- United States

- /

- Medical Equipment

- /

- NYSE:AORT

How Positive AMDS Trial Results Could Shape Artivion's (AORT) Clinical and Market Trajectory

Reviewed by Sasha Jovanovic

- Artivion recently announced the presentation of positive 30-day data from its AMDS PERSEVERE and PROTECT clinical trials at the 39th European Association for Cardio-Thoracic Surgery Annual Meeting in Copenhagen, which showed reduced adverse events and mortality for patients with acute aortic dissection treated with the AMDS hybrid prosthesis.

- The results highlighted that 83% of high-risk patients avoided major gastrointestinal complications, outcomes which support the AMDS device's evidence base for regulatory approvals and market adoption.

- With these positive late-breaking trial results strengthening AMDS’s clinical profile, we’ll examine how this news could influence Artivion’s investment case moving forward.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Artivion Investment Narrative Recap

For Artivion shareholders, the main thesis hinges on successful commercialization of innovative products like the AMDS hybrid prosthesis to drive continued revenue and margin growth. The positive clinical data presented from the PERSEVERE trial could accelerate regulatory approval and market uptake, making it a strong catalyst in the short term, while the chief risk remains the potential for regulatory delays or setbacks in pipeline expansion that would impact future revenue trajectory.

Among recent announcements, the Q2 2025 results stand out, reporting year-over-year revenue growth and a return to net profitability. This financial progress, if sustained and supported by faster adoption following positive AMDS trial results, may reinforce the company’s runway for investing in its clinical pipeline and managing debt obligations.

However, investors should also weigh ongoing regulatory risks that could...

Read the full narrative on Artivion (it's free!)

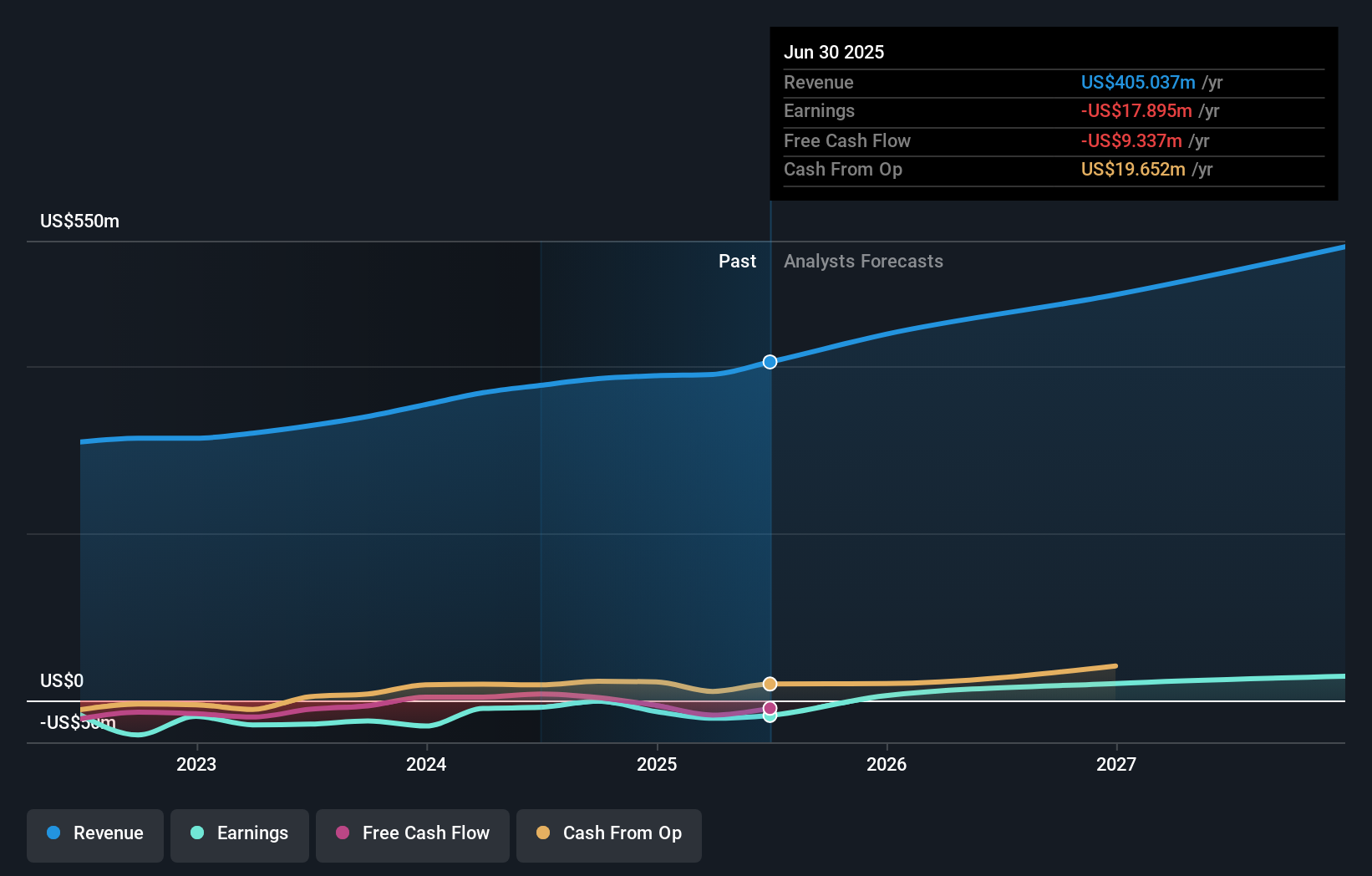

Artivion's narrative projects $571.4 million revenue and $37.4 million earnings by 2028. This requires 12.2% yearly revenue growth and a $55.3 million earnings increase from the current earnings of -$17.9 million.

Uncover how Artivion's forecasts yield a $45.26 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Only one Community member placed a US$45.26 fair value for Artivion before this recent news. With positive trial results strengthening a short-term catalyst, you may want to review the broader range of views posted by others.

Explore another fair value estimate on Artivion - why the stock might be worth as much as 6% more than the current price!

Build Your Own Artivion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Artivion research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Artivion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Artivion's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AORT

Artivion

Manufactures, processes, and distributes medical devices and implantable human tissues worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives