- United States

- /

- Medical Equipment

- /

- NYSE:BAX

Baxter International (NYSE:BAX) Unveils Voalte Linq Voice-Activated Tech for Enhanced Patient Care

Reviewed by Simply Wall St

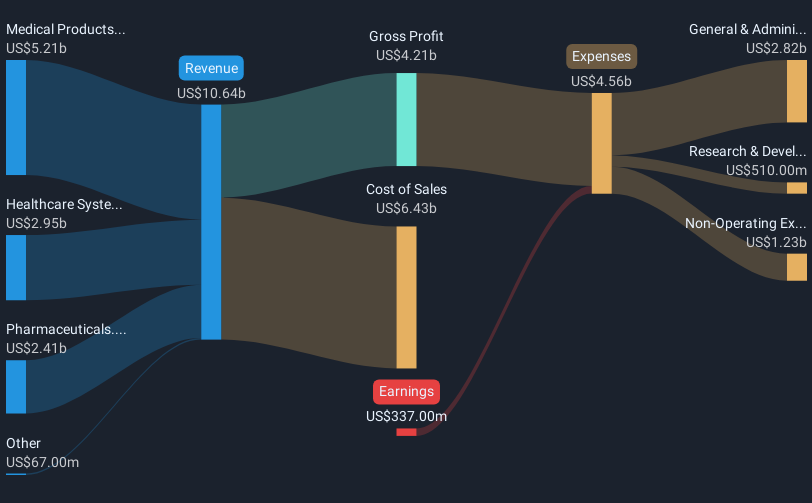

Baxter International (NYSE:BAX) recently launched the Voalte Linq device, a voice-activated communication tool for healthcare environments, which aligns with their strategy to enhance connectivity in care settings. This product launch, which took place at the 2025 HIMSS Global Healthcare Conference, addresses a critical need for modern communication solutions in healthcare. Despite the broader market experiencing a 2.5% drop due to tariff concerns impacting major indexes, Baxter's share price increased by 7% over the past month. This rise occurred amidst a challenging backdrop as other sectors faced economic pressures. The company's recent financial announcements include a quarterly cash dividend and guidance for moderate sales growth in 2025. These mixed financial signals, combined with sector-specific innovations and resilient performance against market trends, paint a complex picture of Baxter's position relative to broader market movements.

Take a closer look at Baxter International's potential here.

Over the past year, Baxter International's total shareholder return, including dividends, was a 15.79% decline, underperforming both the US broader market, which rose by 15.3%, and the US Medical Equipment industry, which grew by 10.4%. Several factors contributed to this performance. Key product-related developments included the introduction of five injectable pharmaceutical products in December 2024, including treatments for Candida infections and malignant diseases. Despite these launches, earnings announcements disclosed a net loss of US$512 million for Q4 2024, shifting from a net income position the previous year.

Additionally, operational challenges posed by Hurricane Helene disrupted their North Cove facility in September 2024, which may have further affected their operational continuity. The retirement of CEO José E. Almeida and appointment of Brent Shafer as interim CEO in February 2025 could also have impacted investor sentiment, alongside reported impairments, including a goodwill impairment of US$425 million in Q4 2024. These pivotal factors contributed to Baxter's challenging year in the stock market.

- Unlock the insights behind Baxter International's valuation and discover its true investment potential

- Assess the potential risks impacting Baxter International's growth trajectory—explore our risk evaluation report.

- Shareholder in Baxter International? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baxter International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAX

Baxter International

Through its subsidiaries, provides a portfolio of healthcare products in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives