- United States

- /

- Medical Equipment

- /

- NYSE:AORT

Artivion (AORT): Evaluating Valuation Following Positive Clinical Trial Results for AMDS Hybrid Prosthesis

Reviewed by Simply Wall St

Artivion (NYSE:AORT) just shared encouraging data from its AMDS PERSEVERE and PROTECT clinical trials at a key international conference. This drew attention to the performance of its AMDS Hybrid Prosthesis in treating acute aortic dissection.

See our latest analysis for Artivion.

Artivion’s latest clinical success comes as momentum builds in its share price. The latest close sits at $42.3, with a 90-day share price return of 35.4% and a one-year total shareholder return of 59.4%. These recent gains reflect growing optimism as the company delivers tangible clinical milestones while working towards regulatory approval, signaling renewed investor confidence in both its innovation and growth outlook.

If this leap in medtech progress caught your attention, you’ll want to see other healthcare leaders making headlines. See the full list for free.

With shares up sharply over the past year and strong clinical results driving momentum, investors now face a key question: is Artivion still undervalued, or is the market already pricing in its next phase of growth?

Most Popular Narrative: 6.5% Undervalued

With Artivion’s narrative fair value sitting above the latest close, the spotlight is now on what is fueling this bullish outlook and whether it is defendable amid heightened expectations.

Strong growth in constant currency revenue (14% YoY) and adjusted EBITDA (33% YoY), primarily driven by increasing adoption of innovative and clinically differentiated products like On-X valves and AMDS, positions Artivion to benefit from the rising need for heart valve replacements as the global population ages, supporting sustained revenue and earnings growth.

Want to know what is behind this premium valuation? This narrative depends on rapid margin expansion, fast-growing sales, and an aggressive future earnings target. Which bold projections stand behind the consensus fair value? Read to see what numbers drive this call.

Result: Fair Value of $45.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including uncertainty around future product adoption and the challenge of defending margins as competition increases and healthcare pricing pressures intensify.

Find out about the key risks to this Artivion narrative.

Another View: What Do Market Multiples Say?

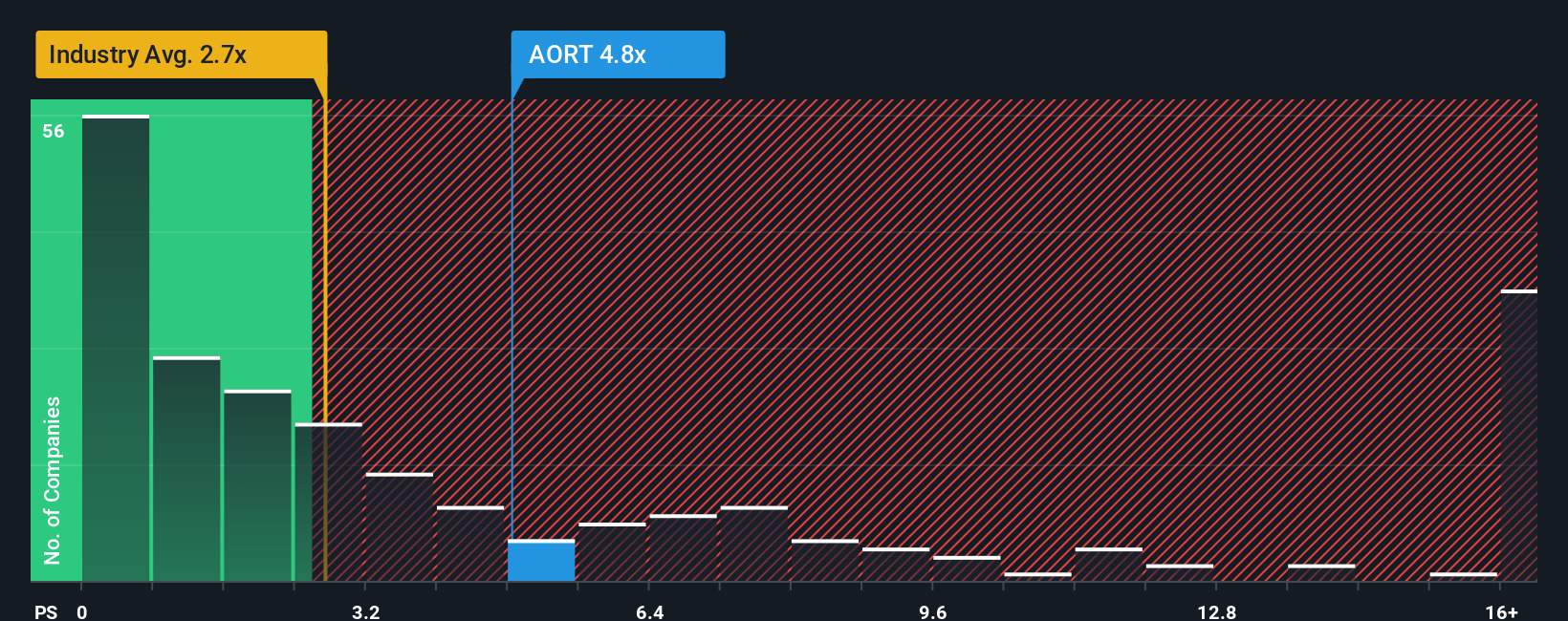

Looking at market ratios offers a different angle. Artivion’s current price-to-sales ratio is 4.9x, which stands well above both the US Medical Equipment industry average of 3.2x and peer average of 3.9x. Compared to the fair ratio of 2.8x, the company looks expensive on this measure. This suggests a risk if sentiment cools or expectations shift. Could investors be getting ahead of the fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Artivion Narrative

If you see the story differently, or want to dig into the numbers and shape your own outlook, you can create a narrative in under three minutes. Do it your way.

A great starting point for your Artivion research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at one opportunity. Take your portfolio further by targeting powerful themes and sectors where upside potential could surprise you.

- Capture the income advantage by targeting companies offering high yields. Start with these 17 dividend stocks with yields > 3% to boost your regular returns.

- Get ahead of the next tech wave and position yourself early with these 24 AI penny stocks leading groundbreaking advances in artificial intelligence.

- Spot untapped potential by considering these 877 undervalued stocks based on cash flows and uncover hidden gems trading below their true worth before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AORT

Artivion

Manufactures, processes, and distributes medical devices and implantable human tissues worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives