- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Will Becton Dickinson’s (BDX) Michigan Partnership Redefine Its Edge in US Pharmacy Automation?

Reviewed by Sasha Jovanovic

- On September 22, 2025, Henry Ford Health announced a partnership with Becton, Dickinson and Company (BD) to automate hospital-based community pharmacies in Michigan using the BD Rowa™ Vmax robotic system, enabling patients to pick up select prescriptions 24/7 and streamlining pharmacy staff workflows.

- This collaboration introduces a widely used European automation technology to the U.S. for the first time, marking a shift toward more convenient and patient-centered pharmacy care.

- We'll assess how BD’s entry into around-the-clock pharmacy automation with Henry Ford Health may reshape its investment narrative and market positioning.

Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

Becton Dickinson Investment Narrative Recap

To be a shareholder in Becton Dickinson (BD), you need to believe the company can offset pressure from global tariffs and procurement challenges, while capitalizing on innovation in healthcare automation and chronic disease solutions. The Henry Ford Health partnership introduces a proven European automation technology to the U.S., but it is unlikely to materially shift BD’s most immediate catalyst, strong new product rollouts in diagnostics and delivery systems, or lessen the ongoing risks from trade headwinds and market volatility in China.

The most relevant recent company announcement is the new $2.75 billion senior unsecured revolving credit facility, which bolsters BD’s financial flexibility to fund innovation and operational initiatives like pharmacy automation. However, this access to liquidity does not directly change the short-term importance of achieving commercial and operational execution for new product launches that drive near-term revenue and margin goals.

By contrast, investors should be aware that persistent and increasing tariff and trade headwinds may have a significant impact in fiscal 2026, especially if ...

Read the full narrative on Becton Dickinson (it's free!)

Becton Dickinson's outlook assumes $24.7 billion in revenue and $2.8 billion in earnings by 2028. This is based on an annual revenue growth rate of 4.9% and a $1.2 billion increase in earnings from the current $1.6 billion.

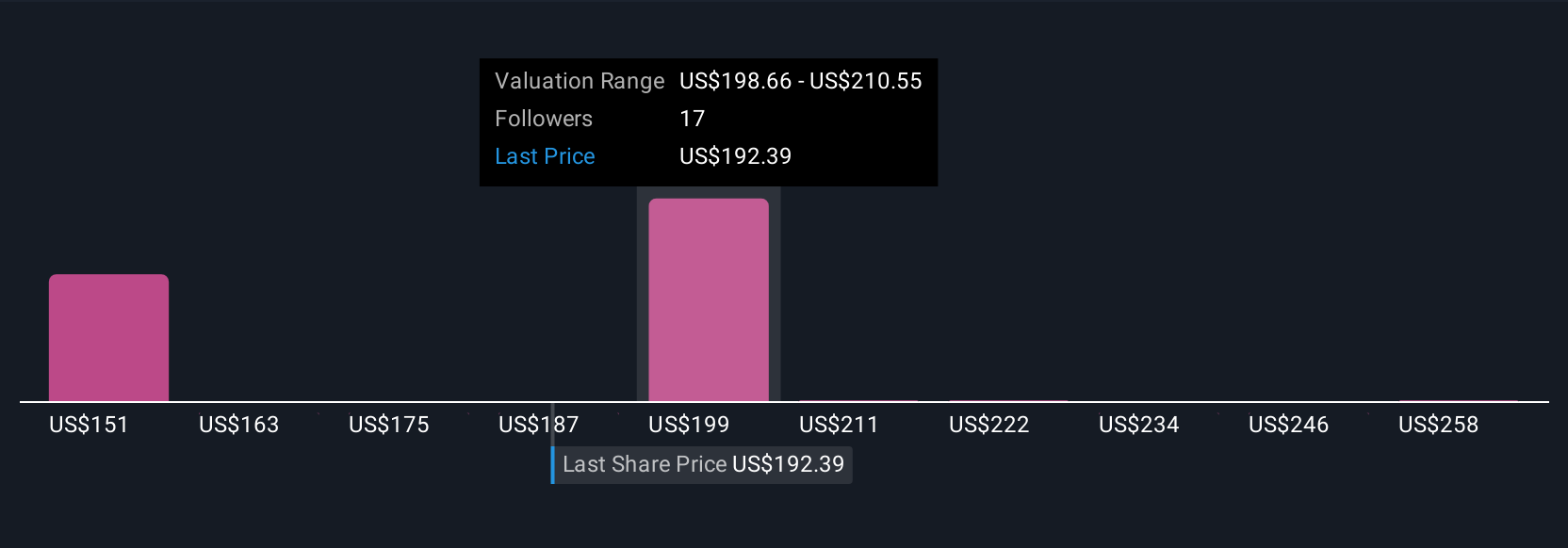

Uncover how Becton Dickinson's forecasts yield a $208.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Six community fair value estimates for BD span US$208 to US$341.77, showing a broad range of opinions on the company’s potential. With ongoing trade pressures possibly affecting margins, you can see why market participants offer such different views and are encouraged to explore multiple perspectives.

Explore 6 other fair value estimates on Becton Dickinson - why the stock might be worth just $208.00!

Build Your Own Becton Dickinson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Becton Dickinson research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Becton Dickinson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Becton Dickinson's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives