- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Earnings Momentum and Insider Confidence Could Be a Game Changer for Abbott Laboratories (ABT)

Reviewed by Simply Wall St

- Abbott Laboratories recently reported strong financial results, achieving 18% annual earnings per share growth over the past three years and a 5.9% rise in revenue, while insider ownership was valued at US$1.1 billion.

- This combination of robust performance and significant insider confidence underlines stability in the company's leadership and alignment with shareholder interests.

- We'll explore how Abbott's large insider ownership and earnings momentum may shape its investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Abbott Laboratories Investment Narrative Recap

To own Abbott Laboratories, an investor must believe in the company’s ability to deliver consistent growth across a diverse healthcare portfolio, with innovation and scale helping to offset pressures from competition and global economic factors. The recent news of robust earnings per share growth and strong insider ownership doesn’t significantly change the immediate focus, as the biggest catalyst remains performance in emerging markets while the main risk is sustained pricing headwinds in diagnostics due to China's procurement policy and shifting demand for COVID testing.

Of the various recent developments, Abbott’s new FreeStyle Libre 3 Plus sensor launch in Canada is particularly relevant, reinforcing the importance of its diabetes franchise. This announcement ties directly to short-term growth opportunities and the ongoing challenge of defending margins in the face of intensified competition and pricing pressures in glucose monitoring solutions.

By contrast, it’s important for investors to remember that persistent pressure on diagnostic pricing in China could ...

Read the full narrative on Abbott Laboratories (it's free!)

Abbott Laboratories' outlook anticipates $53.3 billion in revenue and $9.4 billion in earnings by 2028. This implies a 7.3% annual revenue growth rate but a decrease in earnings of $4.5 billion from the current $13.9 billion.

Uncover how Abbott Laboratories' forecasts yield a $142.48 fair value, a 8% upside to its current price.

Exploring Other Perspectives

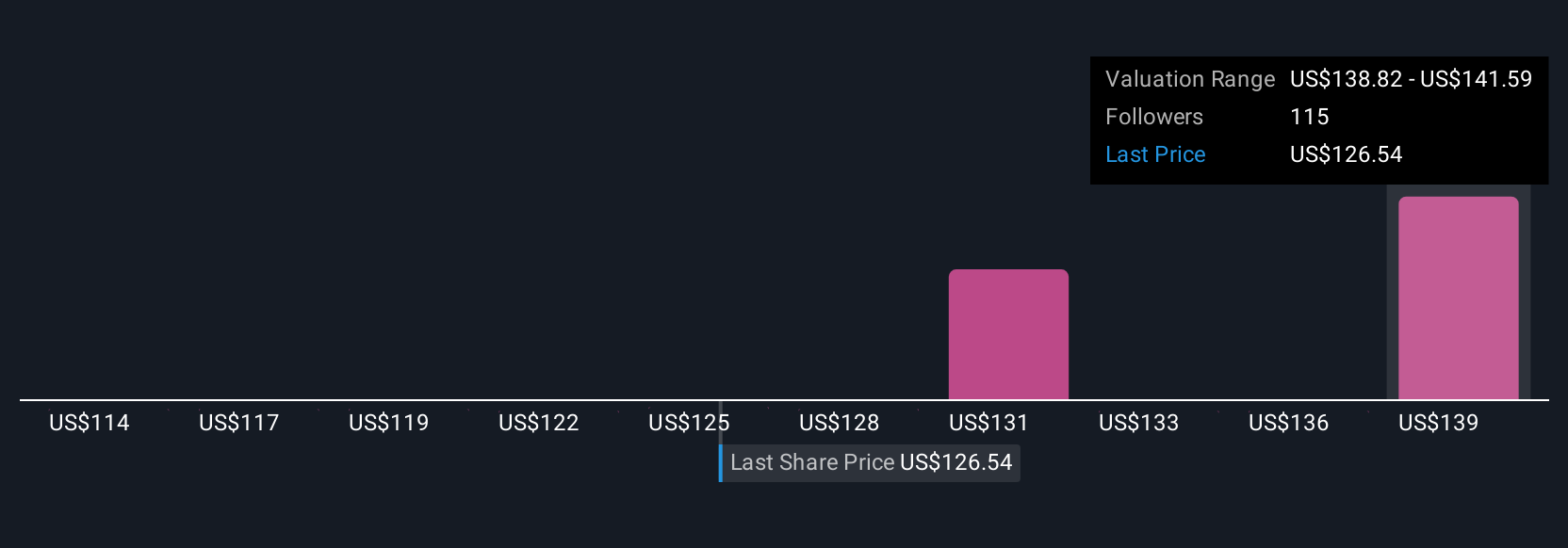

Simply Wall St Community members provided ten fair value estimates for Abbott Laboratories, ranging from US$113.88 to US$142.48 per share. While views differ on future growth, many are weighing how pricing challenges in diagnostics could affect overall performance and earnings stability in the years ahead.

Explore 10 other fair value estimates on Abbott Laboratories - why the stock might be worth 14% less than the current price!

Build Your Own Abbott Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abbott Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Abbott Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abbott Laboratories' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives