- United States

- /

- Medical Equipment

- /

- NYSE:BDX

The Bull Case for Becton Dickinson (BDX) Could Change Following CFO Transition and Revenue Miss – Learn Why

Reviewed by Sasha Jovanovic

- Becton, Dickinson and Company recently announced that Chief Financial Officer Chris DelOrefice will depart the company on December 5, 2025, with Vitor Roque stepping in as interim CFO while a permanent successor is sought.

- This executive transition coincides with the release of preliminary fourth-quarter and full-year revenue results that came in below market expectations, drawing investor attention to both leadership stability and future financial performance.

- We'll explore how the upcoming CFO change and softer revenue outlook may influence Becton Dickinson's investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Becton Dickinson Investment Narrative Recap

To be a shareholder in Becton Dickinson, you need to believe in the company’s ability to transform itself into a leading pure-play medtech provider through innovation, operational efficiency, and margin expansion, particularly as it prepares to spin off its Biosciences and Diagnostics business. The recent CFO transition and softer revenue outlook may not materially alter the biggest short-term catalyst, the pending business separation, but it does draw more attention to execution risks in the near term.

Among recent company announcements, the collaboration with Opentrons to automate single-cell multiomics experiments stands out as directly supporting BD’s innovation-driven growth narrative. This move not only underscores the company’s commitment to strengthening its recurring revenue base through advanced solutions but also aligns with its focus on capturing value in developing healthcare segments as a medtech pure play.

However, investors should be alert to the fact that leadership changes during major business separations can increase the risk of unexpected operational or financial...

Read the full narrative on Becton Dickinson (it's free!)

Becton Dickinson's narrative projects $24.7 billion revenue and $2.8 billion earnings by 2028. This requires 4.9% yearly revenue growth and a $1.2 billion increase in earnings from $1.6 billion today.

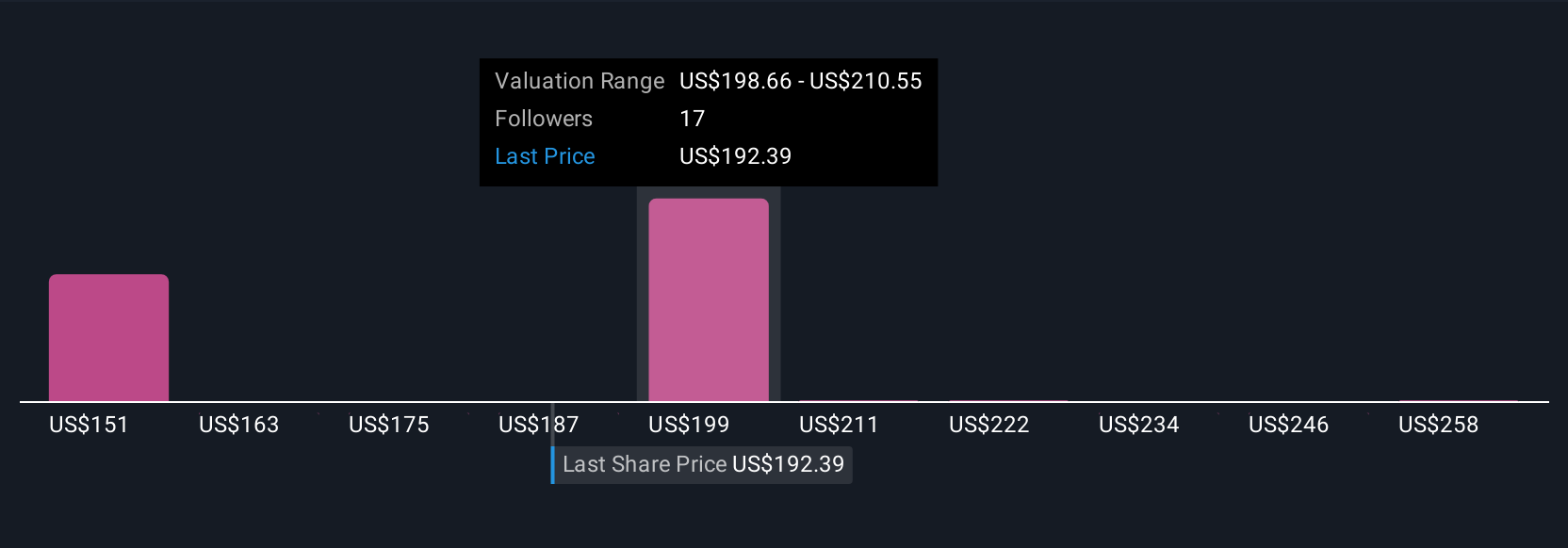

Uncover how Becton Dickinson's forecasts yield a $208.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Five private investors from the Simply Wall St Community estimate Becton Dickinson's fair value between US$208 and US$273 per share. With the upcoming business separation introducing both opportunity and execution risk, it’s clear that market participants see a wide spectrum of possible outcomes, explore the full range of perspectives for additional insight.

Explore 5 other fair value estimates on Becton Dickinson - why the stock might be worth as much as 44% more than the current price!

Build Your Own Becton Dickinson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Becton Dickinson research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Becton Dickinson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Becton Dickinson's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives