- United States

- /

- Medical Equipment

- /

- NasdaqGS:XRAY

Why DENTSPLY SIRONA (XRAY) Is Down 5.9% After Impairment Charge, Guidance Cut, and CFO Departure

Reviewed by Sasha Jovanovic

- DENTSPLY SIRONA reported a US$263 million noncash impairment charge related to goodwill and intangible assets for the third quarter of 2025, revised its full-year sales guidance downward, and announced the departure of its Chief Financial Officer.

- The impairment was primarily attributed to tariffs and reduced projected equipment, implant, and prosthetic volumes in the U.S., signaling potential challenges in some of the company’s core markets.

- We’ll examine how the impairment charge and revised sales guidance affect DENTSPLY SIRONA’s future earnings outlook and its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DENTSPLY SIRONA Investment Narrative Recap

To be a DENTSPLY SIRONA shareholder, you need to believe in the company's ability to reignite sustainable revenue growth through product innovation and expansion of its digital dentistry platforms, despite current top-line declines and margin pressures. The recent impairment charge and downward sales guidance highlight ongoing demand headwinds in the U.S. and reinforce that near-term performance hinges on stabilizing equipment and implant volumes, making margin compression from tariffs a significant risk in the short term.

Among the latest announcements, the US$263 million impairment charge directly connects to these risks, as it's rooted in lower projected volumes and the impact of tariffs. This charge raises important questions about the effectiveness of cost control efforts and whether additional write-downs could occur if market conditions remain challenging, putting more pressure on profitability and investor confidence.

However, investors should also be aware that while long-term growth potential exists, the immediate concern lies in the lingering impact of tariffs and the possibility of ...

Read the full narrative on DENTSPLY SIRONA (it's free!)

DENTSPLY SIRONA's narrative projects $3.9 billion in revenue and $502.2 million in earnings by 2028. This requires 2.3% yearly revenue growth and a $1,451.2 million increase in earnings from the current earnings of -$949.0 million.

Uncover how DENTSPLY SIRONA's forecasts yield a $16.00 fair value, a 52% upside to its current price.

Exploring Other Perspectives

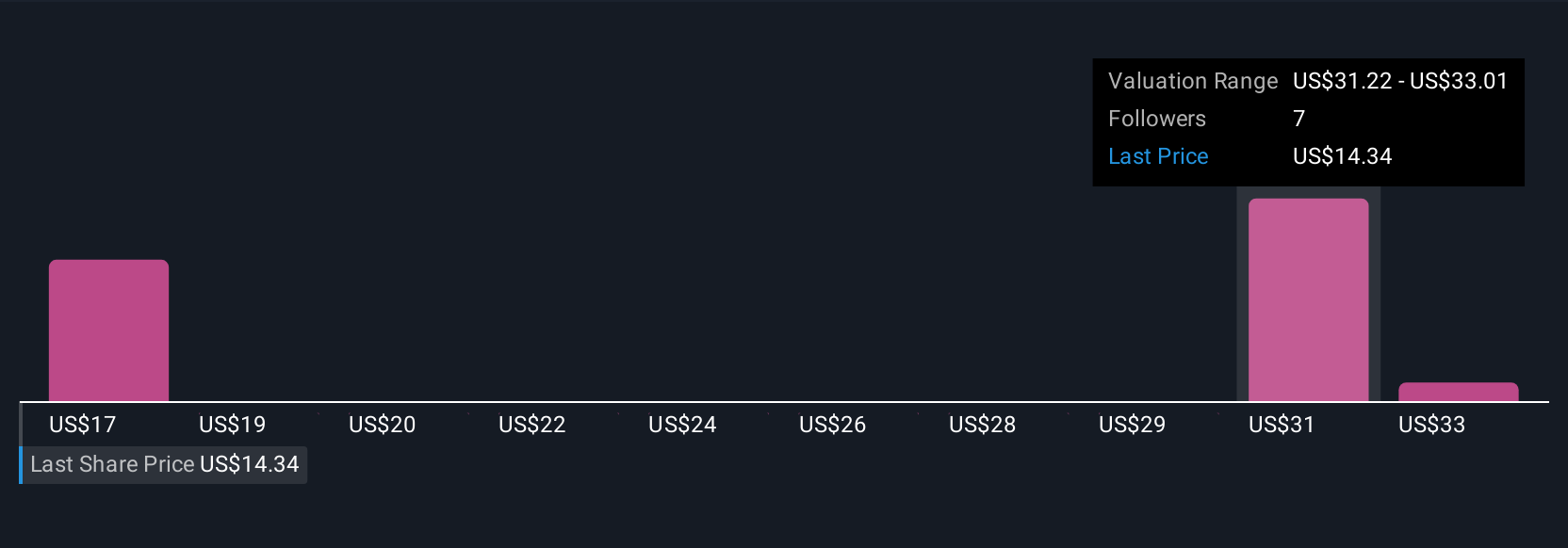

Simply Wall St Community members estimate DENTSPLY SIRONA’s fair value between US$16 and US$34.81 across three analyses. These views contrast sharply with recent earnings challenges and cost headwinds, highlighting how much investor expectations and risk assessments can differ.

Explore 3 other fair value estimates on DENTSPLY SIRONA - why the stock might be worth over 3x more than the current price!

Build Your Own DENTSPLY SIRONA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DENTSPLY SIRONA research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DENTSPLY SIRONA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DENTSPLY SIRONA's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XRAY

DENTSPLY SIRONA

Develops, manufactures, and markets dental equipment supported by cloud-enabled solutions, dental products, and healthcare consumable products in urology and enterology worldwide.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives