- United States

- /

- Medical Equipment

- /

- NasdaqGS:XRAY

Dentsply Sirona (XRAY): Evaluating Valuation After New AI Partnership Boosts Dental Platform

Reviewed by Kshitija Bhandaru

If you’ve been unsure about what to do with Dentsply Sirona (XRAY), the company’s latest move might have caught your attention. Dentsply Sirona just rolled out a partnership with Pearl, bringing AI-assisted X-ray support directly into its DS Core cloud platform. The idea is to give dental professionals smarter tools that could raise the bar for diagnostics and patient care, especially at a time when operational challenges and slow growth have put XRAY’s future in question.

Zooming out, this leap into dental AI comes after a year where Dentsply Sirona’s stock has struggled. Returns over the past year have been disappointing and momentum has faded, with a steady decline capping off a multi-year backdrop of underperformance. While integration with Pearl addresses some of those growth concerns, investors have seen nearby competitors take different tracks, some with better outcomes, some worse. It is clear the company is leaning into innovation as a way to reinvigorate its story for the market.

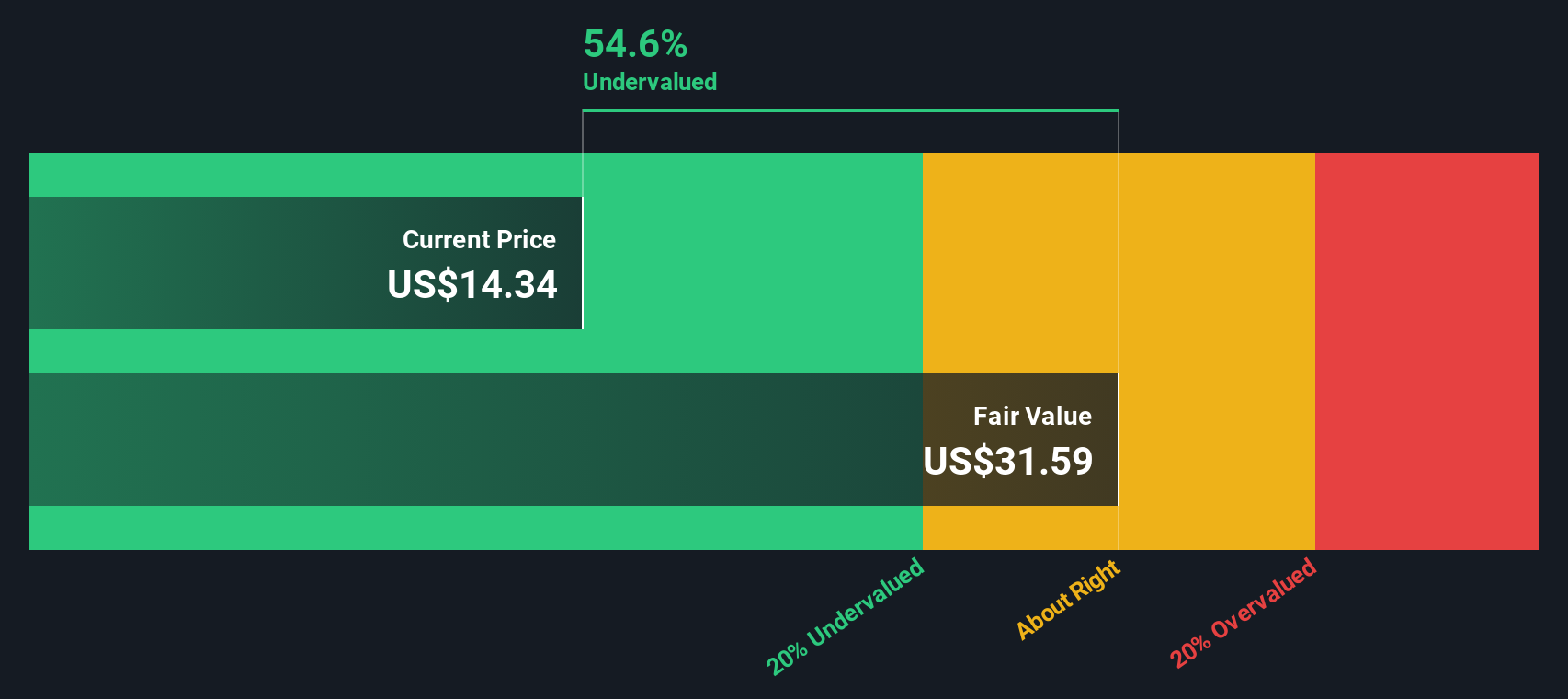

Which leads to the big question: after a tough stretch for the stock, does this new technology partnership mean Dentsply Sirona is undervalued at current levels or is the market already pricing in all of its future growth?

Most Popular Narrative: 25.8% Undervalued

According to the most widely followed valuation narrative, Dentsply Sirona’s shares are currently undervalued by a significant margin based on consensus analyst forecasts and long-term growth assumptions.

Disciplined capital allocation toward innovation, organic growth, and financial flexibility, along with new leadership focused on execution, positions DENTSPLY SIRONA to capitalize on long-term industry consolidation and the shift toward value-based, high-quality dental care. This should support multi-year top-line and bottom-line growth.

Buckle up. The numbers driving this narrative’s undervaluation story are bolder than most expect. Want to discover which future profit leaps and improved margins are fueling that projected upside? This narrative’s valuation thesis is built on ambitious growth and a transformation that defies the company’s recent stock slump. The surprising financial targets behind the fair value will make you look twice.

Result: Fair Value of $16.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent sales declines and mounting cost pressures could threaten Dentsply Sirona’s turnaround if the company does not counter these challenges with swift and effective innovation and execution.

Find out about the key risks to this DENTSPLY SIRONA narrative.Another View: SWS DCF Model Offers a Different Take

While analysts see upside based on long-term growth estimates and multiples, our SWS DCF model takes a more fundamental approach. This model also indicates that Dentsply Sirona is trading well below its intrinsic value. However, could future earnings really bridge the gap, or are expectations running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DENTSPLY SIRONA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DENTSPLY SIRONA Narrative

If the consensus doesn't sway you or you're keen to test your own perspective with the numbers, exploring the data and building a unique viewpoint is straightforward and quick. Your fresh take could be ready in just a few minutes. Do it your way

A great starting point for your DENTSPLY SIRONA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Open yourself up to a wider world of promising stocks with some of the most dynamic screens available on Simply Wall Street. Waiting too long could mean missing out on the next big move. Get ahead now with these handpicked strategies:

- Unlock hidden value by targeting companies trading well below their intrinsic worth using our undervalued stocks based on cash flows.

- Tap into tomorrow’s breakthroughs by following AI penny stocks pushing advancements at the cutting edge of artificial intelligence.

- Boost your portfolio’s income with dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XRAY

DENTSPLY SIRONA

Develops, manufactures, and markets dental equipment supported by cloud-enabled solutions, dental products, and healthcare consumable products in urology and enterology worldwide.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives