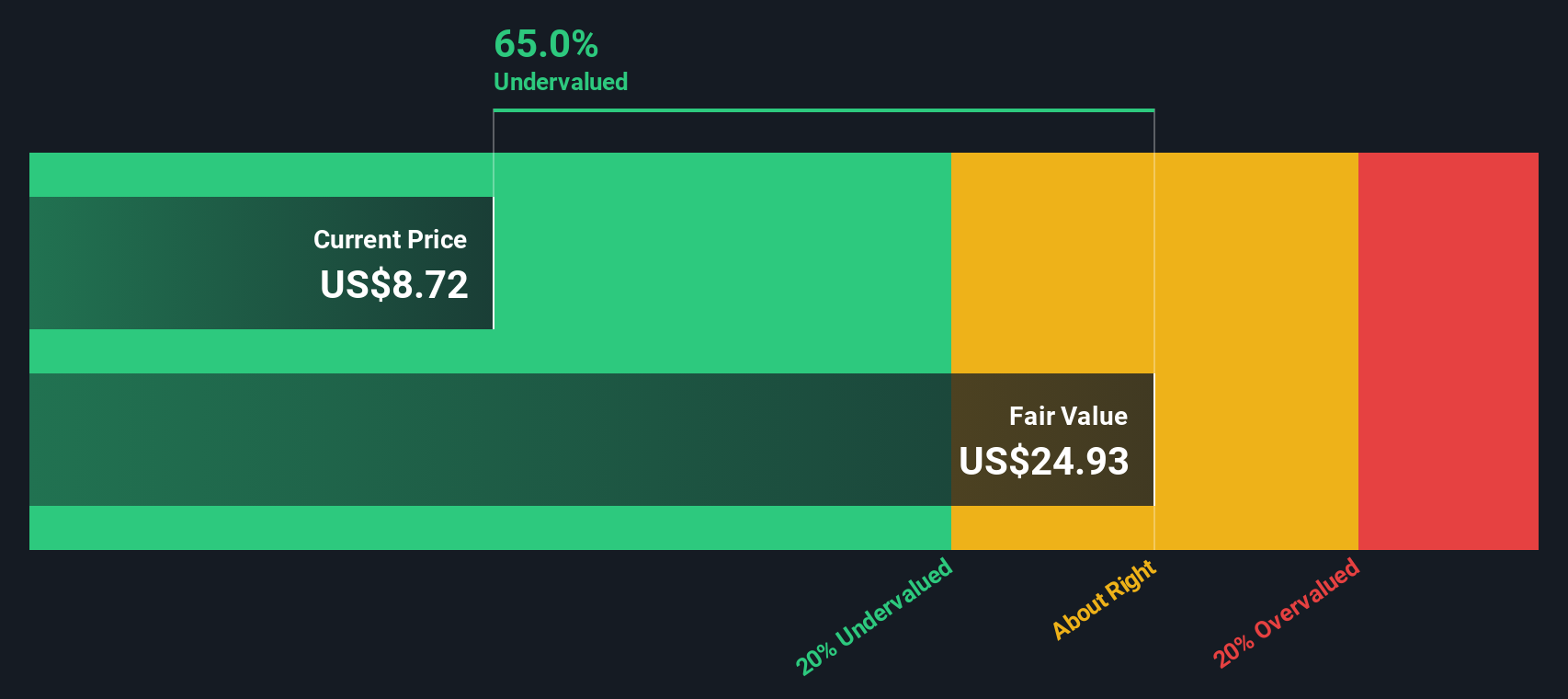

With shares up sharply and operating data trending positive, investors now face a key question: Is Brookdale Senior Living undervalued at current levels, or has the market already priced in expectations for continued recovery?

Most Popular Narrative: 4% Overvalued

With Brookdale Senior Living’s latest close at $8.61 and the narrative’s fair value target at $8.30, followers are watching a market that has slightly run ahead of consensus expectations. The discussion centers not just on the path of recovery but on whether this recent rally has fully reflected the company’s earnings potential and business transformation.

Brookdale is benefiting from accelerating occupancy gains as a result of operational initiatives (such as local empowerment, focused SWAT teams, and targeted incentives). With a large and growing share of communities above the 80% occupancy threshold, rising occupancy will increasingly fall to the bottom line due to fixed-cost leverage. This is expected to drive meaningfully higher margins, EBITDA, and free cash flow over the next several years.

Wondering what bold projections sit at the heart of this call? The narrative hints at an aggressive turnaround. Think juiced margins, robust free cash flow, and a trajectory that echoes top industry leaders. Curious what it will take for Brookdale’s numbers to meet sky-high expectations? Peek inside the full analysis to discover the key financial leaps and shifting assumptions that underpin this value.

Result: Fair Value of $8.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost pressures and a heavy reliance on portfolio optimization could quickly challenge the bullish outlook if trends worsen or expected gains fall short.

Find out about the key risks to this Brookdale Senior Living narrative.

Another View: Discounted Cash Flow Signals Deep Value

Switching gears from the market and analyst outlook, our DCF model paints a very different picture. By estimating Brookdale Senior Living’s future cash flows, the SWS model sets fair value at $24.97 per share, which is far above the current price. Does this suggest a hidden opportunity or a market blind spot?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Brookdale Senior Living Narrative

If you see things differently or want to dig into the numbers on your own, you can shape your own Brookdale Senior Living story in just a few minutes. Do it your way

A great starting point for your Brookdale Senior Living research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always scan beyond the headlines for the next big story. Don't let these opportunities pass you by; your portfolio could thank you later.

- Tap into the AI surge by searching for tomorrow’s innovators through these 25 AI penny stocks, targeting companies that are redefining how industries operate.

- Secure potential income streams and beat inflation by reviewing these 17 dividend stocks with yields > 3%, yielding reliable payouts and attractive growth prospects.

- Capitalize on undervalued gems the market might be missing by checking out these 879 undervalued stocks based on cash flows, backed by real cash flow performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookdale Senior Living might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKD

Brookdale Senior Living

Owns, manages, and operates senior living communities in the United States.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives