- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Abbott Laboratories (NYSE:ABT) Expands Diabetes Care with FreeStyle Libre 3 Plus Launch in Canada

Reviewed by Simply Wall St

Abbott Laboratories (NYSE:ABT) recently introduced the FreeStyle Libre 3 Plus in Canada, marking an advancement in diabetes management technology with its small, sensor-based glucose monitoring system. This development, alongside other approvals and partnerships like the i-STAT TBI test and mitral valve replacement system, may have bolstered investor confidence contributing to the company's quarterly share price growth of almost 5%. However, against a backdrop of generally rising market indices, these innovations would align with broader upward trends rather than signify any drastic deviation from market dynamics.

Abbott Laboratories has 1 warning sign we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The introduction of Abbott Laboratories' FreeStyle Libre 3 Plus in Canada exemplifies its ongoing commitment to innovative healthcare solutions, which may bolster its market presence and investor sentiment. Over a five-year period ending today, Abbott's total shareholder return, including share price appreciation and dividends, reached 53.08%, indicating solid long-term performance. This positions the company favorably against the US Medical Equipment industry, which delivered a 10.7% return over the past year, showcasing Abbott's robustness amid broader market challenges.

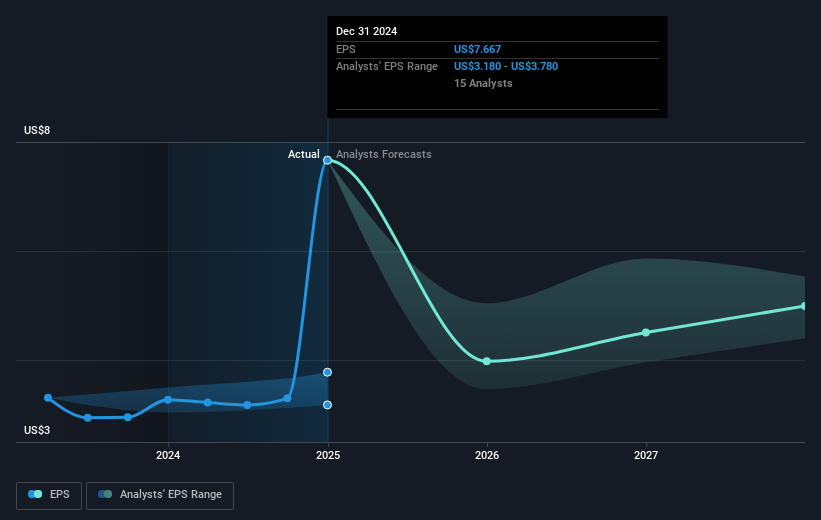

In light of recent strategic advancements, such as new product launches and market expansion, revenue and earnings forecasts could see positive adjustments. However, potential revenue growth resulting from these initiatives may demand substantial initial investments, possibly impacting net margins in the near term. Analysts project a revenue increase to $52.4 billion by 2028, although expectations for earnings in that timeframe are mixed, with forecasts as low as $8.2 billion. Currently, Abbott's share price is roughly 5.2% below the analyst consensus price target of approximately $140.41, suggesting that the market may already account for some of these growth factors. Investors should weigh these developments against potential economic headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives