- United States

- /

- Medical Equipment

- /

- NYSE:BAX

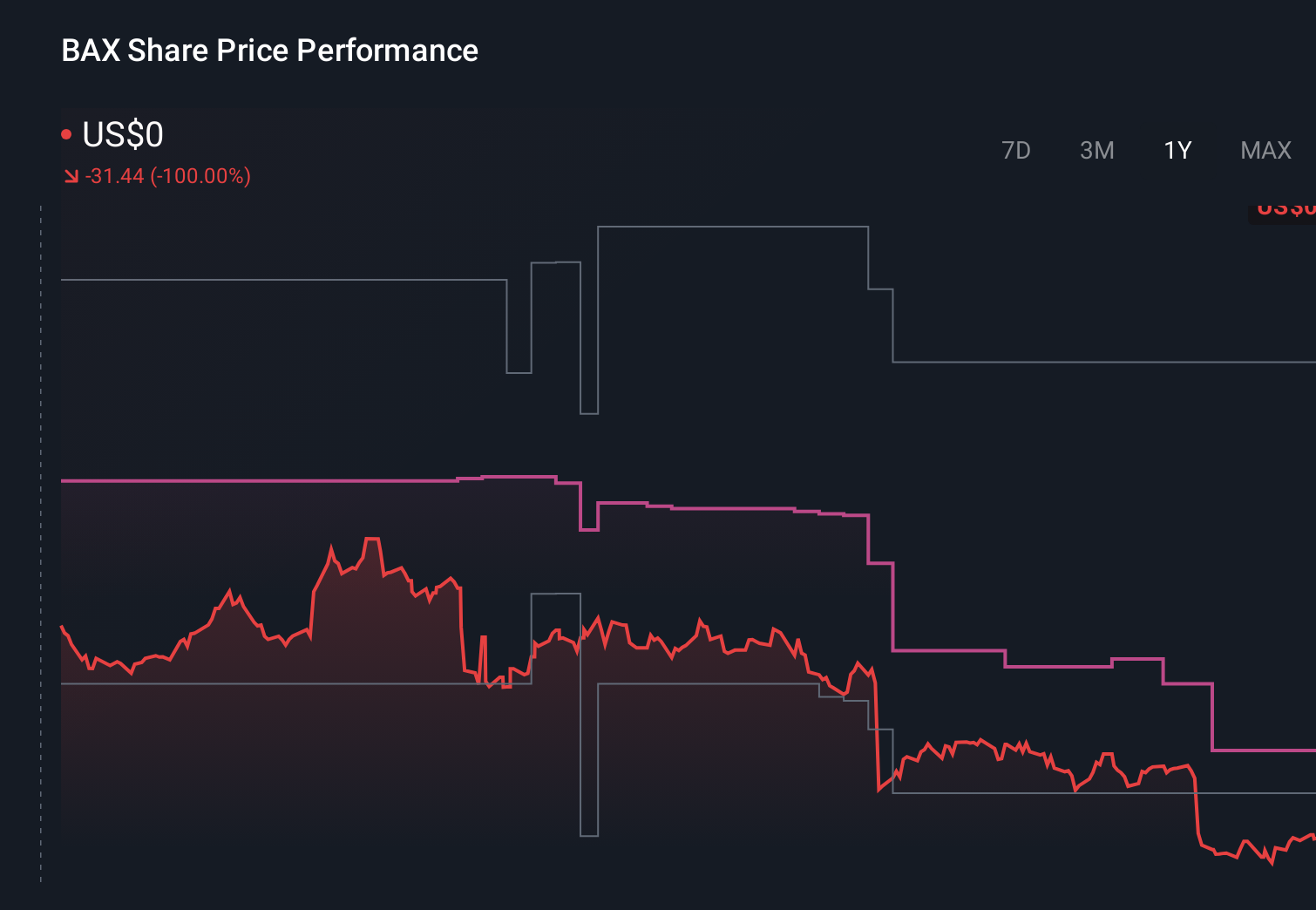

How Investors Are Reacting To Baxter (BAX) Legal Headwinds And Balance Sheet Moves

Reviewed by Sasha Jovanovic

- In recent weeks, Baxter International Inc. launched cash tender offers to repurchase any and all of its US$750,000,000 2.600% senior unsecured notes due 2026 and up to US$600,000,000 of its US$1.45 billion 1.915% senior unsecured notes due 2027, while also amending its five-year credit agreement to temporarily relax net leverage covenants.

- These balance sheet moves come as Baxter faces a wave of securities class action lawsuits tied to alleged undisclosed safety defects in its Novum LVP infusion device, raising fresh questions about legal, operational, and financial risk management.

- We’ll now examine how the Novum LVP legal challenges could affect Baxter’s earlier margin-recovery investment narrative and management’s efficiency agenda.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Baxter International Investment Narrative Recap

To own Baxter today, you need confidence that its core hospital products can recover margins after several tough years, while management manages legal, operational, and balance sheet pressures. The Novum LVP class actions now sit alongside already elevated quality and demand risks, making near term execution on margin recovery and product reliability the key catalyst and the central uncertainty for shareholders.

The recent decision to launch cash tender offers for the 2026 and 2027 notes, alongside relaxing net leverage covenants under its credit agreement, matters here because it ties financial flexibility directly to how Baxter absorbs potential Novum LVP related costs, margin pressure, and any earnings volatility around its recovery plan.

Yet behind the margin recovery story, investors should be aware of how the Novum LVP related quality issues could...

Read the full narrative on Baxter International (it's free!)

Baxter International's narrative projects $12.1 billion revenue and $913.6 million earnings by 2028. This requires 3.7% yearly revenue growth and about a $1.2 billion earnings increase from -$247.0 million.

Uncover how Baxter International's forecasts yield a $24.07 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community currently estimate Baxter’s fair value between about US$14.80 and US$20,500.83, showing how far apart personal models can be. Against that backdrop, the cluster of Novum LVP lawsuits and quality concerns gives you a concrete risk to weigh as you compare these very different views on Baxter’s future performance.

Explore 6 other fair value estimates on Baxter International - why the stock might be a potential multi-bagger!

Build Your Own Baxter International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Baxter International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Baxter International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Baxter International's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baxter International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAX

Baxter International

Through its subsidiaries, provides a portfolio of healthcare products in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026