- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Becton Dickinson (NYSE:BDX) Unveils Advanced Cell Analyzer With Spectral And Imaging Innovations

Reviewed by Simply Wall St

Becton Dickinson (NYSE:BDX) gained attention this week with the global launch of its new cell analyzer, integrating advanced spectral and real-time cell imaging technologies. This development coincided with the company's share price increasing 6%, reflecting its positioning in the biotech sector's forefront. Meanwhile, broader market indices, including the S&P 500 and Nasdaq, experienced notable gains, driven by a rally in tech stocks like Nvidia and Tesla, following favorable economic news such as reduced U.S.-China tariffs and declining inflation. The company's innovative product enhancements likely added weight to its positive stock performance amid such a bullish market environment.

Becton Dickinson has 2 warning signs (and 1 which is significant) we think you should know about.

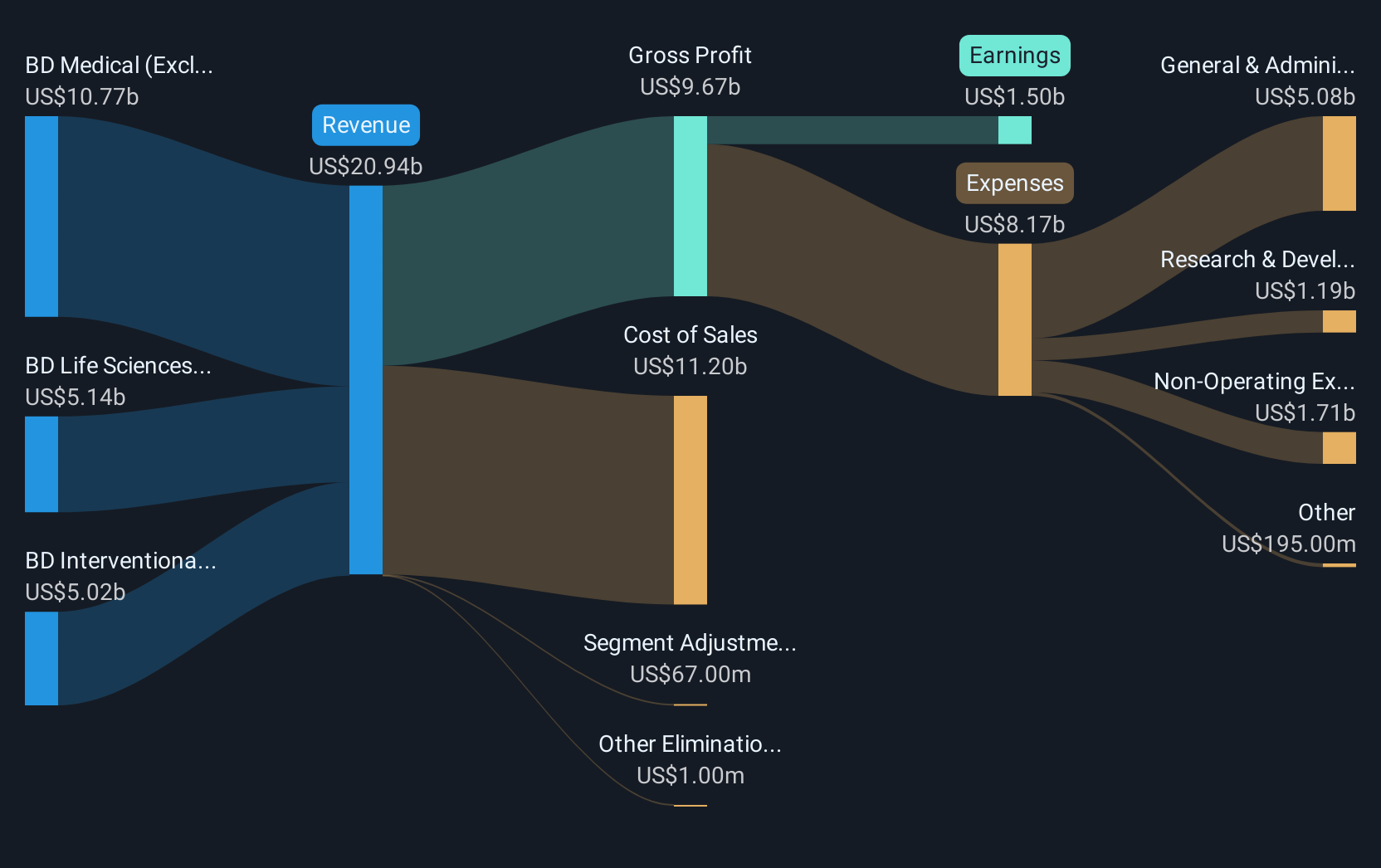

The global launch of Becton Dickinson's new cell analyzer, with its advanced spectral and real-time cell imaging technologies, marks a pivotal development that aligns with the company's focus on enhancing its medical technology offering. This innovation is poised to augment Becton Dickinson's revenue potential and earning forecasts, supporting the broader company narrative of expansion and market leadership in high-growth areas. While the immediate impact fueled a 6% rise in Becton's share price, the broader implications may fortify its long-term financial foundation, especially as operational and strategic efficiencies are anticipated to boost gross margins and R&D funding.

Looking at the company's performance over a longer time frame, Becton Dickinson's total shareholder return, including share price and dividends, was a 24.08% decline over the past year. This downturn contrasts with broader market trends, noting that the company underperformed relative to the US Medical Equipment industry's 9.3% return. This underperformance highlights potential challenges the company faces, such as pressure from market conditions in China and trade policy uncertainties, which could impact investor confidence.

In this context, Becton Dickinson's current share price of US$165.15 remains below the consensus analyst price target of US$225.25, suggesting a potential upside of approximately 26.7%. While the company's recent product launch adds an optimistic tone to future revenue and earnings projections, analysts anticipate revenue growth of 5.5% annually over the next three years, with earnings projected to reach US$2.9 billion by May 2028. The realization of these forecasts will be crucial in aligning its market valuation closer to the price target, reinforcing investor confidence in its growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives