- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Can Abbott (ABT) Balance Medical Devices Growth Against Diagnostics Challenges in 2025?

Reviewed by Sasha Jovanovic

- Abbott Laboratories announced third-quarter 2025 earnings with sales of US$11.37 billion, up from US$10.64 billion a year prior, and net income essentially flat at US$1.64 billion year over year; the company also reaffirmed and narrowed its full-year adjusted EPS guidance to between US$5.12 and US$5.18.

- Despite strong growth in its medical devices segment, performance was mixed overall, as diagnostics revenue declined and management maintained rather than raised its full-year guidance, underscoring ongoing challenges in certain business units.

- We'll explore how Abbott's decision to reaffirm earnings guidance, despite weaker diagnostics sales, impacts the company's investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Abbott Laboratories Investment Narrative Recap

To own Abbott Laboratories, I believe you need to have confidence in its ability to balance pockets of volatility in diagnostics with strong, consistent performance in medical devices and pharmaceuticals, anchored by a long history of dividend reliability. The recent third-quarter report and reaffirmed guidance do little to change the near-term story: while medical devices show momentum, the real short-term catalyst remains a recovery in diagnostics, and ongoing headwinds in that segment pose the biggest risk. Neither was materially altered by the Q3 results, as management’s decision to maintain rather than raise guidance signals a cautious approach, but not a reversal in the fundamental thesis.

Among recent announcements, Abbott’s continued string of quarterly dividend declarations stands out as particularly relevant, especially when viewed alongside this week’s steady financial guidance. This ongoing commitment to dividend payments, now spanning more than a century, is reflective of the company’s culture of discipline and financial resilience amid turbulent conditions. For investors, this payout stability serves as reinforcement that management sees the current challenges as manageable rather than existential.

By contrast, one thing investors should be aware of is the persistent weakness in the diagnostics business and the risk that price erosion in China or further declines in rapid test revenue could...

Read the full narrative on Abbott Laboratories (it's free!)

Abbott Laboratories is projected to reach $53.3 billion in revenue and $9.4 billion in earnings by 2028. This outlook assumes annual revenue growth of 7.3% and a decrease in earnings of $4.5 billion from current earnings of $13.9 billion.

Uncover how Abbott Laboratories' forecasts yield a $144.40 fair value, a 13% upside to its current price.

Exploring Other Perspectives

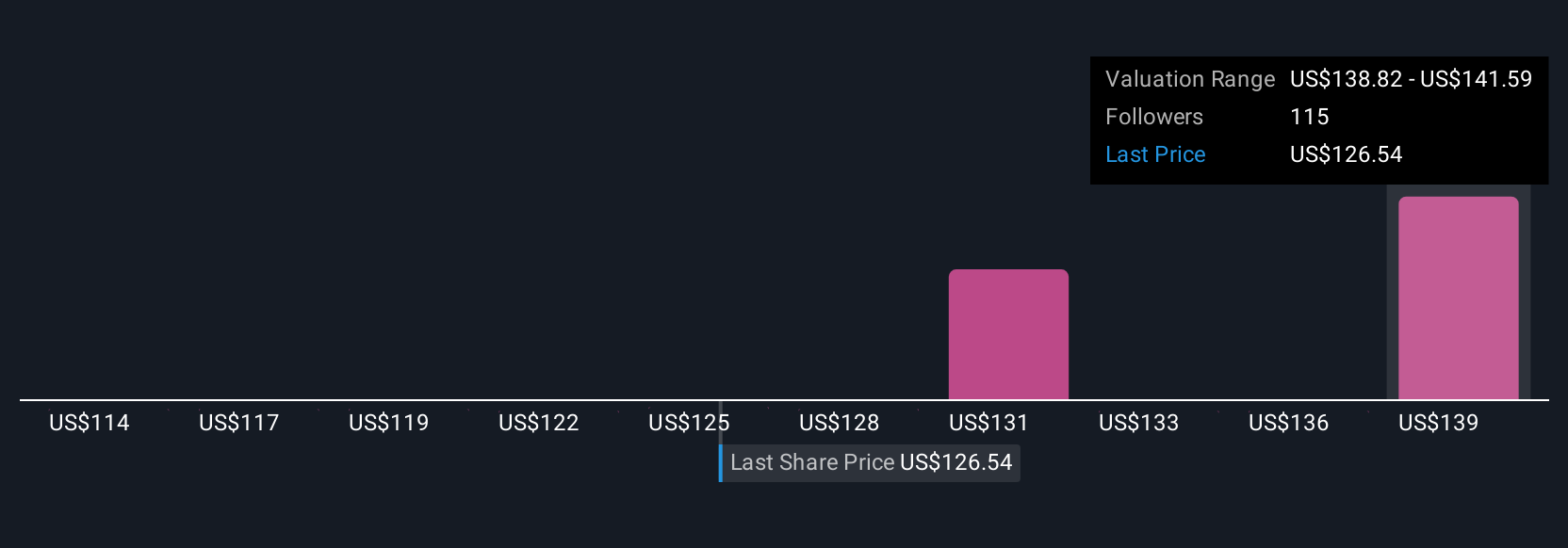

Twelve private investors from the Simply Wall St Community estimate fair values for Abbott ranging from US$97 to US$144 per share. With recent results highlighting ongoing risk in diagnostics and guidance remaining cautious, it’s clear opinions can vary widely on what to expect next.

Explore 12 other fair value estimates on Abbott Laboratories - why the stock might be worth 24% less than the current price!

Build Your Own Abbott Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abbott Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Abbott Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abbott Laboratories' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives