- United States

- /

- Medical Equipment

- /

- NYSE:BFLY

Why Butterfly Network (BFLY) Is Up 18.9% After Analysts Forecast Superior Revenue Growth

Reviewed by Sasha Jovanovic

- In recent weeks, Butterfly Network has captured investor attention with a dramatic surge in interest, buoyed by analysts’ forecasts of above-industry revenue growth and a higher price-to-sales ratio versus peers.

- This momentum reflects increasing optimism about Butterfly's ability to outperform the broader medical equipment industry in the upcoming year, according to analyst projections.

- We'll explore how analysts’ expectations of superior revenue growth influence Butterfly Network's investment outlook and risk profile moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Butterfly Network Investment Narrative Recap

To be a shareholder in Butterfly Network right now, you need conviction in its ability to achieve sustained, above-industry revenue growth in handheld ultrasound markets as healthcare shifts toward point-of-care technology. While the recent 55% share price surge and upward revenue forecasts signal renewed momentum, the biggest immediate catalyst remains successful execution on large enterprise and medical school contracts. However, risks like delays in closing these deals and ongoing leadership transitions are still present; this news does not fundamentally change these near-term challenges.

Among relevant updates, the announcement and publication of results from the POCUS-CARE trial stands out: Butterfly demonstrated over US$750,000 in cost savings through workflow enhancements for pulmonary congestion diagnosis. This outcome aligns directly with the thesis that point-of-care ultrasound adoption is accelerating, validating a central catalyst tied to expanding market penetration and value-based healthcare integration.

In contrast, investors should also be aware of ongoing leadership changes and the interim CFO situation, which could create...

Read the full narrative on Butterfly Network (it's free!)

Butterfly Network's outlook anticipates $135.9 million in revenue and $17.0 million in earnings by 2028. This implies a 15.8% annual revenue growth rate and a $79.8 million increase in earnings from -$62.8 million today.

Uncover how Butterfly Network's forecasts yield a $3.17 fair value, a 36% upside to its current price.

Exploring Other Perspectives

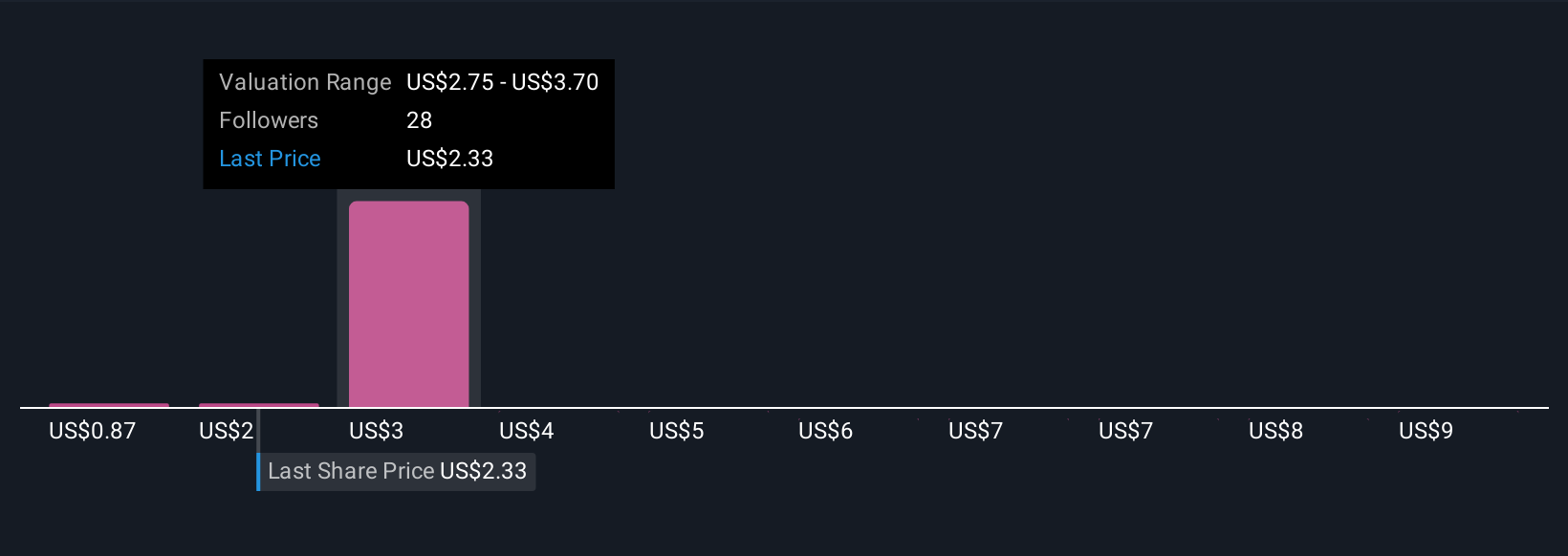

Simply Wall St Community members put forward 8 fair value estimates for Butterfly Network, ranging from US$0.87 to US$10.29 per share. With high revenue growth forecasts but persistent unprofitability, perspectives diverge widely on the company's potential and risk profile, see how other investors are weighing these factors.

Explore 8 other fair value estimates on Butterfly Network - why the stock might be worth less than half the current price!

Build Your Own Butterfly Network Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Butterfly Network research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Butterfly Network research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Butterfly Network's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Butterfly Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFLY

Butterfly Network

Develops, manufactures, and commercializes ultrasound imaging solutions in the United States and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives