- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Weighing Abbott Stock After Strong 21.8% Rally and Diagnostic Demand Surge in 2025

Reviewed by Bailey Pemberton

Trying to decide whether Abbott Laboratories belongs in your portfolio right now? You are not alone. With shares closing recently at $134.59, Abbott's stock has been generating plenty of conversation among investors weighing its long-term potential against its current price tag. Over the past year, Abbott has delivered a strong 21.8% return, and its performance since the start of this year is even more impressive, up 18.6%. Even taking a longer view, Abbott’s five-year return of 34.2% and three-year gain of 40.2% point to a company with genuine staying power.

What is behind this steady momentum? On one hand, market optimism about the wider healthcare sector and Abbott’s ability to innovate have kept sentiment positive. Meanwhile, recent developments such as increased demand for diagnostic technologies and positive industry trends have helped underpin the company’s resilience in shifting conditions. It is not just about hype either; Abbott’s relatively low volatility during choppy market periods has carved out a reputation for stability and growth, making it a go-to name for many cautious, long-term investors.

If you are wondering about valuation, here is a quick scorecard: according to our six-point undervaluation checklist, Abbott comes in at a 3 out of 6. That means half our criteria suggest the stock is undervalued, and the other half say maybe not. Still, those numbers do not tell the full story. Next, we will dig into the specific valuation approaches. At the end, I want to share a truly insightful way to think about valuation that goes beyond any score or checklist.

Approach 1: Abbott Laboratories Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting those amounts back to today's values. This approach is widely regarded as one of the most comprehensive ways to assess a business’s intrinsic value, as it focuses directly on the actual money a company is expected to generate.

For Abbott Laboratories, the most recent reported Free Cash Flow stands at $6.79 billion. Analysts provide detailed forecasts for the next five years; beyond that, projections are estimated using a two-stage model. By 2029, cash flows are projected to rise to $8.42 billion, with further, smaller increases extrapolated into the following decade.

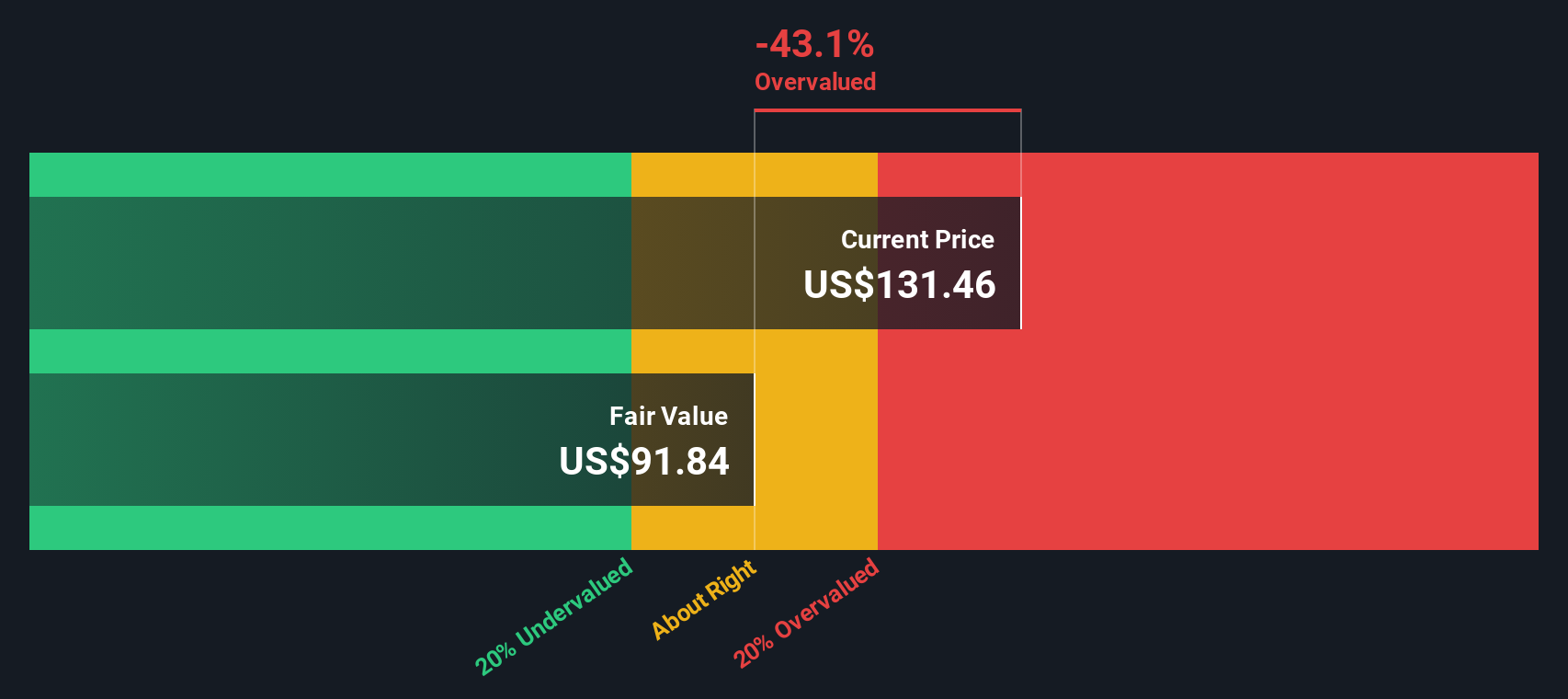

Based on these projections, the DCF model estimates Abbott's intrinsic value at $93.82 per share. Comparing this to the recent share price of $134.59, the model suggests the stock is trading at a 43.5% premium to its calculated worth. In summary, according to this methodology, Abbott Laboratories currently appears overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Abbott Laboratories may be overvalued by 43.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Abbott Laboratories Price vs Earnings

When valuing a consistently profitable business like Abbott Laboratories, the Price-to-Earnings (PE) ratio is a logical metric to turn to. The PE ratio is widely used because it relates what investors are willing to pay for a company to how much profit the business actually generates. In essence, it helps frame whether the stock price fairly reflects the business’s underlying earning power.

A "normal" or "fair" PE ratio is shaped by a range of factors, chief among them being the expected growth in earnings and the perceived risks facing the company or its industry. Investors are generally willing to pay a higher PE for businesses with strong growth prospects and lower risk profiles, while a lower PE may signal concerns about future growth or potential headwinds.

Abbott Laboratories currently trades at a PE ratio of 16.8x. For context, the broader Medical Equipment industry sits at an average PE of 31.1x, while Abbott’s direct peers average an even higher 48.8x. On the surface, Abbott looks meaningfully cheaper than both its industry and peers, but those numbers do not consider the company’s specific growth rates, profit margins, and risk factors. That is where Simply Wall St's "Fair Ratio" comes in, as it offers a more nuanced benchmark for each company by factoring in all those business-specific details. For Abbott Laboratories, the Fair Ratio is estimated at 21.5x. Comparing this to Abbott’s current PE of 16.8x shows that the market is valuing the stock below what would be justified by its fundamentals. This suggests potential undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Abbott Laboratories Narrative

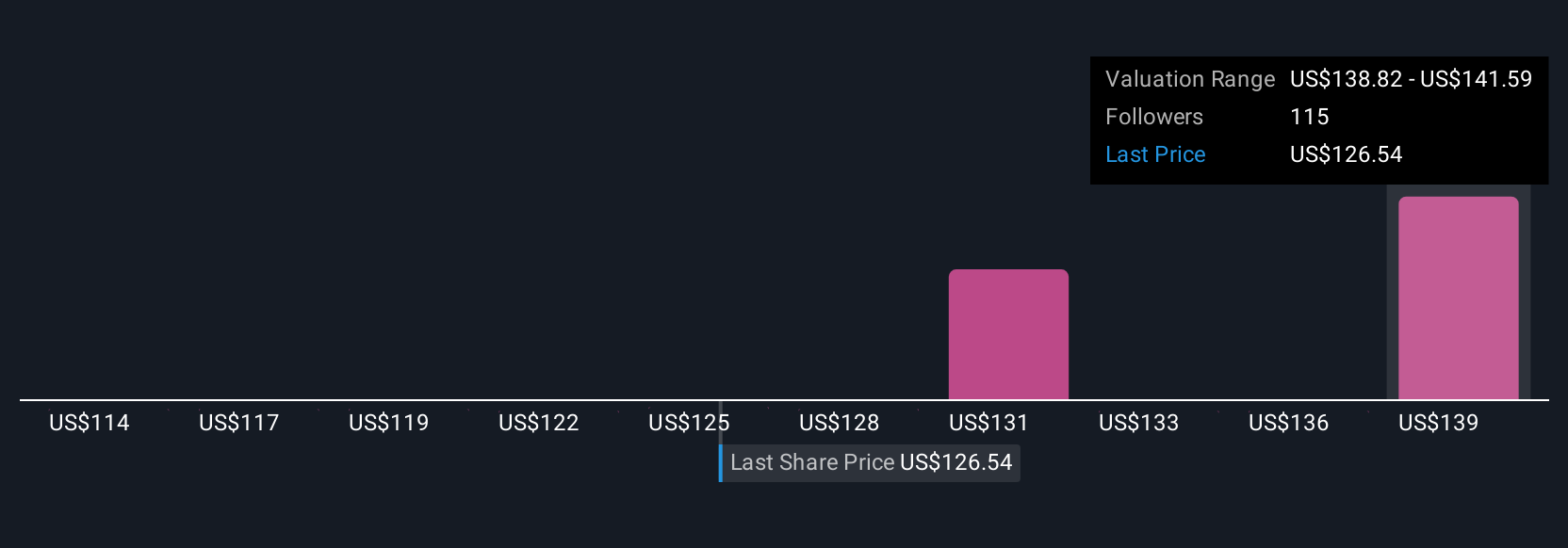

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story you believe about a company, brought to life by your very own estimates for things like future revenues, profit margins, and a fair value for the stock. Instead of just looking at numbers in isolation, Narratives connect Abbott Laboratories’ business outlook and the bigger context of its industry directly to a set of financial forecasts and fair value that you think makes sense.

With Narratives, used by millions of investors on Simply Wall St’s Community page, you quickly see how your outlook compares to others. Whether you are an optimist focusing on emerging markets and innovation, or a skeptic concerned about margin pressure and regulation, Narratives help clarify your perspective. Each Narrative compares your fair value (built from your assumptions) to the latest share price, giving you an easy way to decide if you should buy, hold, or sell. Narratives also update automatically as new earnings, news, or data become available, ensuring your view is always relevant.

- For example, one bullish Narrative envisions Abbott’s fair value at $159.00, focusing on strong global growth and new product launches.

- A more cautious Narrative estimates the fair value at just $122.00, emphasizing margin risks and global headwinds.

Do you think there's more to the story for Abbott Laboratories? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives