Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Exagen Inc. (NASDAQ:XGN) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Exagen

How Much Debt Does Exagen Carry?

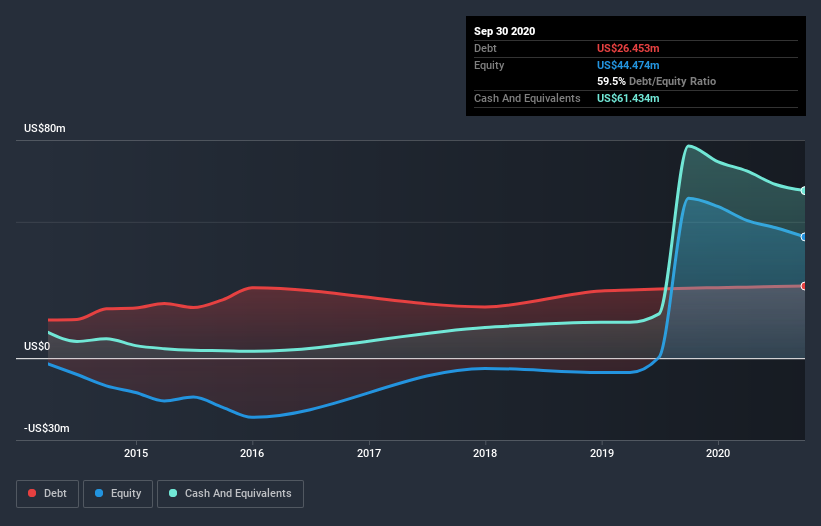

The chart below, which you can click on for greater detail, shows that Exagen had US$26.5m in debt in September 2020; about the same as the year before. However, it does have US$61.4m in cash offsetting this, leading to net cash of US$35.0m.

How Strong Is Exagen's Balance Sheet?

The latest balance sheet data shows that Exagen had liabilities of US$8.27m due within a year, and liabilities of US$27.2m falling due after that. Offsetting this, it had US$61.4m in cash and US$9.30m in receivables that were due within 12 months. So it actually has US$35.2m more liquid assets than total liabilities.

This surplus suggests that Exagen has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Exagen has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Exagen's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Exagen's revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

So How Risky Is Exagen?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Exagen lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through US$15m of cash and made a loss of US$17m. But the saving grace is the US$35.0m on the balance sheet. That means it could keep spending at its current rate for more than two years. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Exagen has 2 warning signs we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Exagen, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Exagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:XGN

Exagen

Designs, develops, and commercializes various testing products under the AVISE brand in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success