- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Abbott Laboratories (ABT): Assessing Current Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

If you are watching Abbott Laboratories (ABT) this week, the stock’s recent run-up might have you wondering if there is a new story unfolding. There is no single headline or corporate event moving shares, but the persistent climb in its price is starting to draw more investor attention. When a stock like Abbott moves higher without a big, clear-cut catalyst, it often prompts investors to dig deeper into what is really driving sentiment, especially with economic uncertainty still present in the background.

Currently, Abbott is up roughly 20% over the past year, with most of that move coming in just the past few months. The momentum appears steady, with the stock tacking on nearly 5% this past month after spending the spring mostly flat. This comes against a backdrop of modest annual revenue growth, along with some softness in net income, reminding investors that strong share performance does not always mirror operational trends. Still, the lack of a recent trigger makes the share price movement all the more intriguing for those focused on valuation.

After this year’s climb, is Abbott Laboratories trading at a compelling entry point, or is the market already pricing in future growth?

Most Popular Narrative: 7% Undervalued

According to community narrative, Abbott Laboratories is considered modestly undervalued, with current prices sitting around 7% below fair value based on projected growth and risk-adjusted assumptions.

The expansion of healthcare access and rising middle class in key emerging markets (such as India, China, Latin America, and the Middle East) is fueling robust growth in branded generics and biosimilars. Abbott's record sales in these regions and imminent biosimilar launches highlight this momentum. This trend is expected to drive sustained double-digit top-line growth and greater geographic revenue diversification.

Curious what’s powering this bullish outlook? The key factors are a blend of strong revenue growth, ambitious margin forecasts, and noteworthy valuation multiples. This narrative suggests interesting assumptions about future profits and global expansion. Interested in how these projections contribute to Abbott’s fair value?

Result: Fair Value of $142.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent headwinds in diagnostics and potential volatility in emerging markets could put sustained pressure on Abbott's future growth story.

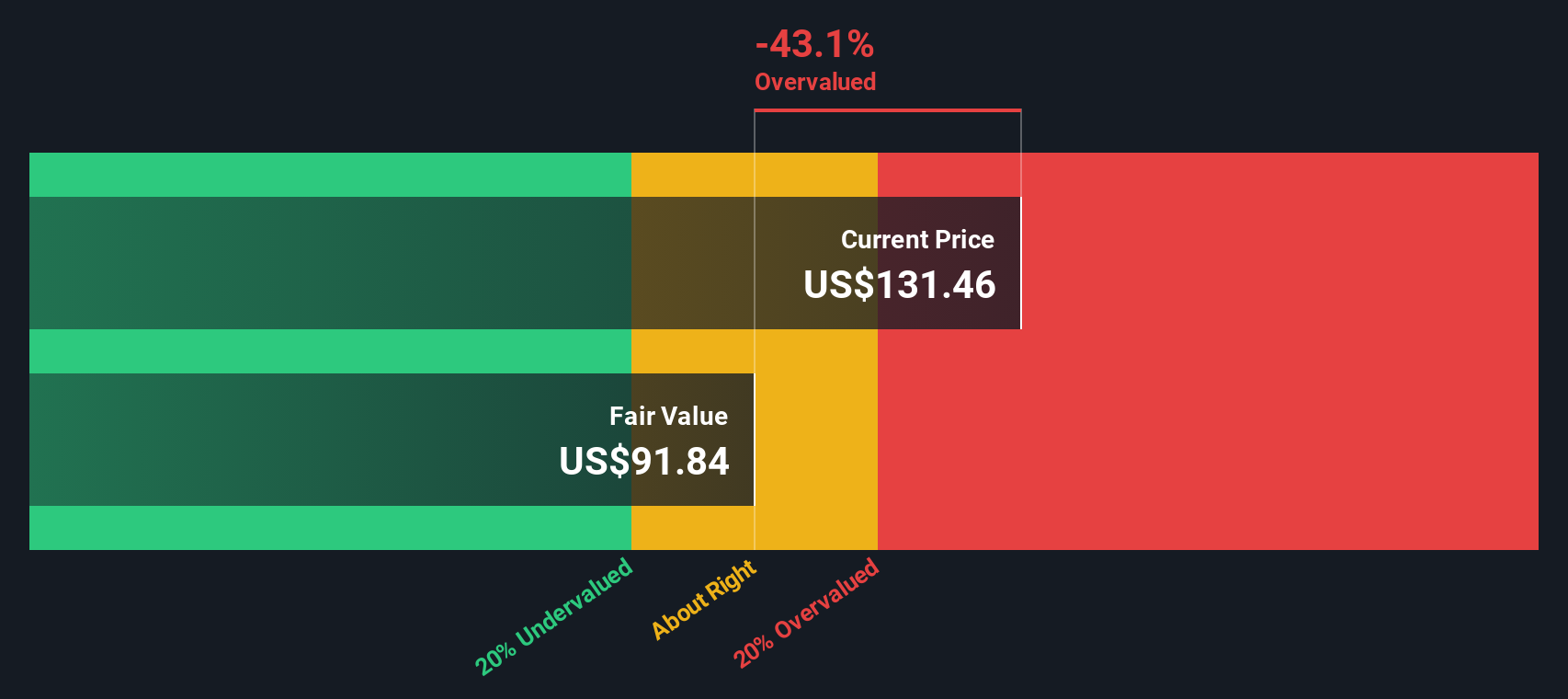

Find out about the key risks to this Abbott Laboratories narrative.Another View: Our DCF Model Tells a Different Story

Looking at Abbott through the lens of our DCF model reveals a different picture. This analysis suggests the shares may not be as attractively priced as the multiples approach implies. Could the market be overestimating future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Abbott Laboratories for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Abbott Laboratories Narrative

If you want to see the numbers for yourself or believe a different perspective might fit, you can build your own case in just a few minutes. So why not do it your way?

A great starting point for your Abbott Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't let your research stop at Abbott Laboratories. There are exceptional companies out there that deserve your attention. Make sure you’re ahead of the curve by searching beyond the obvious. These are some of the most promising areas where you can uncover your next big winner:

- Tap into game-changing artificial intelligence trends by checking out AI penny stocks that are leading innovation in AI-driven solutions worldwide.

- Secure your financial future with dividend stocks with yields > 3%. Find rock-solid businesses offering consistent yields above 3% for steady income.

- Seize opportunities in the digital finance revolution through cryptocurrency and blockchain stocks and discover trailblazers harnessing the power of cryptocurrency and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives