- United States

- /

- Medical Equipment

- /

- NYSE:BFLY

Butterfly Network (BFLY): Evaluating Valuation Following Breakthrough AI Deployment in Maternal Healthcare

Reviewed by Kshitija Bhandaru

Butterfly Network (NYSE:BFLY) just launched a new AI tool for assessing gestational age, rolling it out in Malawi and Uganda. This move highlights the company’s efforts in advancing maternal and fetal healthcare.

See our latest analysis for Butterfly Network.

Butterfly Network has been making headlines not only for its AI-driven healthcare solutions but also with recent leadership changes, including the appointment of John Doherty as CFO. Despite momentum from innovations and executive updates, the stock tells a mixed story: after a sharp 30% one-month share price return, Butterfly still stands 47% lower year-to-date, while long-term investors can point to a 20.5% one-year total shareholder return showing glimmers of recovery.

If the latest in medical AI innovation has your attention, you might find it rewarding to explore other healthcare-focused stocks. See the full list for free.

With shares sitting nearly 50% below their analyst price target despite a recent rally, investors are left to wonder whether Butterfly Network is an overlooked value play or if the market is already factoring in its future growth potential.

Most Popular Narrative: 33.1% Undervalued

With Butterfly Network closing at $2.12 and the most widely followed narrative estimating fair value at $3.17, the gap draws attention and raises the stakes on what could propel the next move.

Butterfly's pipeline of large enterprise and medical school deals, bolstered by recent success in landing a top global health system for full deployment, points to accelerating penetration of handheld ultrasound solutions as healthcare systems shift toward more accessible, cost-effective, point-of-care diagnostics. This supports forward-looking revenue growth as funding clarity returns.

How is this ambitious narrative justified? The entire calculation rests on bold upward projections for recurring digital revenue and margin expansion, plus a leap of faith around sector-leading profit multiples. The full breakdown might catch you off guard—see how the pieces fit together before making a call.

Result: Fair Value of $3.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent delays in sealing big enterprise deals and ongoing high R&D expenses could quickly undermine Butterfly Network’s ambitious growth and margin outlook.

Find out about the key risks to this Butterfly Network narrative.

Another View: What Do Price Ratios Tell Us?

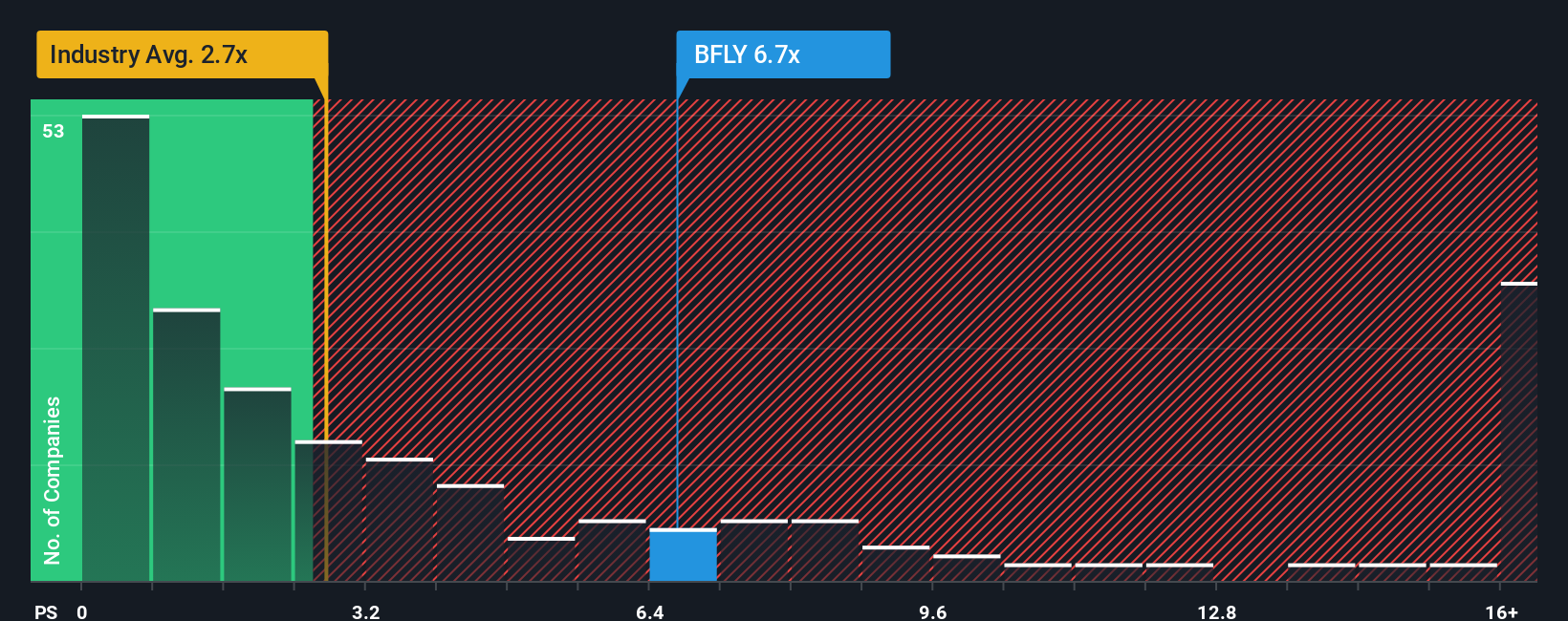

Looking at Butterfly Network through its price-to-sales ratio gives a different perspective. The company trades at 6.1 times sales, which is well above the US Medical Equipment industry’s 2.9 and the peer average of 2.7. The fair ratio points even lower, at 2.6. This means shares could face downwards pressure if the market grows wary of paying premium multiples. Does the stock deserve such optimism, or is the current price running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Butterfly Network Narrative

Prefer a hands-on approach? Dive in and assemble your own investment narrative. It's quick, straightforward, and could offer a new perspective. Do it your way

A great starting point for your Butterfly Network research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stop waiting on the sidelines and get ahead of the curve by finding unique investment opportunities that others might miss. Start now and spot tomorrow’s trends before they’re mainstream.

- Tap into value by tracking these 869 undervalued stocks based on cash flows, delivering strong cash flows and recognized for their upside potential in the current market landscape.

- Power up your growth strategy with these 24 AI penny stocks, harnessing artificial intelligence to drive disruptive innovation and reshape entire industries.

- Boost your income stream with these 18 dividend stocks with yields > 3%, which consistently provide yields over 3% and can add extra stability to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Butterfly Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFLY

Butterfly Network

Develops, manufactures, and commercializes ultrasound imaging solutions in the United States and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives