- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Becton Dickinson (BDX): Evaluating Valuation After BD Rhapsody’s 1,000th Placement and New Genomics Innovations

Reviewed by Kshitija Bhandaru

Becton Dickinson (NYSE:BDX) just hit a key milestone: the company announced the 1,000th placement of its BD Rhapsody System at Addenbrooke's Hospital of the University of Cambridge. If you have been following the genomics and cell analysis space, you know how competitive it is. Landing a spot in one of the UK’s top research hospitals signals real-world demand for Becton Dickinson’s instruments and technology. The accompanying launch of new assays, upcoming automation upgrades, and deeper integration with emerging workflows further support the innovation narrative, making this an event worth a closer look.

These milestones arrived against a backdrop of mixed market sentiment. Over the past year, Becton Dickinson’s stock has struggled, returning -19% despite the broader excitement around precision medicine. There have been encouraging signs recently; the shares have recovered 9% in the past 3 months, yet a year-to-date decline reminds us momentum is not guaranteed. Meanwhile, the company’s fundamentals reflect annual revenue and net income growth, and management is navigating a turnaround that includes spinning off its biosciences and diagnostics division in a planned sale to Waters by 2026.

Now, with innovation clearly in focus and the stock still trailing last year, is Becton Dickinson a potential value play, or is the company’s growth pipeline already reflected in the share price?

Most Popular Narrative: 10% Undervalued

The most widely followed view is that Becton Dickinson is currently trading about 10% below its estimated fair value, based on future earnings growth and margin expansion.

Strong new product launches in diagnostics, advanced tissue regeneration, and connected care, including the BD COR HPV platform and at-home collection kits, are expected to capture growing demand from the increasing chronic disease burden and the global shift toward decentralized and home-based care. These trends may support future revenue growth acceleration.

Why do some investors see significant upside for Becton Dickinson? This narrative points to a combination of profit expansion, margin gains, and a noticeably different earnings outlook in the coming years. What projections are leading to a fair value well above today's price? The answers and the key drivers are found in the bullish case behind this valuation.

Result: Fair Value of $208.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariff pressures and the operational complexity of the planned business separation could easily shift Becton Dickinson’s outlook in the opposite direction.

Find out about the key risks to this Becton Dickinson narrative.Another Perspective: Market Comparison

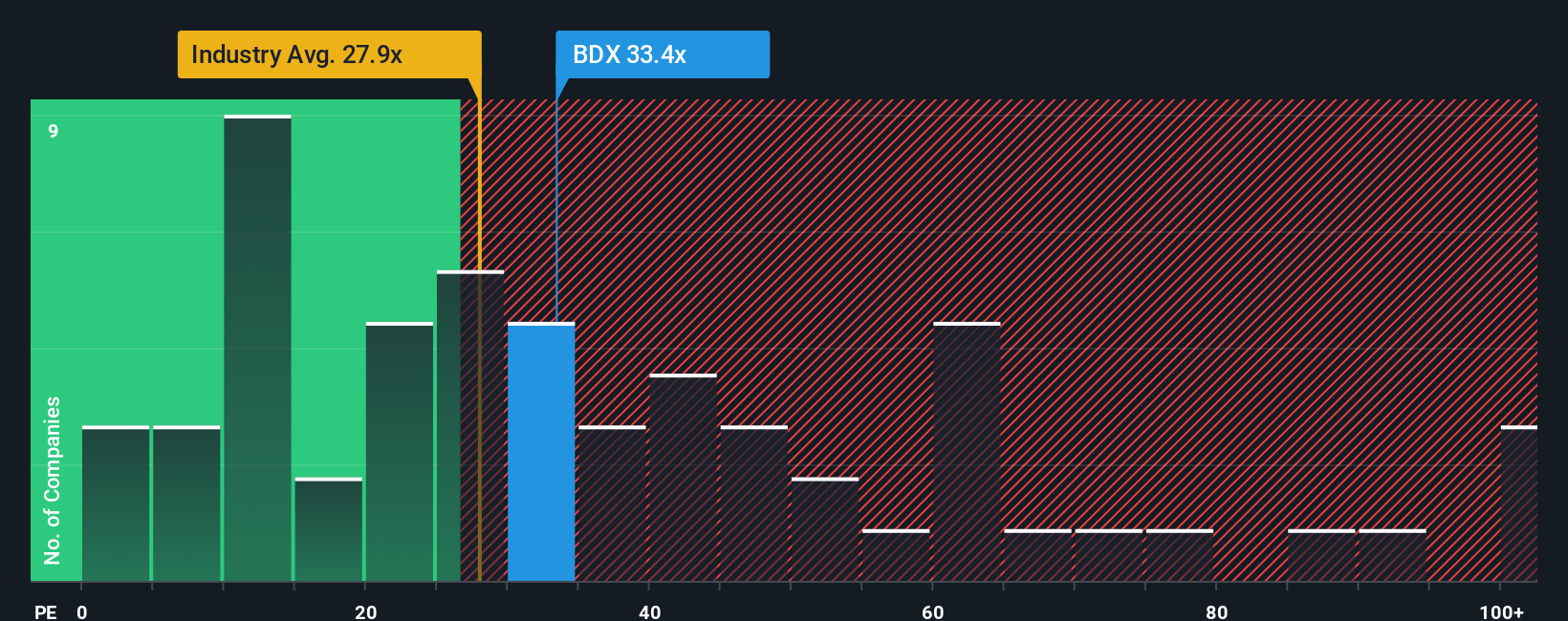

Looking at Becton Dickinson through the lens of market ratios, it is currently priced higher than the average for similar companies in its industry. Does this mean the growth story is already priced in? Alternatively, is the market missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Becton Dickinson to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Becton Dickinson Narrative

If you want to dig deeper, question the assumptions, or shape a perspective based on your own research, you can chart a different path in just a few minutes. Do it your way

A great starting point for your Becton Dickinson research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

The market is always moving, and smart investors keep fresh opportunities on their radar. Don't miss your chance to uncover stocks that fit your unique strategy. Take action now to get ahead.

- Capture the upside of artificial intelligence by tracking innovative companies making breakthroughs in automation and smart technology with our AI penny stocks.

- Access a shortlist of undervalued potential winners by reviewing businesses that stand out for strong cash flows and overlooked market pricing with our undervalued stocks based on cash flows.

- Target reliable income with companies offering strong dividend yields and proven payout records using our carefully curated dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives