- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Abbott Laboratories (ABT): Exploring Valuation as Steady Gains Draw Investor Interest in 2024

Reviewed by Kshitija Bhandaru

Abbott Laboratories (ABT) shares have been steady lately, moving less than 1% over the past week, with the stock up about 17% this year. Recent movements are drawing investor attention mainly to broader trends and the long-term potential for the company’s portfolio.

See our latest analysis for Abbott Laboratories.

Momentum is gradually building for Abbott Laboratories, as the stock’s positive year-to-date share price return hints at renewed investor confidence. Its robust one-year total shareholder return of 20.8% also underscores sustained longer-term growth potential.

If you’re tracking the latest moves in healthcare, this is a great moment to discover emerging opportunities with our See the full list for free.

With steady share price movement and a healthy track record, investors now face a crucial question: is Abbott Laboratories undervalued at current levels or has the market already factored in the company’s future growth prospects?

Most Popular Narrative: 6.7% Undervalued

Abbott Laboratories last closed at $132.99, but the most widely followed narrative sets its fair value higher at $142.48. This places the current share price below what the consensus expects the stock to be worth in light of future developments, highlighting a pricing gap that may intrigue valuation-focused investors.

The expansion of healthcare access and rising middle class in key emerging markets (such as India, China, Latin America, and the Middle East) is fueling robust growth in branded generics and biosimilars, highlighted by Abbott's record sales in these regions and imminent biosimilar launches. This trend is poised to drive sustained double-digit top-line growth and greater geographic revenue diversification.

What does it take to arrive at this higher fair value? The underlying formula weights aggressive top-line ambitions, margin trends, and an earnings outlook that defies recent declines. Consider major bets on global expansion and a pricing multiple that pushes industry norms to the limit. Intrigued by the bold assumptions behind this valuation leap? Unlock the narrative and decide if the confidence adds up.

Result: Fair Value of $142.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pricing pressures in diagnostics and vulnerability to global currency swings could quickly shift the outlook and challenge the bullish case.

Find out about the key risks to this Abbott Laboratories narrative.

Another View: What Does the SWS DCF Model Say?

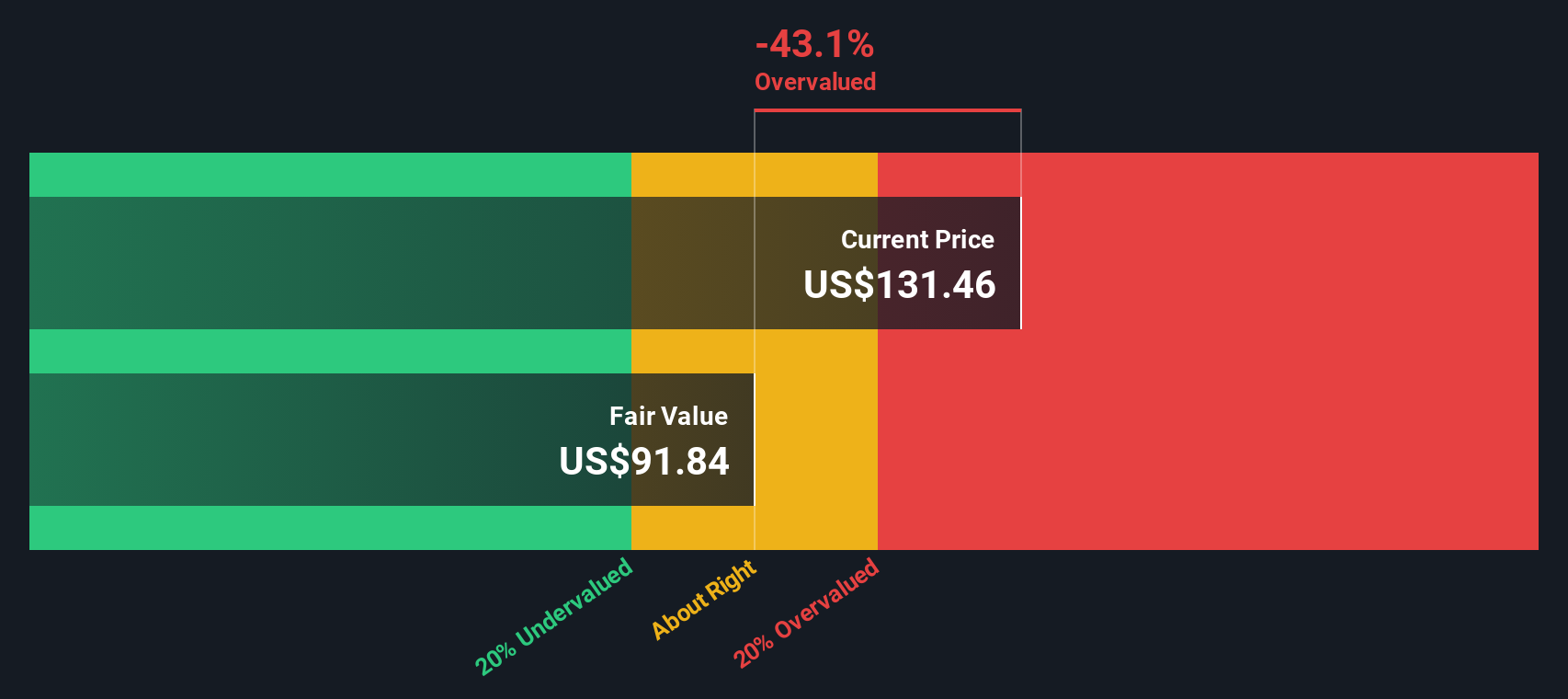

While analyst price targets suggest Abbott Laboratories is undervalued, our DCF model presents a more cautious outlook. According to this cash flow-based approach, the stock is actually trading above its intrinsic value. This difference raises a critical question: will future expectations or fundamentals be more influential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Abbott Laboratories for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Abbott Laboratories Narrative

If you would rather run your own analysis or check the underlying figures yourself, you can build your own full narrative in just minutes using Do it your way

A great starting point for your Abbott Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip past you. Uncover powerful stocks across unique themes and keep your investing edge sharp with these handpicked market possibilities.

- Grow your returns by targeting market leaders with ultra-reliable income. Start with these 19 dividend stocks with yields > 3% yielding over 3% for income-focused portfolios.

- Jump into the forefront of innovation by exploring these 24 AI penny stocks powering the evolution of artificial intelligence and automation.

- Stay ahead of the curve on emerging digital assets. Scan these 78 cryptocurrency and blockchain stocks for exposure to the companies shaping tomorrow’s blockchain landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives