- United States

- /

- Medical Equipment

- /

- NYSE:BFLY

Insider Spends US$571k Buying More Shares In Butterfly Network

Butterfly Network, Inc. (NYSE:BFLY) shareholders (or potential shareholders) will be happy to see that the Independent Director, S. Phanstiel, recently bought a whopping US$571k worth of stock, at a price of US$3.08. That increased their holding by a full 65%, which arguably implies the sort of confidence required for a shy sweet-natured nerd to ask the most popular kid in the school to go out on a date.

Butterfly Network Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the CEO, President & Chairman of the Board, Joseph DeVivo, sold US$781k worth of shares at a price of US$2.44 per share. That means that even when the share price was below the current price of US$3.56, an insider wanted to cash in some shares. As a general rule we consider it to be discouraging when insiders are selling below the current price, because it suggests they were happy with a lower valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. It is worth noting that this sale was only 11% of Joseph DeVivo's holding.

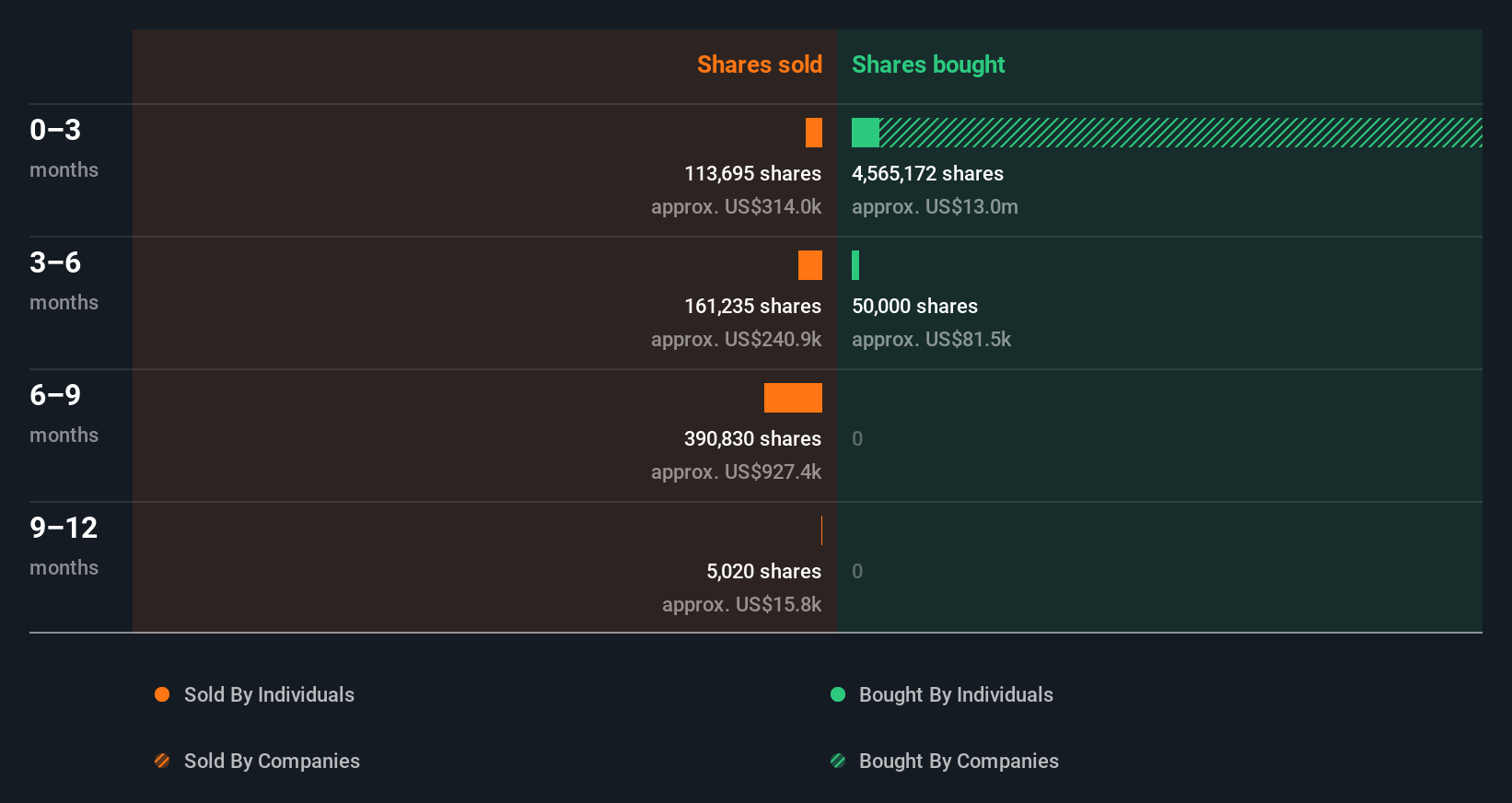

Happily, we note that in the last year insiders paid US$653k for 235.26k shares. But insiders sold 670.78k shares worth US$1.5m. In total, Butterfly Network insiders sold more than they bought over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Check out our latest analysis for Butterfly Network

I will like Butterfly Network better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Does Butterfly Network Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Butterfly Network insiders own 17% of the company, currently worth about US$155m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Butterfly Network Insider Transactions Indicate?

The recent insider purchase is heartening. On the other hand the transaction history, over the last year, isn't so positive. Overall, we'd prefer see a more sustained buying from directors, but with a significant insider holding and more recent purchases, Butterfly Network insiders are reasonably well aligned, and optimistic for the future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For instance, we've identified 3 warning signs for Butterfly Network (1 can't be ignored) you should be aware of.

Of course Butterfly Network may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Butterfly Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BFLY

Butterfly Network

Develops, manufactures, and commercializes ultrasound imaging solutions in the United States and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion