- United States

- /

- Healthcare Services

- /

- NYSE:ARDT

Ardent Health (ARDT): Evaluating Valuation Following New $500 Million Shelf Registration Filing

Reviewed by Simply Wall St

Most Popular Narrative: 32.7% Undervalued

According to community narrative, Ardent Health is currently trading at a significant discount compared to what analysts see as its fair value. The consensus points toward strong future performance that could justify a higher price.

"Company investments in expanding the ambulatory and urgent care footprint, with ongoing projects and recent acquisitions, enable access to higher-margin outpatient services and enlarge Ardent's patient base. This drives a sustained increase in net margins and diversified recurring revenues."

Curious why analysts see such untapped potential? The explanation lies in the forecasted growth from new services, margin expansion, and how future profits could be valued by the market. This narrative depends on bold financial projections and a pricing multiple that remains well below healthcare peers. Want to know which key numbers power this valuation? Discover what factors are shaping these expectations.

Result: Fair Value of $19.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain. Changes to Medicaid funding and growing payer challenges could undermine Ardent Health's margin expansion and projected revenue growth.

Find out about the key risks to this Ardent Health narrative.Another View: SWS DCF Model Suggests a Different Story

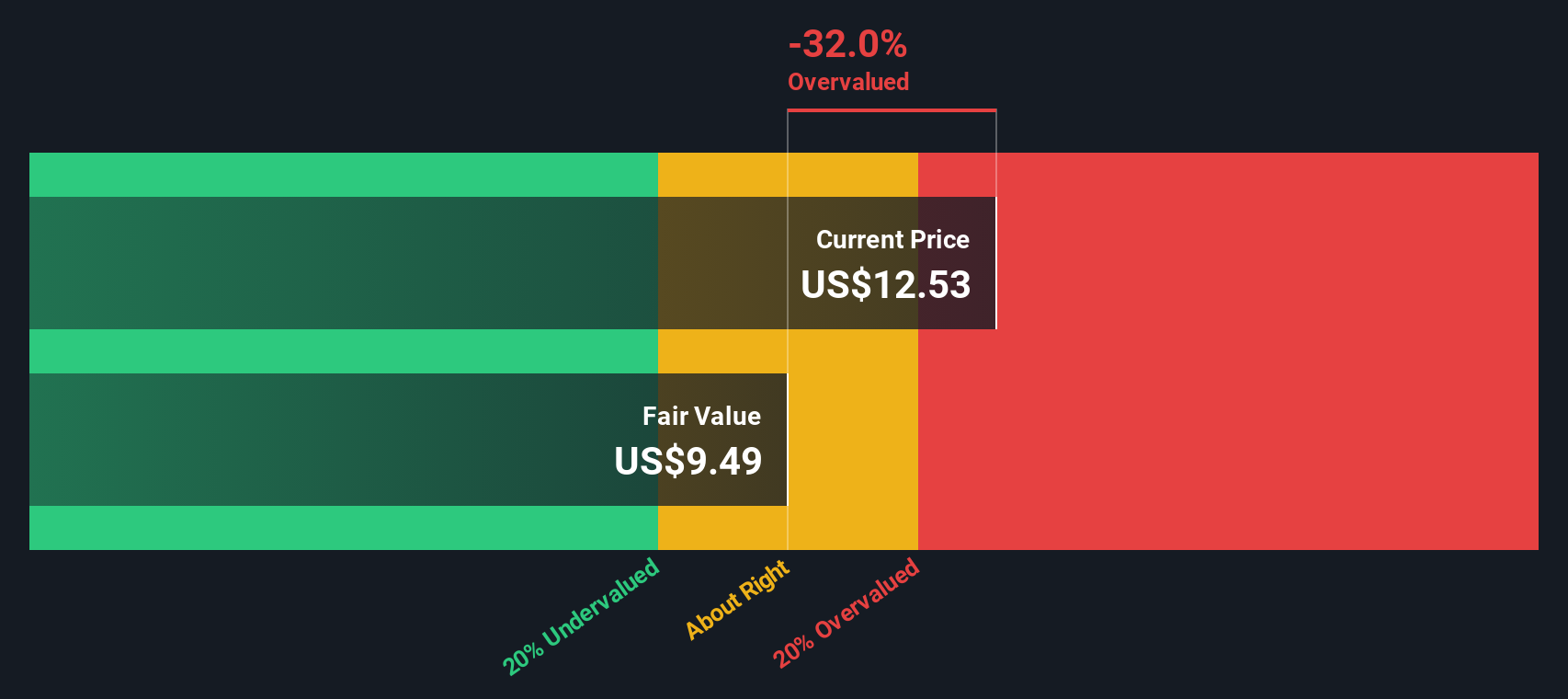

While analysts see upside, our DCF model offers a more cautious perspective and indicates the stock could be trading above its estimated fair value. Could the market’s optimism be overlooking important risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ardent Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ardent Health Narrative

If you have a different perspective or want to delve deeper into the numbers, you can build your own custom narrative in just a few minutes. So why not do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Ardent Health.

Looking for More Investment Opportunities?

Great investors never stop searching for the next edge. Put yourself among them by taking advantage of screening tools that highlight trends and strengths you might otherwise overlook. With a few clicks, unlock a world of compelling stocks chosen for their fundamentals, innovation, or reliable income streams.

- Maximize your portfolio's potential by screening for shares with robust returns using dividend stocks with yields > 3%; this approach is ideal for those seeking consistent income and stability from their investments.

- Seize new tech revolutions as you scan the universe of high-potential innovations in healthcare by following healthcare AI stocks, where companies blend medical expertise and artificial intelligence.

- Supercharge your value hunt with undervalued stocks based on cash flows. Here you can uncover stocks trading below their intrinsic cash flow worth, ready for your next smart move.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARDT

Ardent Health

Owns and operates a network of hospitals and clinics that provides a range of healthcare services in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives